The largest bitcoin futures traders are positioned to win big if the cryptocurrency keeps falling. But the data tells an important story.

I’ve talked about how futures markets revealed an upcoming stock market index rally. But there’s another side to the story within the crypto market.

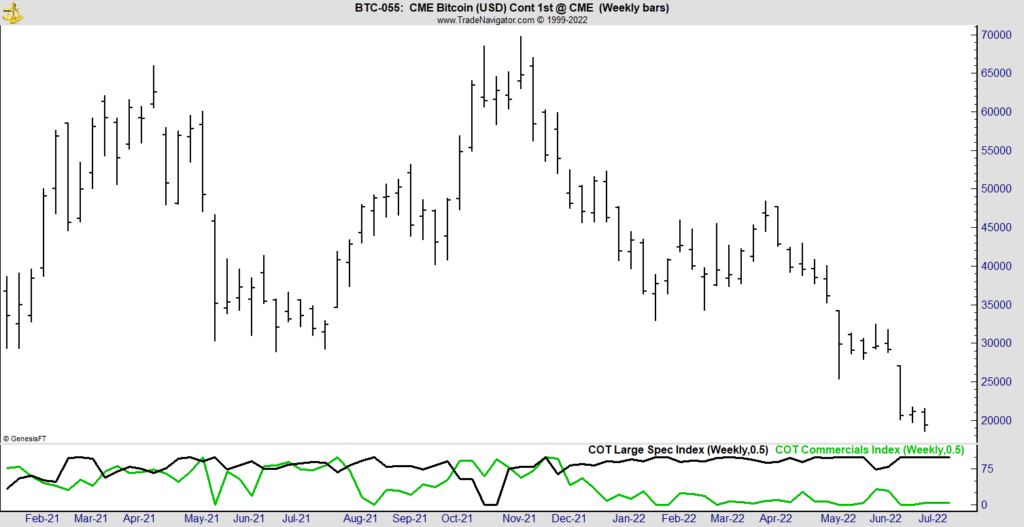

Let’s see what the weekly Commitment of Traders (COT) report says. Every week, the Commodity Futures Trading Commission’s report tells us who is buying and selling different commodities and futures contracts, like bitcoin.

Commercial Bitcoin Buyers

The report assigns all positions in the market to one of three groups: commercials, large speculators and small speculators.

For bitcoin, commercials could be financial firms that offer exchange-traded funds (ETFs) but want to reduce risk as much as possible. Or it could be lenders (such as investment banks or insurance companies) who helped fuel the bubble but knew they needed to manage risk.

Large speculators are hedge fund owners with large portfolios, while small speculators are individual traders who buy or sell a few contracts at a time.

Right now, the smart money (commercials) is bearish on bitcoin, while large speculators are still bullish.

6-Month Bullish and Bearish Standings for Large & Commercial Traders

Commercials are shown as the green line in the chart above. Large traders are represented by the black line. The lines show degrees of bullishness or bearishness over the past six months.

High values are bullish.

Commercials, the green line, are bearish and have been since the market peaked in November. Large speculators, the hedge funds, have been buyers on the way down.

Bottom line: To side with the smart money, investors should consider waiting for a change in the COT data before buying bitcoin.

Prices are down but can still fall further.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.