My grandfather was a farmer in south-central Kansas.

He used to tell me there were two things a farmer always needed:

- A good relationship with the local weatherman.

- A good relationship with his banker.

I laughed at the first one, but as I grew older and struck out on my own, I understood what he meant by the second.

When I lived in a small town in southeast Kansas, I developed that kind of a relationship with the president of a local community bank.

That relationship helped me buy a car and save for retirement.

I would not have had the same experience at a larger institution.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a community bank with strong financials and a 105% stock price upswing in the last 12 months.

We are “Strong Bullish” on this company’s stock, which means it is poised to outperform the broader market by at least three times over the next 12 months.

What I discovered about community banks can make investors profits if they act quickly.

Community Bank Growth Surpasses Large Lenders

It’s easy to assume that community banks (those with $10 billion or less in assets) are only located in areas with sparse population.

But the data reveals an even bigger story.

According to BankingStrategist.com — a banking data company — community banks are very strong in small areas — 2,371 banks in counties with populations less than 50,000.

However, there are 7.5 times more community banks (680) than large banks (90) in counties with more than 750,000 people, as of Q2 2021.

Community banks are gaining ground in more populous areas.

Investors can find big profits in this growing trend.

A Strong Community Bank Stock: ConnectOne Bancorp Inc.

ConnectOne Bancorp Inc. (Nasdaq: CNOB) is a community bank headquartered in Englewood Cliffs, New Jersey — across the Hudson River from Yonkers, New York.

It is a chartered commercial bank with 29 banking offices and branches in and around the New York City metropolitan area.

The bank offers a full line of traditional banking services, including:

- Personal and business checking accounts.

- Retirement accounts.

- Consumer and commercial business loans.

- Commercial and residential mortgage loans.

From 2017 to 2020, ConnectOne’s total annual revenue went from $147.3 million to $211.4 million — a 43.5% increase.

Revenue forecasts project similar growth from 2020 to 2023, with the company’s annual revenue reaching nearly $300 million by the end of 2023 — a 41% jump from 2020.

In Q1 2017, the bank had $4.45 billion in total assets.

Those assets have ballooned to $7.71 billion as of Q2 2021 — a 73% increase in a little more than five years.

ConnectOne Bancorp continues to grow its customer base through deposits and loans.

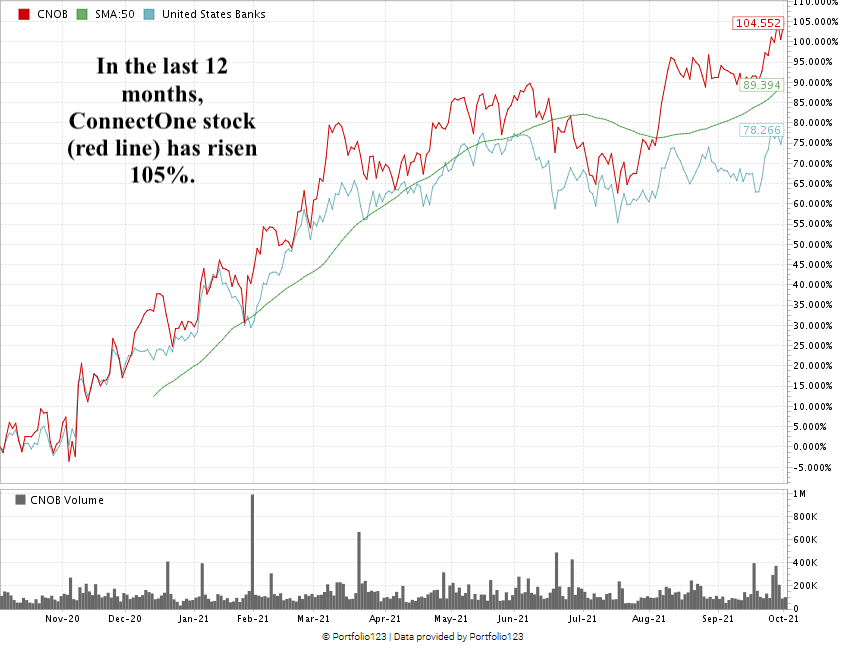

ConnectOne Stock Jumps 105% in the Last 12 Months

Over the last 12 months, the company’s stock has experienced strong growth — to the tune of 105%.

The stock experienced a slight dip in June, but quickly rebounded by mid-July and pushed past its resistance point of $28 per share. At the end of September, CNOB hit a 52-week high of over $30 and has maintained that level since.

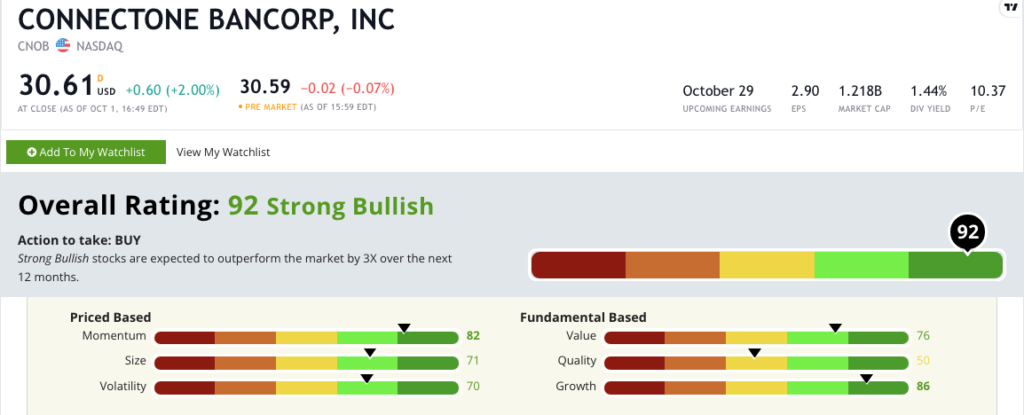

ConnectOne’s Stock Rating

Using Adam’s six-factor Green Zone Ratings system, ConnectOne Bancorp scores a 92 overall. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

ConnectOne Bancorp’s Green Zone Rating on Oct. 4, 2021.

ConnectOne stock rates in the green in five of our six factors:

- Growth — The company has a one-year annual sales growth rate of 15.4% and a three-year sales growth rate just shy of 20%. The company earns an 86 on growth.

- Momentum — ConnectOne’s rise in stock price over the last 12 months has met little resistance, despite the recent market downturn. The company earns an 82 on momentum.

- Value — The company’s price-to ratios (earnings, sales, book and cash flow) are in line with the rest of the U.S. banks industry. It trades with a 10.58 price-to-earnings ratio which is slightly lower than the 11.46 industry average. ConnectOne earns a 76 on value.

- Size — With a market cap of $1.21 billion, ConnectOne is a great size for stocks we rate. It earns a 71 in this metric.

- Volatility — ConnectOne’s stock momentum experienced minor resistance before reaching its 52-week high last week. It earns a 70 on this metric.

The company earns a 50 on quality, but its returns on assets, equity and investments are all in the positive and in line with the rest of the industry. Its return on equity is at 12.56% compared to the industry average of 11.15%.

Bottom line: Community banks are becoming more popular … even in more populous areas.

Smaller banks offer a personal level of financial care that you won’t find at larger national chains.

With a strong bottom line and stock growth, ConnectOne Bancorp is a community bank stock worth adding to your portfolio.

Note: ConnectOne is a great community bank to consider for your portfolio. However, chief investment strategist Adam O’Dell’s highest-conviction small bank stock is in the Green Zone Fortunes model portfolio. To find out more about this great stock and his Green Zone Fortunes premium service, click here.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.