A shortage in semiconductors coupled with the manufacturing slowdowns during the COVID pandemic put a serious crimp in the automotive market.

The falling supply of vehicles drove prices up, forcing many Americans to forgo buying a new vehicle.

Things are starting to change:

The chart above shows the change over time in new (orange line) and used (green line) vehicle prices according to the Consumer Price Index.

Used car and truck prices dropped 3.8% from February 2022 to March 2022, while new vehicle prices stayed flat.

This is terrific news for people in the market for a car or truck.

Today’s Power Stock is a large U.S. automotive retailer: AutoNation Inc. (NYSE: AN).

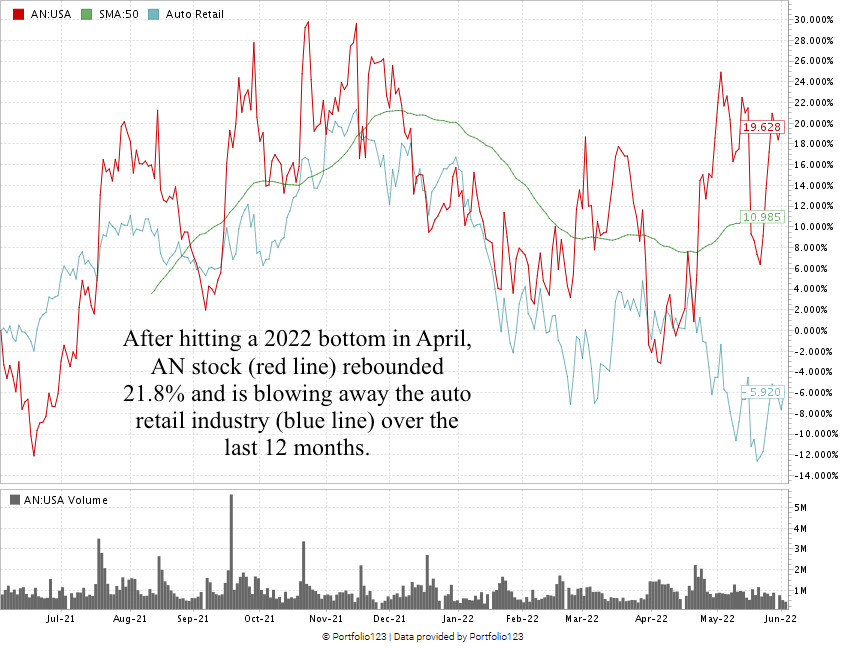

AN Stock Power Ratings in June 2022.

AutoNation Inc. operates 339 new-vehicle franchises in the U.S.

It sells domestic, imported and premium vehicles. It also arranges financing through third-party sources.

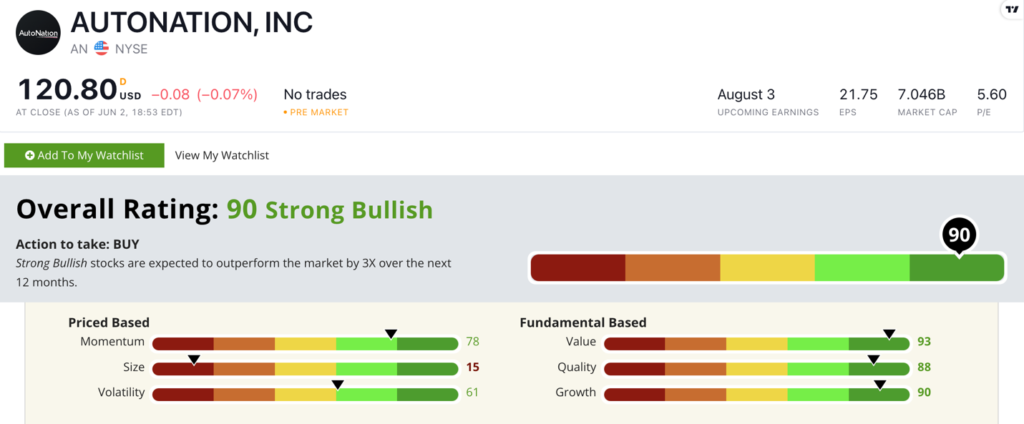

AutoNation stock scores a “Strong Bullish” 90 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

AN Stock: High Value With Excellent Growth

During the last quarter, AN posted solid numbers. Here’s what stood out to me:

- The company posted $6.8 billion in quarterly revenue, thanks to a 47% increase in used car sales over the same quarter a year ago!

- Its quarterly earnings-per-share of $5.78 is a 103% jump from the first quarter of 2021.

As you can see, the company’s strong growth numbers back up its 90 rating on the metric.

But AN shines on value.

The stock’s reasonable price-to-earnings ratio of 0.3 is much lower than the auto retail industry average of 1.2 — meaning AN is a better deal than its peers.

In the last 12 months, AN gained 19.6%. After reaching a 2022 low in April, however, the stock rebounded 21.8%.

It’s also blowing the doors off the rest of the auto retail industry, which is down 6% over the last year.

AutoNation Inc. stock scores a 90 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

With prices of new and used vehicles starting to come down, more Americans are inclined to start car shopping again.

AutoNation is in a perfect position to help these folks find the automobile they want — and to help smart investors profit!

Stay Tuned: Top Aircraft Maintenance Co.

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an aircraft maintenance provider that I know you’ll want to hear about.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got a comment about Stock Power Daily? Reach my team and me anytime at Feedback@MoneyandMarkets.com.