Recently, Warren Buffett, the Oracle of Omaha, shocked the investment world by announcing he bought 21 million shares in an industry he spent decades bashing: gold.

You’ve heard the phrase “follow the smart money.”

It’s common among investors.

It means that you should pay attention to where big, successful investors are putting their money.

Some of the smartest money out there belongs to Buffett, the head of investing firm Berkshire Hathaway Inc. (NYSE: BRK.B).

To put his success in context, the Berkshire portfolio has about $202 billion in holdings — including $89 billion of Apple Inc. (Nasdaq: AAPL) and $21 billion of Bank of America (NYSE: BAC).

Investors follow Buffett’s investments like a religion … and for good reason.

He’s made billions in profits over the years.

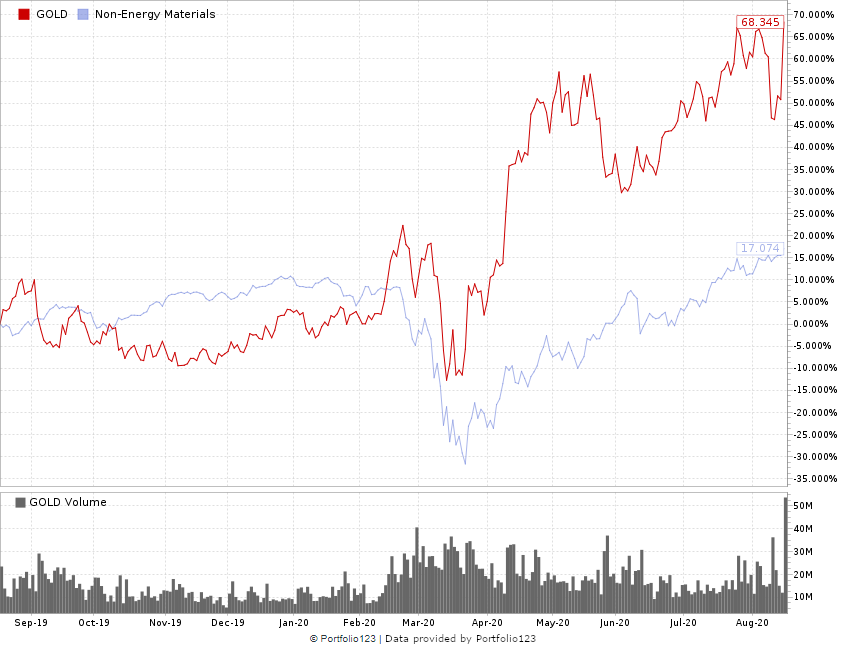

On Aug. 14, Berkshire Hathaway’s 13F filing showed the firm dropped $563 million on gold miner Barrick Gold Corp. (NYSE: GOLD).

Not to take a victory lap, but we told you about Barrick Gold stock way before Buffett even considered the stock.

If you took our recommendation, you’ve seen nearly 60% gains! And this is just the beginning.

What We Said About Barrick Gold Stock

Money & Markets Chief Investment Strategist Adam O’Dell beat Buffett to the punch — by about six months!

Back in February, Adam recommended a bullish options play on Barrick Gold stock to his Cycle 9 Alert readers.

They closed the option trade at the end of July for a 500% gain!

But trading options isn’t the only way to make a fortune on gold stocks.

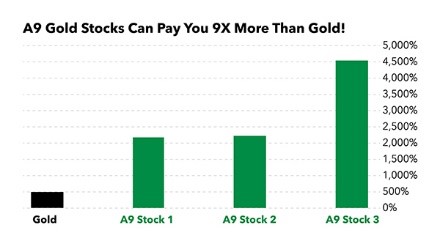

You see, Adam recommends buying shares of what he calls “A9 Gold stocks” in his Green Zone Fortunes service.

These aren’t your typical gold stocks.

They’re a specific type of gold mining company that can massively outperform the gold price.

As the gold price rises, these stocks go way up.

Take a look:

Now, we advise you to keep tuning in to Money and Markets. After all, on March 6, just before the Dow Jones Industrial Average shed 7.5%, 10% and 13% in three days — March 9, March 12, March 16 — we recommended three gold stocks to buy as we saw the downturn coming.

One of those was Barrick Gold.

At the time, Barrick’s shares sold for $18.95.

Today, they are floating around $30 per share — jumping another 11.6% on Tuesday after we learned Buffett bought in. If you followed our advice, you’re sitting on a nearly 60% gain!

Barrick Gold Continues to Rise

What You Should Do Now

Clearly, we saw the potential in Barrick Gold before the “smart money.”

If you bought Barrick Gold stock when we recommended it, congratulations on your gains.

But as I mentioned, this is just the beginning. Buffett’s first foray into gold just shows that Adam’s thesis is right.

And Adam has his eyes on three “A9 Gold stocks” that he’s convinced could boost your gains by up to nine times the price of bullion as the gold price rises.

Find out more now. Watch Adam’s urgent presentation here.

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.