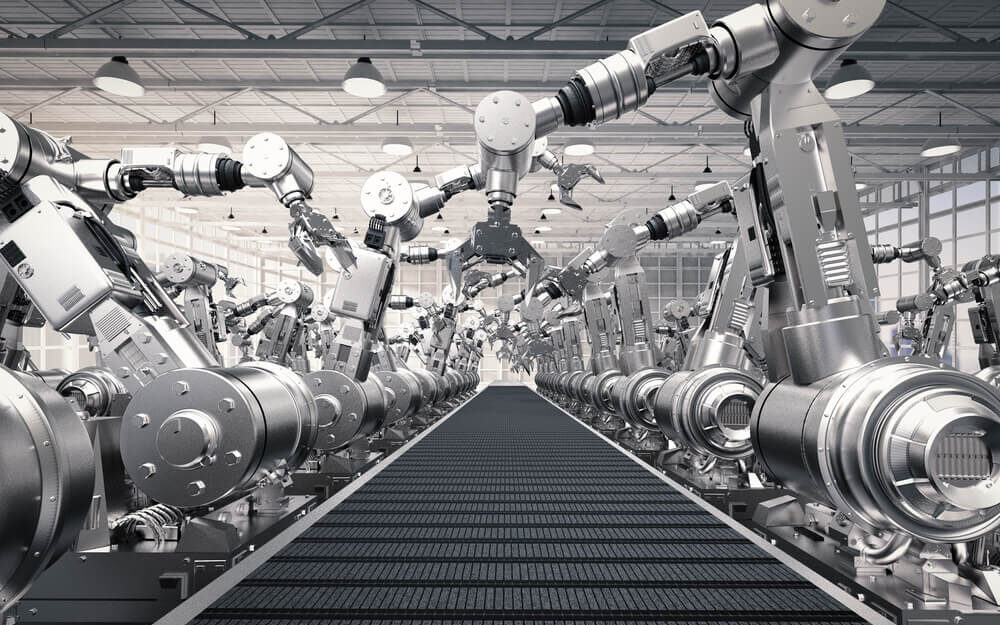

Automation is everywhere.

From robots on assembly lines to drone delivery services, we are finding new ways to build, deliver and use products with limited human interaction.

But the electronics and systems that go into these robots and artificial intelligence (AI) programs are complex.

This week, I reveal a company that produces critical electronic components at a massive scale as automation becomes commonplace in our daily lives.

The stock scores a 91 on our Stock Power Ratings system, meaning we expect it to beat the market by 3X over the next 12 to 24 months.

And despite the market being down, this tech stock is already showing a strong upward trend.

Tech Stock Trend: Global Automation Set for Huge Jump

The automation market is growing at a rapid pace.

According to recent studies, the global industrial automation market was valued at $175 billion in 2020. By 2025, that is expected to balloon to $265 billion — a 51% increase in just five years!

Direct manufacturers of automation components (think: robots) won’t be the only beneficiaries of this massive growth.

Suppliers providing semiconductors and other complex electronic components will also enjoy this tailwind as money moves up the supply chain.

This chart shows the actual and estimated revenue of companies producing semiconductors and other electrical components.

After COVID-19 knocked the industry down a bit, it’s expected to roar back.

Revenue from these companies in the U.S. totaled $89.4 billion in 2020, but that’s expected to grow to $106.3 billion by 2024. It would be the most growth the industry has seen since 2013!

In this episode of The Bull & The Bear, I dive into a top company in our Stock Power Ratings system and tell you why it’s a strong contender for your portfolio.

Its 91 overall rating means we are “Strong Bullish” on this tech stock and expect it to beat the broader market by 3X over the next 12 to 24 months.

Note: Artificial intelligence is revolutionizing manufacturing, but another sector will be a bigger beneficiary of this groundbreaking tech.

Our Chief Investment Strategist Adam O'Dell has found his No. 1 stock set to capitalize on the fastest-growing sector of AI's booming, $80 trillion industry.

To find out more, click here to watch his "x.AI" presentation.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to make money in any market.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to subscribe to our YouTube channel for more videos, including my weekly Marijuana Market Update.

Have something you want us to talk about? Email Feedback@MoneyAndMarkets.com, and give us your thoughts.

Check out MoneyandMarkets.com, and sign up for our free newsletters that deliver you the guidance you need to make money — no matter what the market throws at you.

Also, follow me on Twitter.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.