Paul Singer is one of the most terrifying hedge fund managers in the world.

Bloomberg described Singer as “aggressive, tenacious and litigious to a fault” and noted that he strikes fear into all, including “hedge fund rivals, companies and even countries.”

Singer famously battled the country of Argentina, seizing one of the country’s navy ships and eventually winning billions of dollars from the sovereign country.

Singer’s Elliott Management Corp. manages more than $40 billion in assets, has had just two down years since 1977 and made money every month in 2020. With a resume like this, investors need to consider Singer’s thoughts. Right now, the hedge fund titan sees a long list of concerns.

In his most recent letter to his investors, Singer wrote, “‘Trouble ahead’ is signaled by a rare combination of low-quality securities, staggering valuation metrics, overleveraged capital structures, a scarcity of honest profits, a desperate dearth of understanding evinced by the most active traders and economic macro prospects that are not as thrilling as the mobs braying ‘Buy! Buy!’ seem to think.”

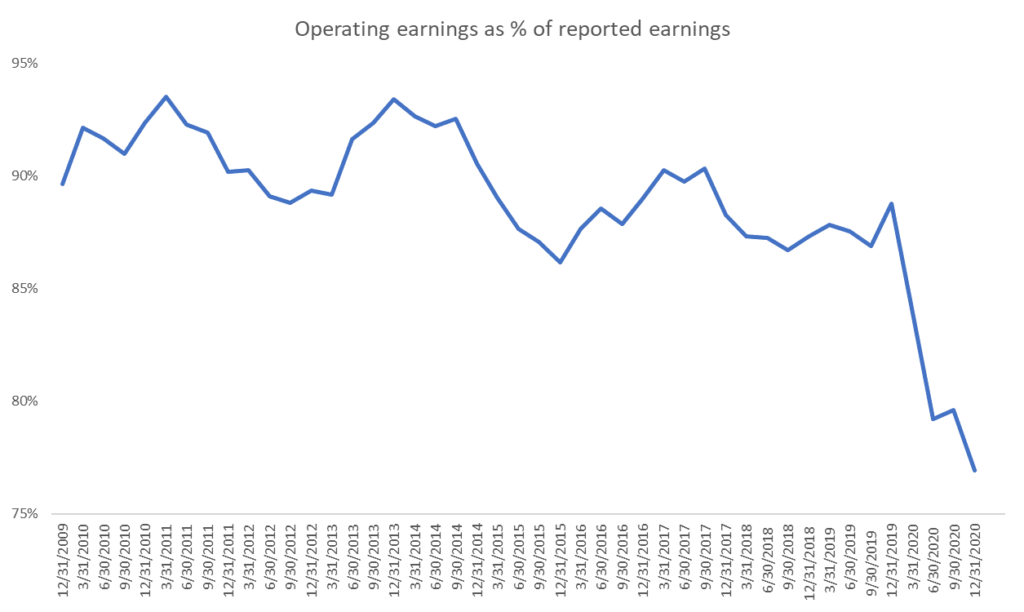

Each of those concerns is important and apparent in the data. But the scarcity of honest profits might not be on the radar of many investors. This problem is shown in the chart below.

Operating Earnings as a Percentage of Reported Earnings

Scarcity of Honest Earnings Should Worry Investors

This chart shows the percentage of operating earnings as a percentage of reported earnings for the companies in the S&P 5000. Operating earnings come from selling things for more money than they cost to make. That’s one way that companies make money. Companies also generate earnings in the accounting department.

Both kinds of earnings are appropriate under generally accepted accounting principles. But we expect strong companies to have high operating earnings. These are higher quality earnings than accounting earnings.

The recently increased earnings from accounting, shown by the sharp decline, is a cause for concern. After all, Enron generated more earnings in the accounting department than in its operating divisions.

The scarcity of honest earnings, those attributed to operations, is worrying to Singer and should be for all of us.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.