One of the fascinating parts of investing is unexpected links between markets. Though difficult to uncover at times, these can be potentially rewarding.

The link offering potential gains now starts with soybeans. That market is up more than 140% from pandemic lows. Barron’s notes several reasons to be bullish on beans:

While the Russian invasion of Ukraine has dominated headlines, that’s hardly the only factor fueling the trend. Even if the conflict were resolved tomorrow, global markets are still dealing with a major La Niña-driven drought in South America and a fertilizer shortage; the latter favors planting less fertilizer-intensive crops like soybeans. Moreover, as wheat prices have shot up, more farmers have switched to soybean meal for their animals, who don’t get a say in menu planning.

Grain prices are likely to remain high at least into 2023. And that’s bullish for sugar.

Why Sugar Looks Bullish

Years ago, I spoke with farmers in northern Colorado. They shared their thoughts on crop selection. They explained they primarily farm sugar beets. But when beans get a better price, more acres are devoted to soybeans. That’s where we are now.

If fewer beets are planted, the supply of sugar diminishes, leading to higher prices. This news comes as the commodity begins a seasonally bullish time of year.

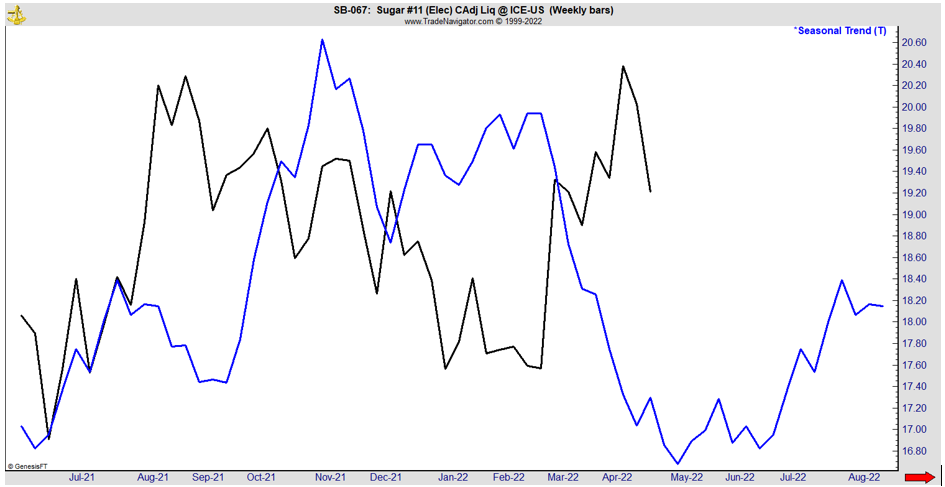

The chart below shows sugar’s seasonal trend (the blue line). Generally, it’s more bullish than expected in bearish times, but gains more than expected in bullish windows.

Sugar’s Seasonal Trend

From May to August, sugar prices tend to rise.

Researchers found sugar can be used as a hedge against falling stock prices because sugar is strongly correlated with crude oil. Another reason to be bullish here.

While futures are one way to trade this commodity, some stocks have exposure to the market. Cosan S.A. (NYSE: CSAN) is a Brazilian sugar producer. Adecoagro S.A. (NYSE: AGRO) has operations throughout South America and provides exposure to multiple commodity markets.

Bottom line: Supply, seasons and higher oil prices all point to gains in sugar for now.

Click here to join True Options Masters.