In our latest Marijuana Market Update, I revisit a stock I’ve covered before: Aphria Inc. (NYSE: APHA).

Sam left a comment on YouTube:

Pleeaase do another one on Aphria after the Sweetwater acquisition and the MORE deal. It has a bit of momentum. Love your videos. Really informative.

Sam, I’m happy to cover Aphria stock again! Thanks for the comment.

When I first covered Aphria, I was bearish on the stock.

Its technical and fundamental data just didn’t support any reason to buy into the stock at the time.

But times, like the market, do change.

What’s Changed for Aphria Stock

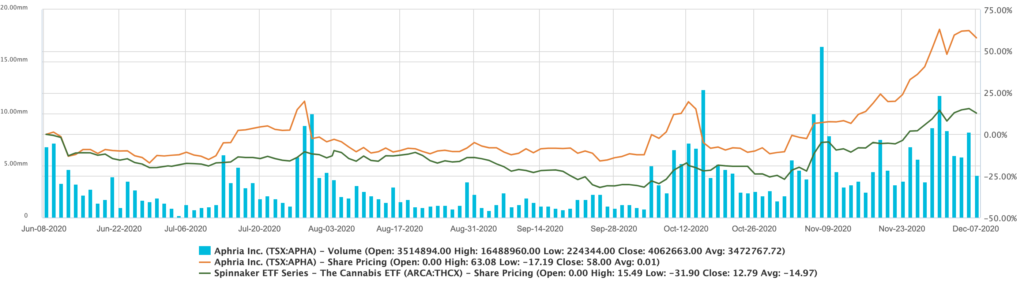

In the chart below, you can see that Aphria has made quite a run since November.

The orange line is Aphria stock, and the green line is the Spinnaker Cannabis ETF (NYSE: THCX) — an exchange-traded fund that tracks cannabis stocks.

Aphria Stock (Orange) Vs. THCX Cannabis ETF (Green)

The difference here is telling.

Since June 2020, Aphria shares have gained 58% in value — most of that occurring since November 1.

THCX, on the other hand, has only moved 12.8% higher in the same time.

So, Aphria is outperforming the broader cannabis market.

It’s also beating its broader industrial sector: agriculture.

Aphria (Red) Stock Beats American Ag (Blue)

The agriculture industry has gained around 30% since June 2020, while Aphria has doubled.

Aphria-SweetWater Deal; Politics

There are a couple of reasons APHA stock has risen so fast.

The first is political.

Ushering in a Democrat president with a Democrat-controlled House and the potential for a Democrat-controlled Senate bodes well for federal cannabis legalization.

The U.S. House of Representatives voted just last week to approve the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act.

The act would decriminalize cannabis on the federal level and expunge nonviolent federal marijuana convictions.

Even bigger than that, and the second reason for APHA’s rise, was the November 4 announcement that Aphria is dropping $300 million of available cash — and proceeds from a recent equity program — to acquire Georgia-based independent craft beer manufacturer SweetWater Brewing Co.

With SweetWater distributing its craft beer in 27 states and Washington, D.C., Aphria gained instant access to the larger U.S. market.

SweetWater develops and sells its flagship 420 beverages that are, as Aphria put it: closely aligned with a cannabis lifestyle.

The bigger question here is whether Aphria has the staying power to continue its upward trajectory.

Several analysts seem to think so. I share my two cents on the future for Aphria stock in the latest Marijuana Market Update. Watch it to find out!

Cannabis Watchlist Update

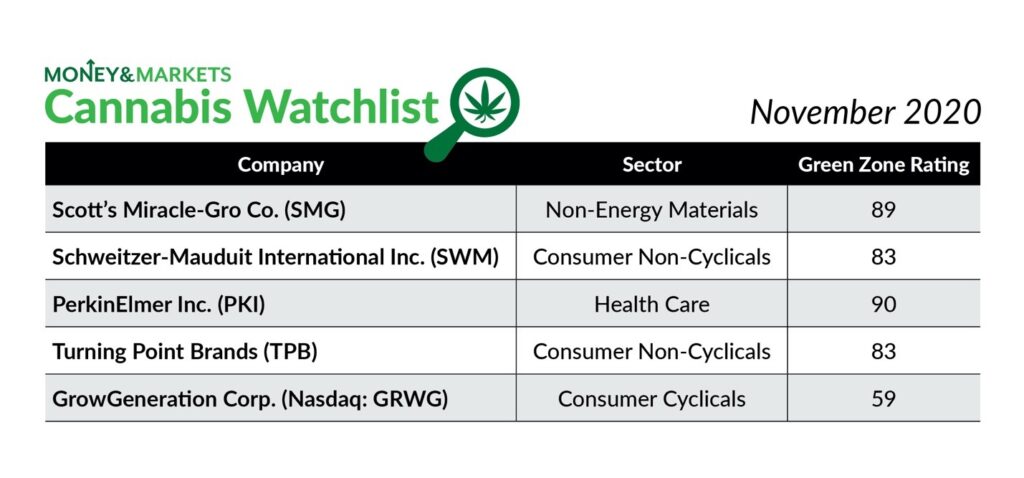

Now for an update on our Cannabis Watchlist.

Four of our five positions are now showing double-digit gains since I put them on the watchlist.

The watchlist’s cumulative gains of 20% blast past the broader market.

The iShares Core S&P 500 ETF (NYSE: IVV) is only up 4.6% since I put the first three cannabis stocks on our watchlist:

Here’s a deeper look at the performance:

- Schweitzer-Mauduit International Inc. (NYSE: SWM) — This traditional tobacco company has been in the black since I put it on the watchlist in September. As I write, it’s showing a 17% gain.

- PerkinElmer Inc. (NYSE: PKI) — The company that tests cannabis strains has also been a consistent winner since I added it in September. JPMorgan Chase & Co. recently increased its stake in PKI. The stock is up more than 20% since I added it in September.

- Turning Point Brands Inc. (NYSE: TPB) — This is another traditional tobacco company making a run into the cannabis market. Turning Point is our best performer thus far on the watchlist — up nearly 37% since I put it on the list in October.

- GrowGeneration Corp. (Nasdaq: GRWG) — This cannabis company is selling more stock in hopes of raising an additional $125 million in public money. Since I added it to the watchlist in November, it’s up more than 23% and still has room to grow.

- Scotts Miracle-Gro Co. (NYSE: SMG) — Despite being down as much as 10% early in October, the stock has rebounded and is up 2%.

If you invested when I made those recommendations, congratulations on your gains!

As always, my team and I love the feedback we’re getting on our YouTube channel and through email.

Feel free to send comments, questions and stocks you want us to examine to feedback@moneyandmarkets.com — or leave a comment on YouTube!

Where to Find Us

To watch the Marijuana Market Update before anyone else, just subscribe to our YouTube channel, and get an alert when we release a new update.

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

P.S. Before I go, I need to tell you about Chief Investment Strategist Adam O’Dell’s Millionaire Master Class, just in case you missed it.

Just go here to find out this trading secret Adam used to “retire” at age 33!

I use this very secret to guide the insight into the cannabis market that I share with you.

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.