If you haven’t invested in new technology stocks over the past decade … well, let’s just say you missed out. The 2010s were a time when many of the tech innovations of the 1990s reached maturity. Think Amazon’s (Nasdaq: AMZN) internet shopping or Paypal’s (Nasdaq: PYPL) non-traditional banking.

But it was also a time where an entirely new generation of tech companies took advantage of widespread smartphone adoption to create another major wave of disruption. Uber (Nasdaq: UBER) put the traditional taxi model out of business, homeowners can now monetize their abodes thanks to Airbnb (Nasdaq: ABNB), and Netflix (Nasdaq: NFLX) has single-handedly changed the way we watch TV.

Impressive Tech Gains

Perhaps no ETF has more embodied the spirt of this age than Cathie Wood’s ARK Innovation ETF (NYSE: ARKK). Like Peter Lynch in the 1980s and Gerald Tsai in the 1960s, Woods “gets it.” She understands today’s major investment themes.

ARKK’s returns have been so good as to be almost ridiculous. The ETF rose 152% in 2020 and has enjoyed a compound annual growth rate of 48.4% over the past five years.

Of course, an ETF is only as good as the stocks it owns. I’ve said it before. Rather than missing the forest for the trees, focusing on a broad index or ETF can cause you to miss the trees for the forest. Before you trade an ETF, you should take a look under the hood to see the individual stocks driving its performance.

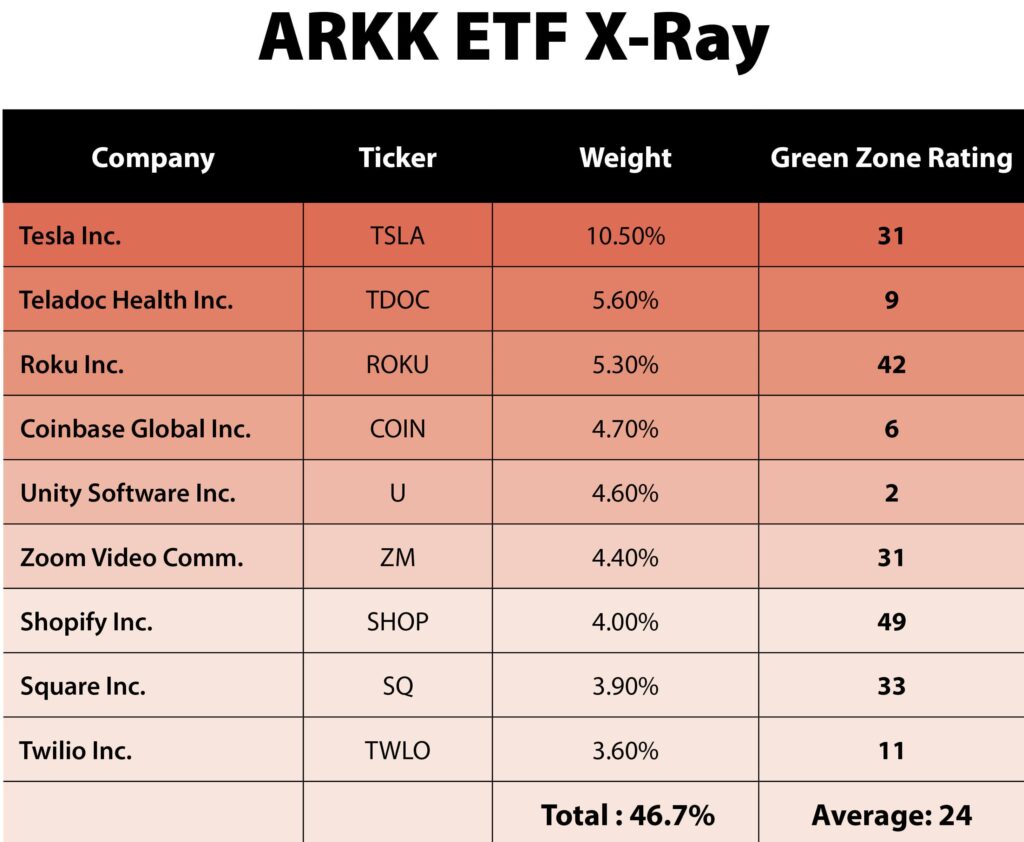

So, today that’s what we’re going to do. We’re going to pick apart the ARKK ETF and look at its largest holdings to see how they stack up on our Green Zone Ratings system.

ARKK ETF X-Ray

ARKK’s top 10 holdings make up nearly half the portfolio. So, it’s safe to say that as go the top 10, so goes the ETF.

At first glance, you may want to run away screaming from this one. The average Green Zone Rating for ARKK’s top 10 holdings is 24 out of 100. That’s deep into bearish territory. And we have several with single-digit ratings. Unity Software rates a 2 … out of 100!

But it’s also important to remember that most of these companies are new, and companies without lengthy track records tend to get penalized in our rating system. The growth metric is especially punishing because it incorporates time periods of up to 10 years. For newer companies, it helps to look through the factors into the underlying data used to compile the numbers.

As a case in point, let’s take a look at Coinbase Global Inc. (Nasdaq: COIN), the exchange of choice for many cryptocurrency traders. Coinbase rates an abysmal 6 out of 100 on our rating scale.

Coinbase Global Inc.’s Green Zone Rating on August 27, 2021.

But digging deeper into the data, the stock rates a 99 in earnings-per-share growth year over year. The company is growing like a weed, but its metrics look low due to the lack of data in prior years.

Now, I’m not going to recommend you run out and buy COIN today. It doesn’t rate well on a single factors. In fact, I’m not going to recommend you run out and buy ARKK. While I love its focus on disruptive new technology, I know we can do a better job picking individual stocks.

In Green Zone Fortunes, that’s exactly what I aim to do with stocks like my “market breakers.”

I’ve identified three market catalysts that will help mint an unprecedented number of new millionaires in the next 12 months.

These catalysts create the perfect environment for certain “market breaker” stocks, like one at the forefront of a $16 trillion investment opportunity.

To learn more about these catalysts and my No. 1 “market breaker” stock of 2021, click here for the details in my Millionaire Market Summit.

To good profits,

Adam O’Dell

Chief investment strategist, Money & Markets