If you’re looking for a solid 6% yield and a payout that should keep up with inflation in the years ahead, look no further than telecom stalwart AT&T Inc. (NYSE: T).

AT&T is one of the oldest companies in the S&P 500, tracing its origins to Alexander Graham Bell’s invention of the telephone in 1876.

But the AT&T we know today is a product of two previous market mega trends:

- A wave of consolidations in the late 1990s.

- And the birth of the mobile internet in the mid-2000s.

Despite the company’s long history, in recent years it acts more like a teenager that doesn’t know what it wants to be when it grows up.

Management fought tooth and nail to acquire Time Warner in 2018 with the goal of becoming a media content empire … only to spin off its media assets three years later.

This returned AT&T to its roots as a communications utility.

The move has left investors confused and made management look directionless. Its stock shares reacted about as you might expect.

AT&T’s shares have taken a drubbing, losing more than half their value from the 2019 highs to the lows set earlier this year.

Its divesture of the Time Warner media assets triggered an unpopular move as well. AT&T had to “right size” its dividend, cutting it almost in half. No one likes dividend cuts, but it was the only move that made sense given how much revenues dropped following the divesture.

But then a funny thing happened.

AT&T’s shares have caught a bid and are up more than 25% in a little over a month. It seems that T stock was finally too cheap to ignore, and the bad publicity surrounding its media plan has run its course.

AT&T Stock’s Turnaround

Today, AT&T is a premier communications utility, providing home and commercial paid TV, internet and wireless services.

The company sells essential services, and its revenue stream tends to be sticky. Changing your mobile carrier is a hassle, so most of us never do it. We’re de facto customers for life!

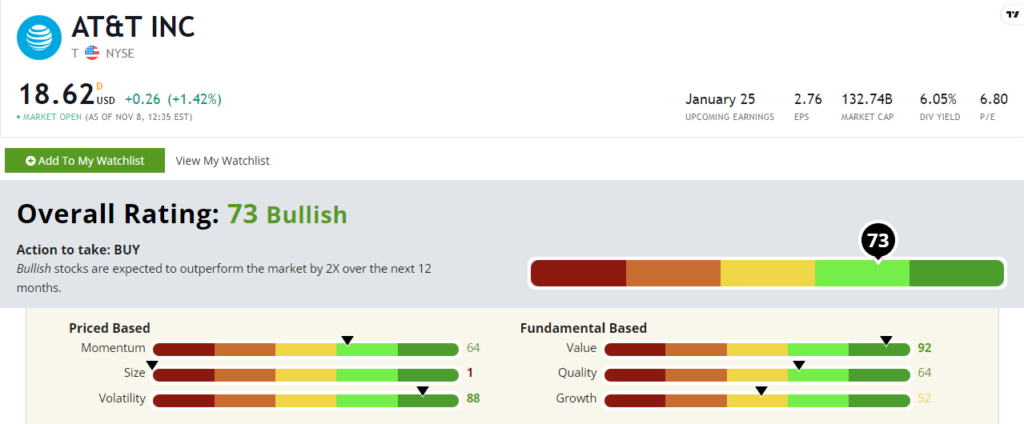

T’s Stock Power Ratings in November 2022.

AT&T rates a “Bullish” 73 out of 100 on our Stock Power Ratings system.

It loses points on size, as this is a stock with a mammoth $132 billion market cap. It also rates about in line with the market average on growth, with a factor rating of 52.

But the stock rates a stellar 92 on value. With a price-to-earnings ratio of just 7 and a dividend yield of over 6%, this is one of the cheapest large-cap stocks in our universe.

I also find the lack of volatility attractive. AT&T rates an 88 on volatility, meaning it is among the 12% least volatile stocks in our universe. That’s exactly what I like to see in a long-term dividend hold. I don’t want heartburn and drama. I want stable, boring consistency. T gives us that.

It’s also worth noting that AT&T rates well on quality, with a factor rating of 64. AT&T posts consistent high margins for what is pretty much a commoditized utility company. Following the Time Warner divesture, it now has less leverage on its balance sheet.

Last thing here, there’s momentum… AT&T was an “anti-momentum” stock for much of the past half-decade. The company went through a rough patch.

But in 2022, the stock is almost flat, which is no small accomplishment in a bear market. And now it’s showing strong momentum over the past month. T stock rates a 64 on our momentum factor.

Bottom line: Will AT&T stock make you wealthy? I wouldn’t count on it. This is not some newfangled tech stock. But it is a stable company essential to the modern world.

Buy it, collect the 6% payout and let the dividends compound.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.