Harry Truman was a plain-spoken politician. His folksy nature defined his approach to the office. Truman believed the president was responsible for his decisions and kept a sign saying: “The buck stops here” on his desk. Economists don’t have signs like that on their desks.

They are notorious for avoiding responsibility. They may believe they are presenting a balanced view when they say things like: “On one hand, low interest rates can boost business investment, but on the other hand, low interest rates can lead to high inflation.”

This sort of analysis led to Truman supposedly telling his staff to “get me a one-handed economist! All my economists say, ‘on the one hand … but on the other.’”

The reason they can speak to both sides of an issue is that the data is rarely clear. Ignoring this reality can lead to overconfidence.

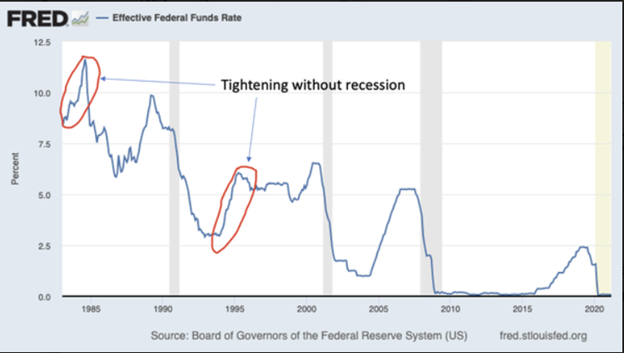

Nobel Prize-winning economist Paul Krugman recently argued that the Federal Reserve doesn’t need to worry about inflation because they have successfully fought it in the past: “in the 80s and again in the 90s it acted to rein in booms without causing recessions.” Of course, he had a chart to support his argument.

Economists Say They Raised Rates Without Causing Economic Crisis

Source: NYTimes.com.

It’s obvious from the chart that the Fed did raise rates without causing a recession (gray bars in the chart) twice. On the other hand, tightening led to recessions four times.

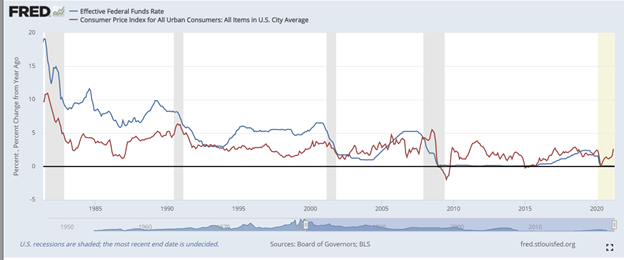

The difference could be that short-term interest rates were higher than inflation when the Fed avoided recession.

Raising Rates Lead to Recession 4 Times

Source: Federal Reserve.

Economists Need to Understand Economic Conditions

The dynamics of investment and savings depend on inflation.

Krugman is arguing that the 2020s will look like the 1980s, but the two eras have more differences than commonalities. Inflation was high and falling in the 1980s. Now, inflation is low and, for now, stable. Tax rates were falling in the 1980s and could now be rising.

Economists need to understand differences — which is why they need two hands. They can also prove things with well-selected examples like Krugman did by ignoring the other hand.

Is this stupid … or brilliant?

I found a way to trade the markets making the same trade every week.

We do this because any given week, this trade can knock it out of the freaking park.

I recommended 59 of these trades last year. We saw five trades go up 100% or more — each in a week or less.

And a total of 18 went up 50% or more — in an average of two days each.

All told, someone could have doubled every dollar they invested last year trading this way.

I want to give you the same chance.

P.S. I’ve been telling my readers that someone could double their money in a year with this. By the end of 2020, I proved that to be true. My “One Trade” strategy has never had a losing year across 12 years of back testing. And last year’s live results were even better. Click here to see how it all works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.