When I’m not analyzing stocks, I teach college communication … primarily to nursing students.

We have a lot of prospective nurses.

And they’ll have options when they’re ready to job search!

During the COVID pandemic, long hours and job-related stress pushed thousands of nurses to switch careers.

The chart above shows the results of a study from recruiting firm Merritt Hawkins. The firm asked health care executives where they expect staff shortages.

You can see that the overwhelming majority expect a shortage of nurses.

Today’s Power Stock is a leader in health care staffing: AMN Healthcare Services Inc. (NYSE: AMN).

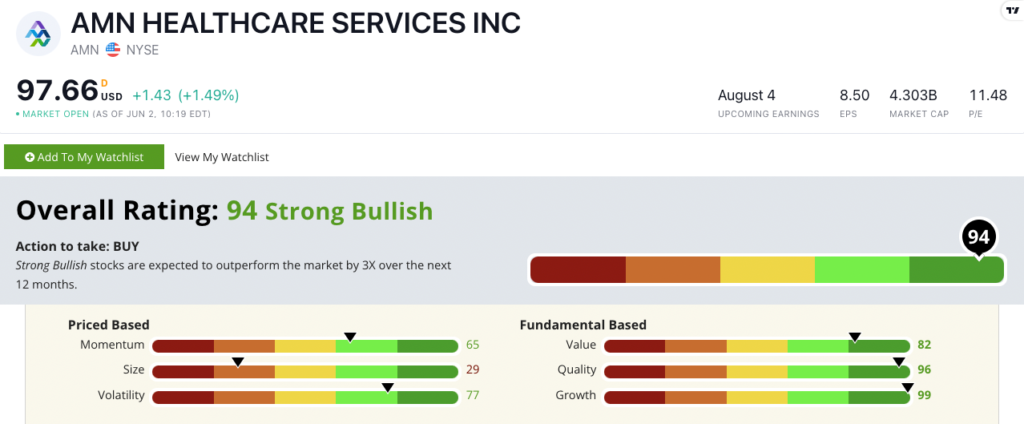

AMN Stock Power Ratings in June 2022.

AMN provides health care workers to hospitals and other facilities in the U.S.

In addition to nurse and physician staffing, it specializes in filling leadership and tech jobs within health care.

AMN Healthcare stock scores a “Strong Bullish” 94 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

AMN Stock: Massive Growth Potential

When I dug into AMN’s last quarterly report, here’s what I found:

- In the first quarter of 2022, the company reported revenue of $1.5 billion — a 75% increase over the same quarter a year ago.

- Its net income and earnings per share (EPS) grew by triple-digits from the last quarter.

AMN is one of the strongest growth stocks we rate on our Stock Power Ratings system, as you can see above.

Its one-year annual EPS growth rate is 359.9%, and its sales growth rate is 66.5%.

AMN is also a strong quality play: Returns on assets, equity and investments reflect double-digits. Its industry peers, on the other hand, average negative returns.

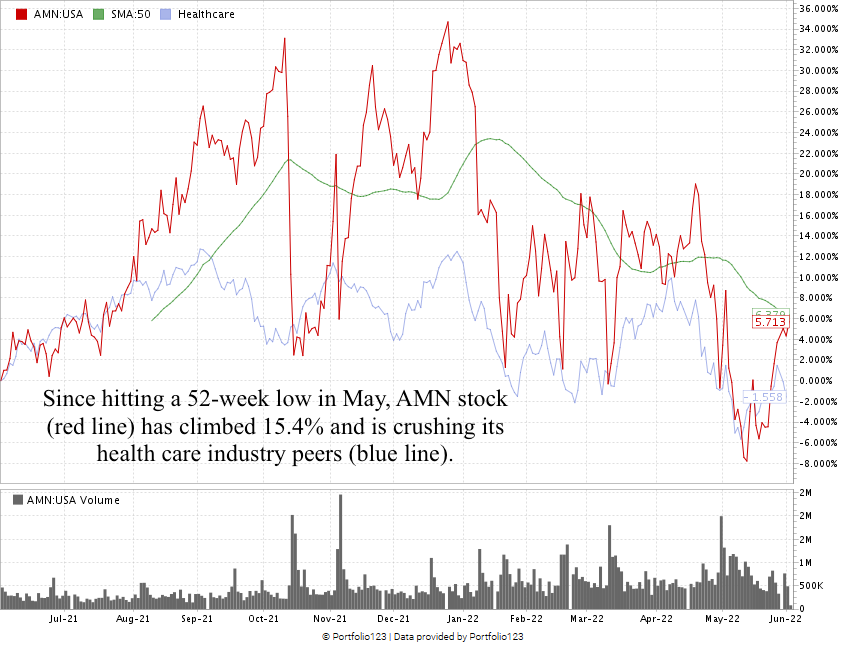

During the market sell-off in April and May, AMN stock dropped 22.5%. After hitting a 52-week low in May, the stock has gained 15.4%.

That shows the maximum momentum we look for in stocks.

For the last 12 months, AMN stock has crushed the broader health care industry.

AMN Healthcare Services stock scores a 94 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

As you know, 83% of hospital executives expect nursing shortages. That leaves a massive void to fill.

Because AMN specializes in filling that gap, its stock would make a terrific addition to your portfolio.

Stay Tuned: Top Auto Sales Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an automotive retailer you’ll want to own.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach out to Feedback@MoneyandMarkets.com — my team and I would love to hear from you!