Growth is critical to dividend investing.

I’ve driven that point home this year as high inflation has wrecked the prices of many yield-focused investments.

A high yield is nice. But unless the payout grows at the rate of inflation or better, you become a little poorer with every passing year.

To support a growing dividend, you also need a growing business. Dividends represent a distribution of profits. For a company to maintain sustainable dividend hikes, it needs a growing stream of profits to back them up.

To see how this all shakes out in practice, let’s take a look a datacenter tech real estate investment trust (REIT) Digital Realty Trust Inc. (NYSE: DLR).

How to Spot Healthy Dividend Growth

At first glance, DLR looks like the perfect long-term dividend stock.

The REIT sports a dividend yield of 4.4%, which is higher than the REIT average. As a point of reference, the Vanguard Real Estate Index ETF (NYSE: VNQ), a popular proxy for the REIT sector, yields 3% at the moment.

Digital Realty has also raised its dividend for 17 consecutive years.

And this REIT is tied to an exciting and growing industry in data centers.

Our world today lives in the cloud, and DLR’s data centers are a major piece of that infrastructure.

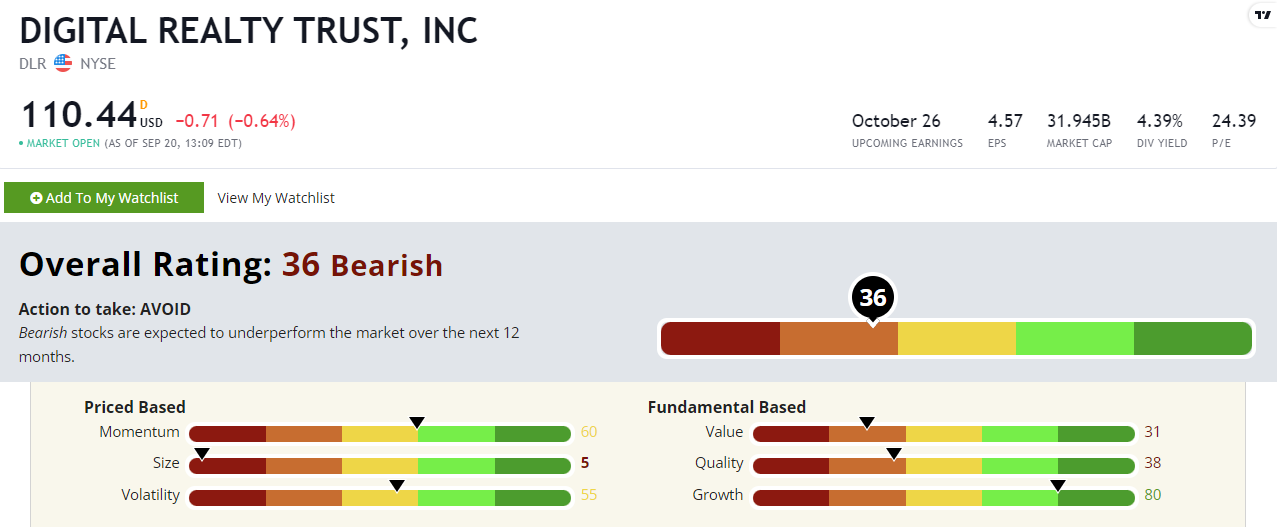

When you run Digital Realty through our proprietary Stock Power Ratings system, its stellar growth stands out with a growth factor rating of 80.

We use a blended metric that measures growth over a variety of time horizons ranging from the last quarter to the past 10 years. To rate as high as 80 on our growth factor, a company has proven its long-term health and viability.

What’s Tech REIT DLR’s Problem?

Digital Realty stock rates well on growth, and that’s about it within our Stock Power Ratings system, where it rates a “Bearish” 36 overall. For reference, “Bearish” stocks should underperform the overall market over the next 12 months.

DLR’s Stock Power Ratings in September 2022.

This tech REIT loses some points on its size factor, but that‘s expected. It’s one of the largest REITs in the world, with a market cap topping $32 billion.

It also loses some points due to its low value and quality ratings. That’s not uncommon for REITs because of quirky accounting that depresses their earnings with large noncash expenses, such as depreciation. Most REITs get penalized on our value and quality scores.

In a vacuum, I might look past the low scores on those three metrics.

Alas, we do not live in a vacuum, and it’s DLR’s mediocre ratings on momentum and volatility are a deal breaker for this stock at the moment.

We’re in a bear market.

When sentiment turns negative, investors gravitate toward lower-volatility stocks. That makes sense, as anyone would prefer a stock that holds steady compared to one that’s in free fall.

With a volatility rating of 60, Digital Realty’s score isn’t terrible.

But in this environment — given that we’re looking at this as a long-term income stock — I want to see less volatility. (That means a higher Stock Power Ratings volatility score, such as 80 or above.)

The same holds true of DLR’s momentum.

This is a year in which one way you win is by not losing.

I don’t need DLR to generate massive capital gains. I would be thrilled collecting a 4.4% yield, so long as the price was at least stable.

But that’s not the case today. Digital Realty stock shares have trended lower throughout 2022. Losses have outpaced those of the S&P 500 at a 2-to-1 clip.

I I still like DLR. I consider it a REIT to revisit in the future. But for now, our system says to stay away.

That’s OK.

Because in the September issue of Green Zone Fortunes, I found a highly rated income stock that does tick all my dividend stock boxes:

- It’s within a powerful mega trend.

- It yields 7%!

- It rates “Strong Bullish” within Stock Power Ratings.

To see how to gain access to my high-conviction income play, along with everything you need to transform your financial outlook, click here to see how you can get my Income Forever bundle.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.