This earnings season, it’s clear there’s one thing on everyone’s minds…

According to Reuters, of the S&P 500 companies that have reported so far, 90% have referenced “tariffs” in their quarterly reports.

I expect that trend to continue, as we still do not have a clear picture of what comes next in this ongoing U.S.-China trade war.

Of course, developments on that front can move the entire market, up or down. But we remain confident this is still a “stock picker’s market.”

Case in point: the stark difference in the earnings reports of two of the largest U.S. defense contractors this week.

Let’s have a look there, and then we’ll give you a heads-up on the firms scheduled to report this coming week…

Earnings Recap: “Bullish” vs. “Bearish” Defense Stocks

Last week, we featured Lockheed Martin (LMT) on our bullish earnings screen, as they were forecast to report higher earnings-per-share (EPS) than the previous quarter.

Meanwhile, Northrop Grumman (NOC) was featured on our bearish screen, as they were forecast to report a decline in earnings.

When those reports were released, we learned that Lockheed Martin overshot analysts’ growth expectations, reporting an impressive 15.3% beat on earnings per share (EPS) ($7.28 reported vs. $6.31 expected).

Investors were encouraged and bid the stock 1.7% higher on Tuesday.

On the other hand, Northrop Grumman disappointed, with a massive -46.9% EPS miss ($3.32 reported vs. $6.26 expected).

NOC shares were accordingly punished as they tumbled 12% lower!

As always, this is only one earnings report, and my Green Zone Power Rating system is designed to show which stocks are poised to beat (or lag) the market over the long run.

But the dramatic difference in the results of these two important defense contractors proves my point — that this is a “stock picker’s market.”

Now let’s look ahead to next week’s earnings reports…

Health Care Fundamentals in Focus

Remember, while my Green Zone Power Rating system is not specifically designed to forecast a company’s results in a single quarter nor predict investors’ reactions to them…

It does give us a 360-degree snapshot of the company’s strength and how the stock has been behaving recently. It’s a robust system that gives longer-term buy-and-hold investors a good gauge of the stock’s potential to beat the market over the following months and even years.

Combine that with an understanding of Wall Street’s expectations for a company’s upcoming earnings report … and you have what’s needed to assess whether a “strong” company is poised to encourage (or disappoint) investors, and vice versa.

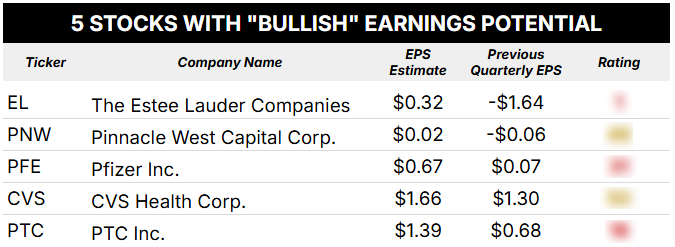

Let’s start with companies that are expected to beat their previous quarter’s earnings numbers and thus poised to trade higher if they succeed in meeting or exceeding those expectations…

For this screen, stocks must meet four criteria:

- The stock is covered by 10 or more analysts.

- The average analyst recommendation is a “Buy.”

- It BEAT analysts’ EPS estimates for the previous quarter.

- The average analyst estimate for the current quarter’s EPS is greater than the previous one.

Here are five important companies set to report next week:

The companies above are expected to deliver “positive” news, so it could spell trouble if they don’t…

And I’ll note that while two of them hold a “neutral” rating on my Green Zone Power Rating system, the other three are in either “bearish” or “high-risk” categories.

I’m particularly eager to see how the health care companies Pfizer (PFE) and CVS Health (CVS) report. Not only will I monitor the stocks’ price action following the report, but we’ll also be looking for potential improvement in their fundamental factor ratings (Value, Quality and Growth) to see if CVS can get itself bumped up to my “bullish” zone.

Now let’s look at the companies expected to report declining earnings next week…

A Few Standout “Bearish” Stocks

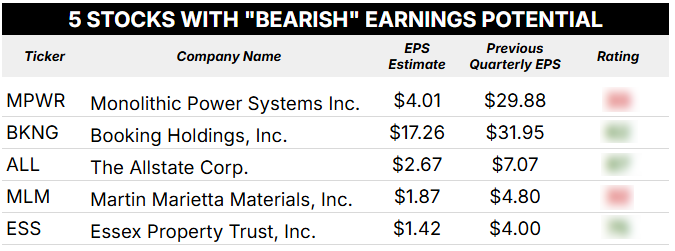

Wall Street’s analysts rarely give stocks “sell” ratings, even when they’re somewhat obviously deserved. So my bearish screen is simpler than the bullish one.

For this screen, we’re only looking for two things:

- The stock must be covered by 10 or more analysts.

- The average analyst estimate for the current quarter’s EPS is less than the previous quarter’s.

We want companies that are covered by a sufficiently large group of Wall Street analysts who collectively expect the company to report a quarter-over-quarter decline in earnings.

Here’s what we’ve got for next week:

Of note here, both Booking Holdings (BKNG) and Allstate (ALL) are expected to report quarter-over-quarter declines in EPS; however, both stocks are rated “bullish” or better on my system.

Realize that some business models experience seasonality in their sales and earnings, so a quarter-over-quarter decline could be attributed to that factor rather than something more lasting or concerning.

Booking’s report should give us a good read on consumer discretionary spending, while Allstate’s report will set the tone for how insurance companies are feeling.

So far, the insurance industry has weathered the current sell-off better than most. Shares of the SPDR S&P Insurance ETF (KIE) are only down 9% from their highs, which is a “mild” drawdown relative to the 20-plus industry ETFs I track. Most of them are down at least 10%, with several still down between 20% and 40%.

As always, we invite you to join us at Green Zone Fortunes for full access to my Green Zone Power Rating system, a rockstar model portfolio and weekly updates.

To good profits,

Editor, What My System Says Today