Today’s chart accidentally reveals something interesting about home prices and politics. Homes are more expensive in states run by Democrats and less expensive in states where voters lean toward Republicans.

I stumbled onto this relationship while I was looking at home price data. Realizing that homes cost more in some parts of the country, I sorted average prices by state.

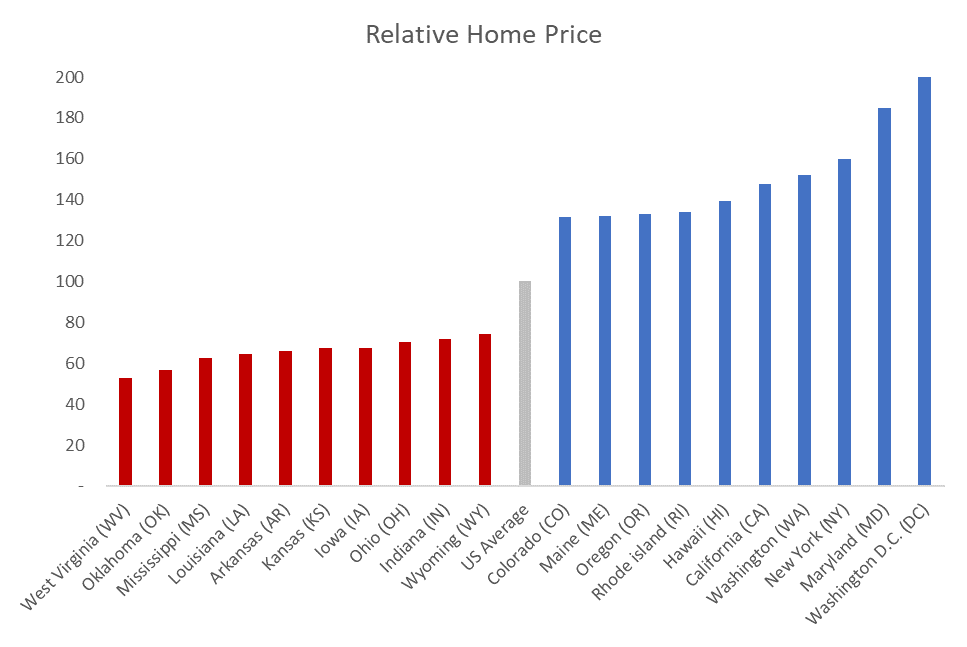

The average home price in Washington D.C. is more than 280% higher than the average home price in West Virginia. Home prices in West Virginia are about half the national average. Surprisingly, most states’ homes are below average, with 29 states reporting a value below the national average.

When there’s a data skew like that, the answer is often that a large state has high prices while a small state has relatively low prices. That pattern was visible, but the politics of the expensive states jumped out.

The chart below shows the ten most expensive states compared to the ten least expensive states. Noticing the pattern on the chart’s right side, I decided to color the bars as red or blue, depending on how the state voted in the 2020 election.

Relative Home Price Comparing Red and Blue States

Investors Must Navigate Changing Policy

There are many reasons housing prices differ from market to market.

Those living in Maryland or New York may argue demand for homes is high because of excellent schools or high-quality public services. It’s likely those living in Oklahoma or Mississippi are also happy with their schools and public services.

Skeptics of blue-state policies might believe restrictive zoning and excessive regulation make home prices more expensive.

There’s no easy answer, but there is a sharp divide in politics and home prices. This could be important information for investors with blue-state policies now seeping into Congressional legislation and executive branch policies.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.