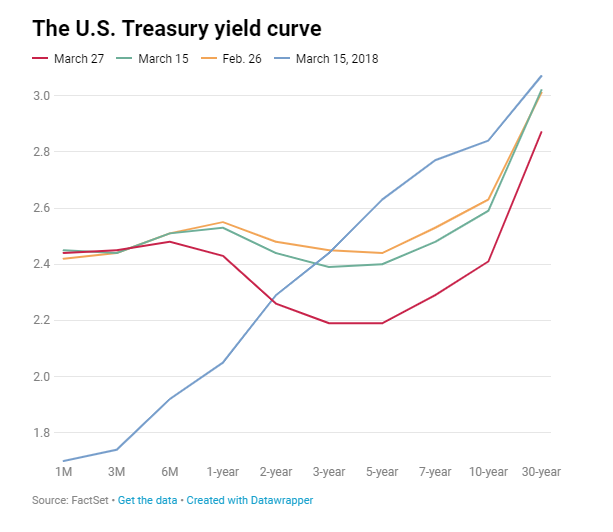

The benchmark 10-year Treasury note dipped to its lowest level since 2017 on Wednesday as government debt yields continued their steep March decline.

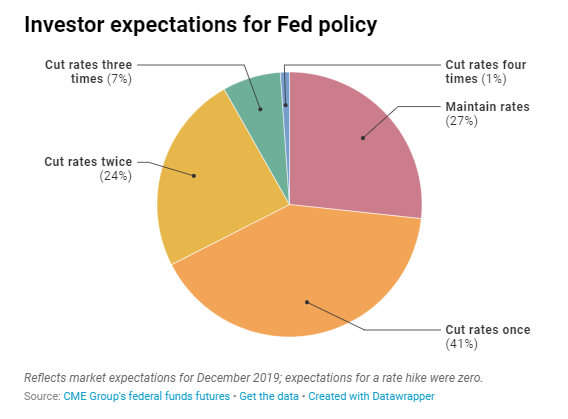

The 3-month Treasury yield remained 10 basis points above the 10-year as investors are growing more and more confident the Fed will actually be forced to cut its interest rate this year rather than raise it.

Per CNBC:

At 1:05 p.m. ET, the yield on the benchmark 10-year Treasury note, which moves inversely to price, was lower at around 2.381 percent, while the yield on the 30-year Treasury bond was also lower at 2.836 percent. The yield on the 3-month Treasury bill dropped 6 basis points to 2.45 percent.

The 10-year yield is down about 25 basis points since March 18.

“There’s definitely angst about global growth,” said Thierry Wizman, global interest rates and currencies strategist at Macquarie Group. “The bad data from Germany last week and a dovish tone from the Fed has made some believe [yields] won’t recover that soon.”

Comments from Stephen Moore, who is expected to be nominated by President Donald Trump for an open seat at the Fed, may have also weighed on yields. He told The New York Times that he thinks the central bank should “immediately reverse course and cut rates by half a percentage point.”

Moore is a distinguished visiting fellow at the Heritage Foundation and a current advisor to the president.

Following the Fed as it downgraded its outlook for the U.S. economy last week, domestic and international fixed-income yields have been under pressure. Yields on both the German 10-year bund as well as the Japanese 10-year traded in negative territory Wednesday; Germany sold 10-year bunds with negative yields for the first time since 2016.

The Treasury Department auctioned $41 billion in 5-year notes at a high yield of 2.172 percent. The bid-to-cover ratio, an indicator of demand, was 2.35. Indirect bidders, which include major central banks, were awarded 59 percent. Direct bidders, which includes domestic money managers, bought 17.2 percent.

Yields initially came of their lows Wednesday morning after the Commerce Department said that the trade deficit between the U.S. and its global peers pulled back in January to $51.15 billion.

China in particular helped reduce the balance shortfall as the deficit between Washington and Beijing decrease to $33.2 billion. Economists polled by Dow Jones had expected the balance to fall to $57 billion. Though a cursory calculation might suggest a boon to U.S. output, Wizman added that the deficit reduction could also suggest softer U.S. demand.

“Because imports into the U.S. were weak, some people are reading as a sign of weakness. Yes, it’s conceivable straight math could add to the first-quarter GDP, but you don’t know how to infer the demand side of the economy,” he said.