We all know that investors don’t always act rationally. There are times when emotions enter the decision process. In the current market, it’s likely that emotions are the most important factor driving prices.

The economist John Maynard Keynes noted that emotions often drive finance markets. He called these emotions “animal spirits.” Keynes also noted that it’s important to consider what happens when animal spirits cool. He wrote:

“Thus, if the animal spirits are dimmed, and the spontaneous optimism falters, leaving us to depend on nothing but a mathematical expectation, enterprise will fade and die; though fears of loss may have a basis no more reasonable than hopes of profit had before.”

We can’t directly measure animal spirits, but indirectly we know that consumer sentiment corresponds to this concept. Optimistic consumers buy homes and cars and invest in speculative stocks. Pessimist consumers delay large purchases and avoid risks in the stock market.

Recent news on consumer sentiment raises cause for concern. Wells Fargo noted, “The preliminary read on consumer sentiment for August shows a plunge to 70.2, the lowest level since 2011. The expectations component also dropped to 65.2 from 79.0 in July.

Although there has been a divergence recently between this measure and the comparatively sanguine readings of confidence from the Conference Board, the message here is a direct one: the one-two punch of inflation and a COVID resurgence threaten to disrupt the consumer-led economic expansion.”

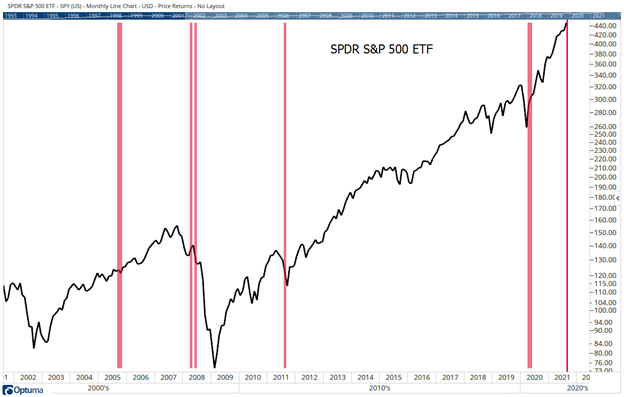

The chart below highlights the performance of the S&P 500 when consumer sentiment suddenly plunges. Red bars mark similar occurrences in the past.

Consumer Sentiment Plunges Harm Stocks

Source: Optuma.

Animal Spirits Predict Stock Performance

Drops like this in sentiment are rare. They have generally coincided with market weakness.

This time seems different. Sentiment broke down while stock prices are moving higher. Continued coronavirus concerns explain part of the drop in sentiment. Fears of inflation also explain some of the drop.

Neither of these concerns will disappear quickly. That means as animal spirits fade, we are likely to see stock prices follow.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.