Inflation forced the Federal Reserve to raise interest rates. Now there are signs it may not need to do much more.

But that doesn’t mean the Fed’s policy is showing results.

Growing evidence shows the economy is slowing. The drop in demand associated with the upcoming recession will lower prices.

That’s not good news. But that’s where the evidence points.

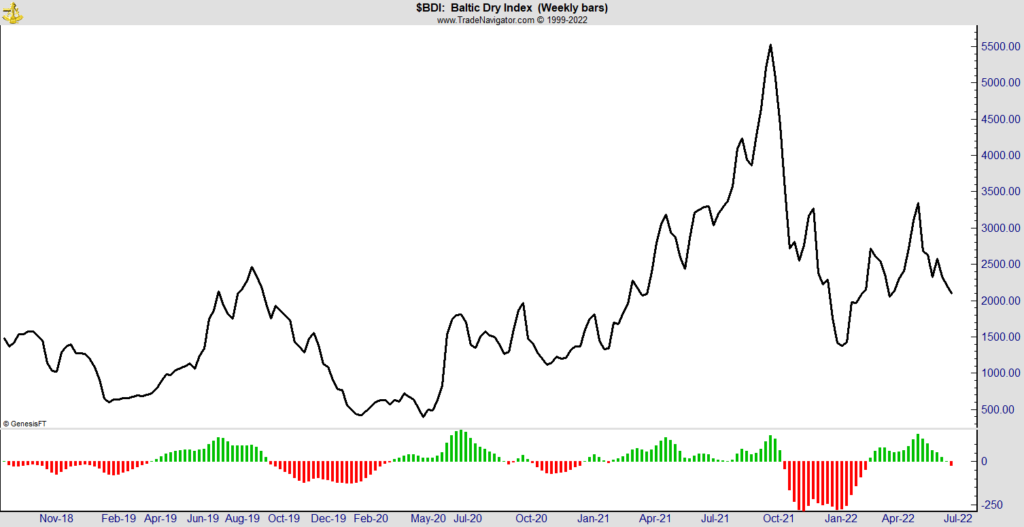

One part of the recession argument is shown in the chart below. Shipping costs are falling.

Shipping Costs Sink

Baltic Dry Index Tracks Supply and Demand

Above is the Baltic Dry Index (BDI), which tracks the average prices paid to transport dry bulk materials (shipping containers, cars, etc.) across 20-plus routes. It doesn’t track the tankers moving oil and natural gas worldwide.

The BDI is often viewed as a leading indicator of economic activity because changes in the index reflect supply and demand for important materials used in manufacturing.

For example, China imports many of the raw materials its manufacturers need.

The imports are often on ships that then transport the manufactured products out of the country.

In a growing economy, demand for shipping is steady or increasing. This pushes the BDI up.

Lower prices indicate demand is decreasing for shippers. The recent drop in new orders according to the Institute of Supply Management confirms this outlook.

Like the BDI, new orders are a leading indicator.

MACD Indicator Turned Bearish

Although many analysts believe the recession has already started, unemployment remains low. This tells me the recession isn’t likely to have started yet.

But the chart above shows the pain of an economic contraction is only beginning.

The MACD (moving average convergence/divergence) indicator at the bottom of the chart tracks the momentum of the BDI. It just turned bearish, indicating more downside is likely.

When the recession does begin, expect unemployment to rise, as it’s one of the defining factors of a recession.

Bottom line: The good news is inflation should drop.

As demand for things in the economy drops, the Fed can stop raising rates in response.

Click here to join True Options Masters.