The coronavirus pandemic has wrecked numerous industries.

One that’s taken a massive hit is the automotive sector.

Because of social distancing, manufacturers have two choices:

Either limit the number of employees in a factory or close it down completely.

In April, data firm IHS Markit estimated a drop of 21.2% in global vehicle production in 2020.

But that trend won’t last past March 2021 (More on that below).

Adam O’Dell is the Chief Investment Strategist for Money & Markets.

Using Adam’s proprietary stock rating system, we found a top-rated auto stock based on its value and quality. This company will lead investors to profit as vehicle manufacturing gets back on track.

I’ll let you in on that company in a minute. But first, I’ll tell you why and when vehicle production will back on track.

Vehicle Production Will Ramp Up

In the U.S., 279.6 million vehicles were on the road in 2019. For context, the population of the U.S. in 2019 was 328.2 million — meaning 85% of all Americans have a vehicle.

Even with a dip in auto production in 2020 and into 2021, the Center for Automotive Research forecasts U.S. auto manufacturers will not only get back to 2019 levels but exceed them in the coming years.

U.S. Auto Production Estimates

You see, as our population continues to grow, more Americans will buy vehicles.

And, in order to avoid lots full of unsold cars, auto manufacturers produce the number of vehicles they expect to sell — plus a few extra for good measure.

Now, let me tell you about this top-rated stock. The company produces a necessary component for all automobiles, regardless of size, make or model.

Unlock the Secret of This Top-Rated Auto Stock

Using Adam’s stock rating system, we found a company with the potential to be a huge player in the vehicle parts industry.

Strattec Security Corp. (Nasdaq: STRT) designs, develops and manufactures automotive access control products. (Think automatic door locks and ignition locks.)

The company rates as a buy — 96 out of 100 — based largely on its value and quality.

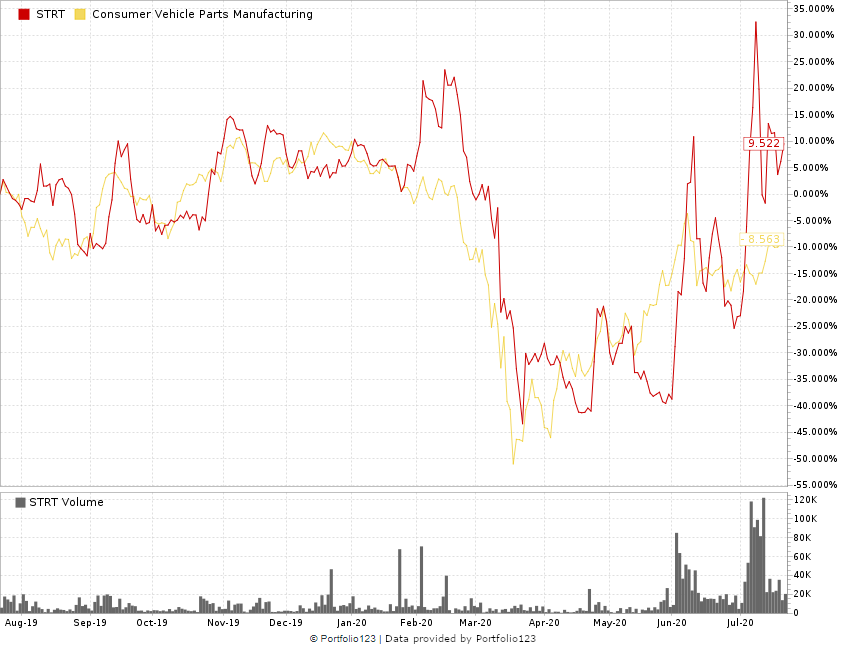

STRT Stock Has Grown Faster Than the Industry

Its sales in 2019 were $472 million, and its annual sales have grown in each of the last four years.

Fun fact: Strattec is an old company — founded in 1908 in Milwaukee, Wisconsin. It was originally part of Briggs & Stratton’s effort to build cars.

Here’s how Strattec stacks up:

- Value — STRT rates better than 96% of all other rated stock in Adam’s system on value. The strength of that rating comes from a 99 on price to cash flow — only 1% of the rest of the market is better — and a 97 on price to sales — only 3% of all other stocks rate higher. In both ratios, Strattec blows away the rest of the vehicle parts industry.

- Quality — The company rates a 91 on this metric — only 9% of all other stock are higher. STRT rated better than 93% of all other stocks on efficiency — meaning it turns over its inventory better than 93% of other stocks. Its debt and cash flow all rate better than at least 80% of the rest of the stocks rated. Strattec also scores a 72 on its return on equity, assets and investment metrics.

What You Should Do Now With Strattec Security

Automobile production will rebound after the coronavirus pandemic.

And the need for Strattec’s vehicle-locking mechanisms will increase.

Even amid the virus outbreak, Strattec’s sales only dropped 8% year-over-year in the quarter ending in March.

The company reported an increase in sales to General Motors Corp. (NYSE: GM).

It still managed to increase its net income and its earnings per share for the quarter.

That means, as vehicle production ramps up, so will Strattec’s sales … and its profits.

Getting in now, before production gets back on track, means investors like you can find big profits from this top-rated auto stock you’ve likely never heard of.