When you think of how cargo is moved from one place to another, you might envision railroads, semitrucks or even ships.

But the leading method to move freight fast is air.

E-commerce giant Amazon uses air transportation to move cargo over long distances.

In this chart, you can see the amount of freight the U.S. will transport through 2025.

The 53.2 billion tons of freight transported over a kilometer by air in 2020 will increase 42.1% in just five years!

In 2018, the market’s value was $1.1 billion. By 2026, analysts expect it to double to $2 billion.

Today’s Power Stock is an air cargo transportation company that’s partnered with Amazon: Air Transport Services Group Inc. (Nasdaq: ATSG).

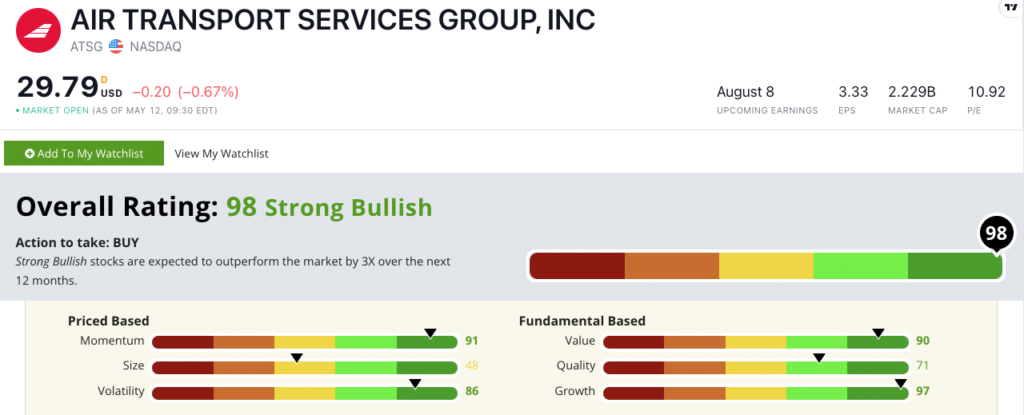

ATSG Stock Power Ratings in May 2022.

Air Transport leases aircraft and transports cargo in the U.S. and abroad.

It provides aircraft, crews, maintenance, fuel and more.

Its headquarters in Wilmington, Ohio, is just 65 miles from Amazon’s Air Cargo Hub in Cincinnati.

ATSG stock scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

ATSG Stock: Outstanding Growth + Solid Value

Researching Air Transport stock, two items caught my eye:

- Last year, the company reported total revenues of $1.93 billion — a company record.

- In 2015, it started its relationship with Amazon.com Inc. (Nasdaq: AMZN) by providing five cargo aircraft for Prime Air. ATSG has since expanded Amazon’s fleet to 35.

In ATSG, we have an exceptional growth stock with solid value and a strong record of upward momentum.

The company grew its earnings per share by 466.6% from 2020 to 2021.

Its quarterly sales jumped 29.2% in the first quarter of 2022.

This kind of performance earns ATSG a rating of 97 on our quality metric — in the top 3% of all stocks we rate!

ATSG’s trading multiples are all in line with or lower than its cargo transportation peers. The stock trades with a price-to-cash flow ratio of 4.6 — better than the industry average of 6.5.

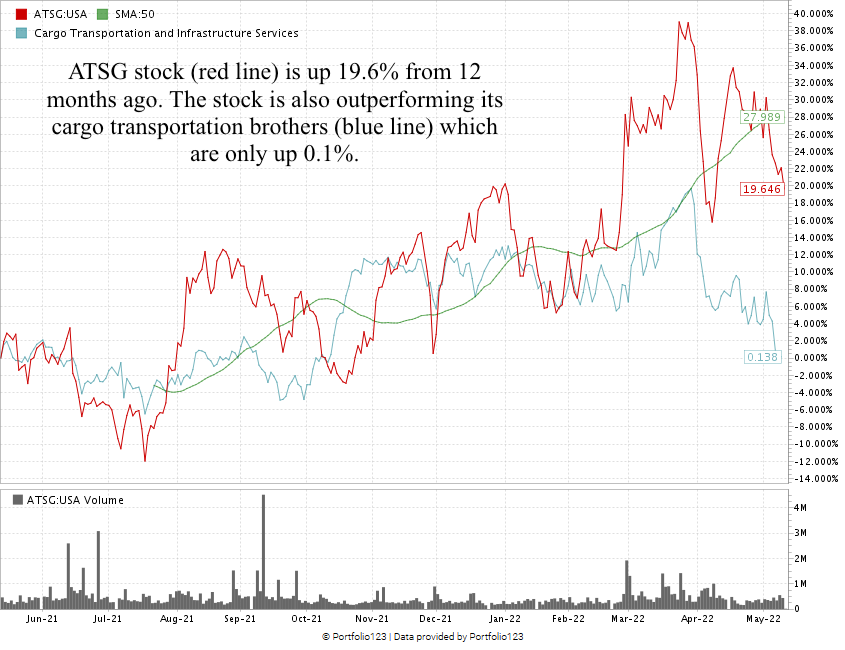

ATSG stock hit a 52-week low of $21.62 in July 2021.

In March, it hit a 52-week high of $34.15 — a 58% jump in stock value in just seven months!

While the broader sell-off has affected ATSG, the stock remains 19.6% higher than a year ago. It continues to crush the cargo transportation and infrastructure services industry, which is up just 0.1%.

Air Transport Services Group Inc. stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

With supply chain issues continuing to grip the global economy, moving goods from one place to another is even more important.

ATSG’s excellent growth and value make it a promising Power Stock for your portfolio!

Stay Tuned: Texas Energy Producer Rates 96 Overall

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an excellent power company that services 6 million people in the Lone Star State.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Got feedback about Stock Power Daily? Reach out to my team and me at Feedback@MoneyandMarkets.com!