Apple Inc. (Nasdaq: AAPL) held a big event this week.

Did you miss it?

Unless you are following Apple more closely than the rest of the market, you likely did. And you didn’t miss much.

At the event, Apple launch three major new services: Apple TV+, Apple News+ and Apple Card.

On the surface, two of these services have considerable potential for Apple’s revenue stream — but Apple News+? For $9.99 a month? Really? Who pays for news anymore?

The headliner for the event was Apple TV+. It’s being hailed as a direct competitor for Netflix and Amazon Prime TV. Apple has even lined up a host of big-name Hollywood talent for the service, including Oprah Winfrey and Steven Spielberg.

On the upside, Apple is reportedly opening up Apple TV+ to third-party smart TVs and streaming players. As someone who has owned an Apple TV streaming player and quickly moved on, this is a very good move for Apple.

On the downside, Apple didn’t talk about pricing for the service. I don’t doubt Apple’s ability to bring content to Apple TV+, but pricing will be the make or break for this service. With both Netflix and Amazon Prime TV hovering in the $13-per-month area, Apple needs to beat those prices.

What’s more, Walt Disney is launching its own streaming service later this year. With a decades-long catalog of Disney movies and TV shows, even Netflix has to worry about this service. It makes pricing even more key for Apple TV+.

The snoozer for the event is the Apple Card. There are some immediate detractors to this strategy. So let’s detail those first.

Apple Pay already exists, and it’s tied to your iPhone. Apple Card doesn’t diverge from this format, as it is also tied to your iPhone in order to maximize your benefits. Apple will offer 2 percent cash back for Apple Card users, but to get that you need to use the tap and pay feature on Apple Pay.

With iPhone sales in decline, this is a considerable detriment to the Apple Card right out of the gate.

What’s more, competitor cards can offer as much as 5 percent cash back without being tied to your smartphone. In short, Apple Card is nothing special in this regard.

But Apple may have a bit of a coup on its hands with one particular feature. Apple Card does not charge late payment fees, a rarity in the credit card industry. This could encourage users to carry a balance, potentially bolstering Apple’s returns.

Finally, the Apple Card pushes the company further into the payment processing market, estimated to be worth $1.9 trillion globally. The more entrenched Apple gets in this market, where name recognition is everything, the better its long-term returns.

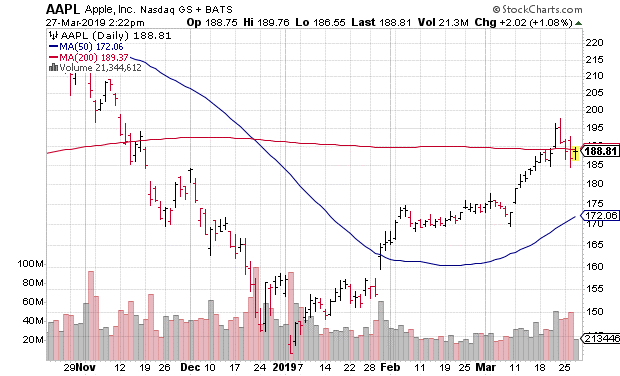

So, how did Wall Street respond to the Apple event?

With a great big “Yawn!” AAPL stock has declined steadily this week and is down 4.7 percent from its Friday high. The shares have even broken back below their 200-day moving average.

While Apple appears to be moving in the right direction in terms of services, many of these offering depend on iPhone sales. And those sales are declining, dropping from 18 percent growth in Q4 2017 to just 16 percent growth in Q4 2018.

Until the company comes up with a solution for this decline, all of its services are going to be handicapped of their true potential.