There’s going to be a lot of infrastructure spending in the years ahead. Though it has yet to be signed, the Biden Administration has reached a deal in principle with the Senate on a $1.2 trillion plan, much of which will be used to repair and upgrade America’s roads and bridges.

$1.2 trillion is a lot of money, even in an economy as large as ours. And the companies on the receiving end of it stand to enjoy a serious — and prolonged — windfall. Infrastructure projects aren’t finished in a day. They take years, if not decades, to complete.

With that as background, let’s take a look at the Global X US Infrastructure Development ETF (NYSE: PAVE).

Why ETFs?

There’s an old market maxim loved by stock pickers: “The stock market is a market of stocks.”

The meaning is crystal clear. When we focus on the market or on a broad index like the Dow Industrials or the S&P 500, we turn the old expression of “missing the forest for the trees” upside down. We focus on the whole and lose sight of the fact that a forest is a collection of trees. Without the trees, there is no forest; without individual companies, there is no market.

The same is true of sector or thematic ETFs. A lot of my work in Home Run Profits revolves around identifying sector trends and riding those trends higher. In most cases, I like to drill down and choose individual stocks that are the best in class or the most tailored to the trend I’m following. But playing a trend via a sector ETF can often be a great way to get blanket exposure to the entire theme … so long as the ETF’s major holdings meet your criteria and aren’t full of dogs that will pull down your returns.

X-Ray: PAVE ETF

Our approach in Green Zone Fortunes is quantitative. We put every stock we recommend through a rigorous six-factor rating system to separate the proverbial wheat from the chaff. So, let’s do an ETF X-ray to see how the individual holdings stand up for PAVE.

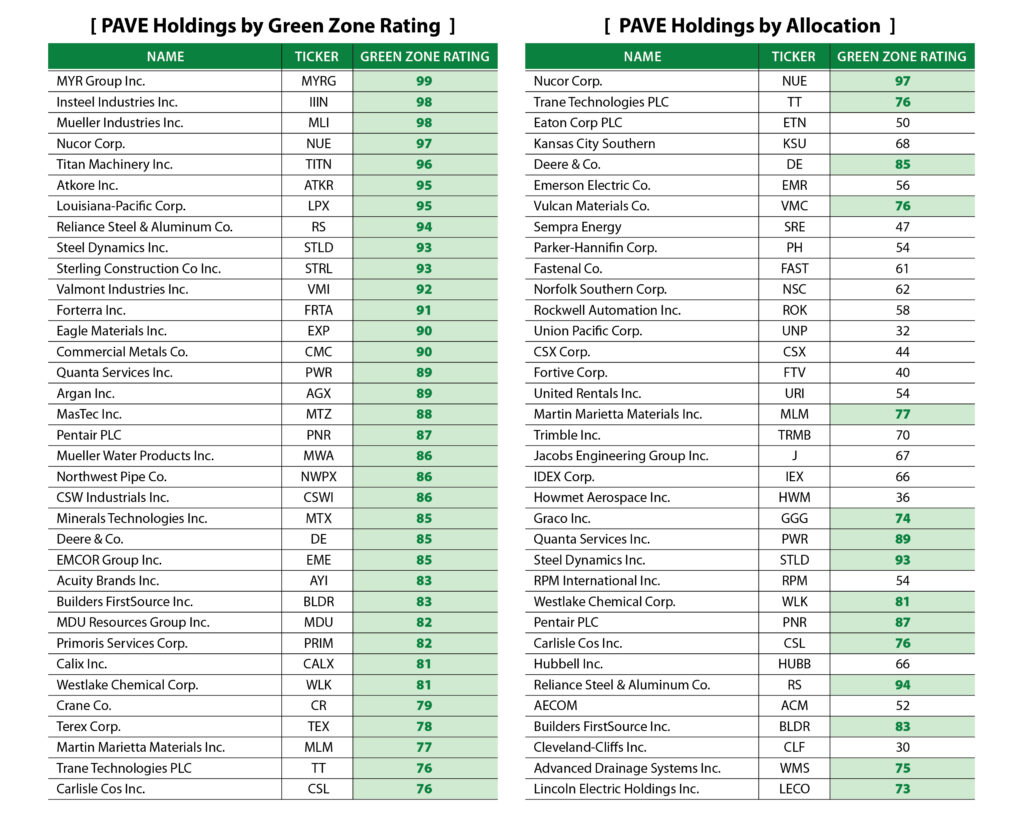

In the left-hand chart, we have the 35 highest-rated stocks in the ETF. PAVE’s holdings total 99 as I write this.

As you can see, most of this list meets our “Strong Bullish” threshold of a rating over 80. These are stocks that, based on our historical research, should outperform the market by three times over the following 12 months. And several are rated in the high 90s, making them some of the highest-rated stocks in our universe.

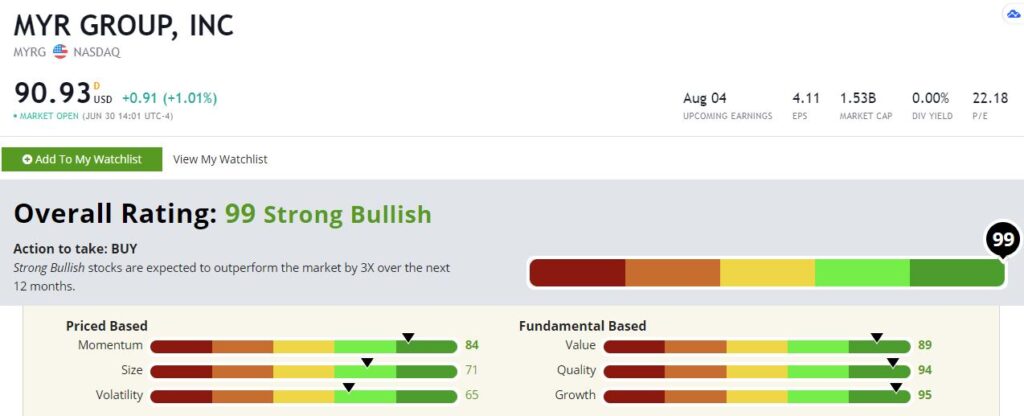

Of course, the highest-rated stocks are not necessarily the highest-weighted stocks. For example, the top three highest-rated stocks are relatively small positions. The highest, MYR Group (Nasdaq: MYRG), makes up only 0.3% of PAVE’s portfolio.

MYR Group Inc.’s Green Zone Rating on June 30, 2021.

This isn’t necessarily a deal-breaker for PAVE, as many of its largest holdings also rate well. Nucor Corp. (NYSE: NYSE: NUE) and Trane Technologies PLC (NYSE: TT), the two largest holdings representing over 3% each, rate at 97 and 76, respectively. And several of the top holdings rate in Strong Bullish territory.

But all the same, there are quite a few in “Neutral” or even “Bearish” territory. I have little interest in letting some of these laggards drag down our returns. I prefer to pick and choose the best of the best.

In our monthly newsletter Green Zone Fortunes, infrastructure has been one of our primary themes of the past year. We expect this to be a major opportunity generator for years to come. And in fact, some of our most promising infrastructure picks happen to be some of PAVE’s highly-rated holdings.

Earlier this month, I added a new stock to the Green Zone Fortunes model portfolio specifically targeting the infrastructure mega trend. It’s a high-momentum play that also rates well in the volatility, value, quality and growth factors of my system.

If you’d like to learn how I use momentum to “buy high … sell higher,” check out the details on my Millionaire Master Class here. You can see how to join my Green Zone Fortunes premium service that includes access to my model portfolio, my highest-conviction monthly stock recommendations and guidance on the best times to buy or sell.

To good profits,

Adam O’Dell, CMT

Chief Investment Strategist, Money & Markets