The U.S. banking system is sound and resilient.

Since March, these are the words the Federal Reserve has used to assuage fears around the “mini” banking crisis we face today.

I say “mini” because, from 2008 to 2009, more than 400 banks failed amid the great financial downturn.

After last week, we’ve only had three bank failures in 2023.

The Fed is optimistic about recent banking issues for one reason: total bank assets.

According to the FDIC and the Fed, First Republic Bank (the most recent bank failure) held just 0.9% of the total bank assets in the U.S.

Silicon Valley Bank accounted for 0.73% and Signature Bank had only 0.48%.

For comparison, in 2008, Washington Mutual held 2.7% of total assets before it became the largest bank to fail.

So 2023’s bank failures pale in comparison to the late 2000s — at least for now.

I don’t think we have seen the last bank collapse by any stretch of the imagination.

Today, I’m going to tell you why I think the Fed is taking such a laissez-faire approach to the banking crisis and how our Green Zone Power Ratings system showed these banks were ones to avoid … even before this “mini” crisis.

Why Central Banks Downplay the Crisis

Both the Fed and the European Central Bank (ECB) have classified their respective banking sectors as “resilient.”

Coupling recent events in the banking sector, that doesn’t make a lot of sense.

But…

Consider that the main role of the Fed and the ECB is to keep the economy in check and cool inflation.

First Republic, Silicon Valley and Signature Bank failing has created a tighter credit market — meaning banks are making it harder to qualify for lending.

A tighter credit environment takes the pressure off central banks, allowing them to raise rates more aggressively to push down inflation. Basically, banks are doing the work for the central banks.

It means two things:

- The Fed has an easier path to pause rate hikes.

- The ECB has followed suit and decreased rate hikes from 50 basis points to 25 with its latest hike last Thursday.

But…

Central banks are making this bet on the condition that these failures aren’t systemic.

Bearish Before Bearish Was Cool

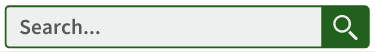

One of the powerful things about our Green Zone Power Ratings System is that it gives us an idea of what’s to come.

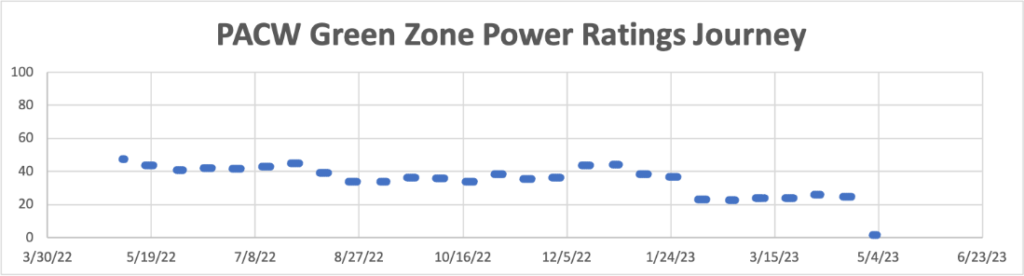

Let’s look at PacWest Bancorp (NYSE: PACW), a regional bank based out of Los Angeles that lost more than 50% of its share value last week as investors worried it could be next to fail.

As you can see, even when there was strength in the financial sector, PACW was never rated above “Neutral” within Green Zone Power Ratings.

Keep in mind, the Financial Select Sector SPDR Fund (NYSE: XLF) gained 19.6% in November 2022 alone. Despite that, PACW was rated “Bearish.”

Last week, its rating dropped to a “High-Risk” 2 out of 100 and the stock collapsed again after a huge drop back in March.

Now, PacWest is on the brink of disaster — even after a strong recovery on Friday.

Our Green Zone Power Ratings System indicated that PacWest was a bank stock to stay away from, even when the financial sector was outperforming.

Looking back, our ratings system was warning to avoid PacWest back in 2022. And it’s sending the same warning for many other smaller regional bank stocks.

Go to www.MoneyandMarkets.com and plug in some tickers of regional bank stocks into our Green Zone Power Ratings system to see how they look. Try ZION, FHN or CFG if you’re stumped on tickers to search for.

All you need to do is look for this search bar in the upper-right corner to get started:

Bottom line: I can’t say that all of these smaller regional bank stocks like PACW are going to fail from here, but our system is sounding the alarm that these are at least stocks you want to avoid as this mini-crisis continues.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets