Many analysts were surprised by the recent employment report. Job growth was much slower than expected.

CNBC summarized the news by noting that:

Hiring was a huge letdown in April, with nonfarm payrolls increasing by a much less than expected 266,000, and the unemployment rate rose to 6.1% amid an escalating shortage of available workers.

Dow Jones estimates had been for 1 million new jobs and an unemployment rate of 5.8%.

Analysts have struggled to find models that reflect the rapid changes in the economy since last year. Because of that, the fact that the report missed expectations isn’t a surprise. The size of the miss indicates the models are broken, but many analysts blamed policy decisions.

The Wall Street Journal explained:

Under federal relief plans, those receiving jobless benefits get an additional $300 a week on top of regular state benefits, nearly doubling the average of $318 a week, according to the Labor Department.

That means the average unemployment recipient earns better than the equivalent of working full time at $15 an hour. Those enhanced benefits are available until September, for a maximum of nearly 18 months—about three times as long as most states typically allow.

Some employers and economists say the enhanced payments are one factor affecting job growth, and the U.S. Chamber of Commerce … asked policymakers to end the additional benefits.

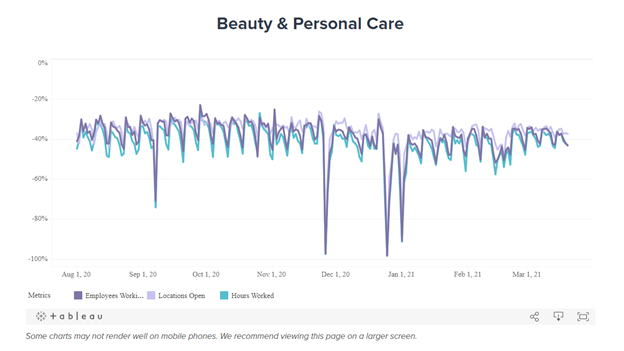

The truth is, even higher benefits might be needed as some jobs are simply not coming back. While the economy is recovering, some sectors show signs of permanent changes. Below is a chart of the changes in the beauty and personal care businesses.

Despite Recovery, 40% of Beauty Workers Still Seek Employment

Source: Homebase.

Employment In Pandemic-Ravaged Industries Isn’t Recovering

Despite a recovery, more than 40% of workers in the sector remain unemployed. That reflects changes in the industry.

Before the pandemic, many beauty salons were small businesses with few employees. Some will never reopen because there may be fewer customers in the future. With shops closed, family members cut each other’s hair. That trend appears to be continuing.

Unemployment benefits may explain some unemployment. But permanent business closures explain some as well. Policymakers need to use the time before benefits expire to understand the new normal and work to help employees in businesses that won’t ever recover.

I’m not quitting anything…

I’m just showing people a new way to make money in the markets.

My typical approach targets setups in individual stocks. With roughly 3,000 U.S. stocks, there’s plenty of opportunity.

But my new approach has simplified everything and boiled the markets down to one repeatable trade in the same ticker symbol.

The annual return was 132% last year. Click here to see how we did it. And most importantly, how it could benefit you.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.