Consumer behavior is returning to normal. We are seeing this in data that implies the economy will be returning to sluggish growth in the next few quarters.

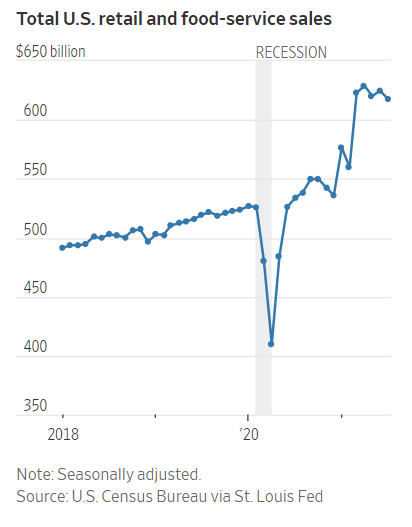

Retail sales are the latest economic report indicating that consumers are back to normal. After months of rapid growth, July’s retail sales dropped 1.1% compared to June, according to the Commerce Department.

Source: The Wall Street Journal.

Post-Stimulus Retail Sales Are Normal

Analysts noted: “Restaurants and bars were a bright spot, with sales rising 1.7% over the month, while sales at nonstore retailers—a proxy for online retail sales—fell 3.1%.” This is an indication that consumers are returning to normal. They want to get back into restaurants, and they are spending less money online as they walk back into brick-and-mortar stores.

The slowdown in sales doesn’t mean the economy is crashing. Retail sales are much stronger than they were before the pandemic shut down the economy. Total sales in July were about 17.5%, higher than they were in February 2020, just before the virus struck.

Higher retail sales reflect higher earnings and pent-up demand funded by months of forced savings. As consumers draw down their savings, the current level of retail sales is unlikely to be sustained.

Average hourly wages are up about 6.7% since February 2020. If retail sales fall to the level supported solely by earnings, we will see a resurgence of the retail apocalypse stories that dominated headlines before the pandemic.

It’s likely that the pandemic interrupted trends in retail but didn’t reverse long-standing trends. There are still too many retailers fighting for consumer spending that is constrained by slow wage growth.

With the economic effects of the pandemic and trillions of dollars in government stimulus subsiding, we are right back to where we were at the end of 2019. That wasn’t a particularly bullish time for stocks, and it isn’t a particularly bullish time for stocks right now.

While I didn’t exactly design the internet, I can take full credit for this.

I’ve created a first-of-its-kind innovation in the financial markets. It allows everyday traders to get ahead making one simple trade per week.

Click here to see how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.