U.S. real estate is a hot seller’s market right now — creating a high-pressure nightmare for buyers.

Low interest rates brought more Americans into the housing market to compete for the dwindling supply. Bidding wars lead determined buyers to pay tens of thousands of dollars over asking or forgo inspections and appraisals … sometimes all of the above!

With all that hassle, is it any wonder that more folks are choosing to build a brand-new house with all their favorite bells and whistles?

The U.S. Census Bureau reported the number of new houses starting construction in February 2022 was 22% higher than the same time last year.

Housing starts are hitting nearly 1.8 million this year — up from 1.5 million in 2021.

All these new houses mean a demand for lumber — not just traditional two-by-fours, but stronger, more durable engineered wood.

In the chart above, we can see that revenue from these specialty products took a 13% hit in 2020.

But the Census Bureau projects that demand will surpass pre-pandemic highs this year … and keep moving up.

A promising Power Stock that stands to benefit from this trend is Boise Cascade Co. (NYSE: BCC).

The company manufactures engineered wood, laminated veneer lumber, plywood panels and decking, as well as commercial roofing and flooring products.

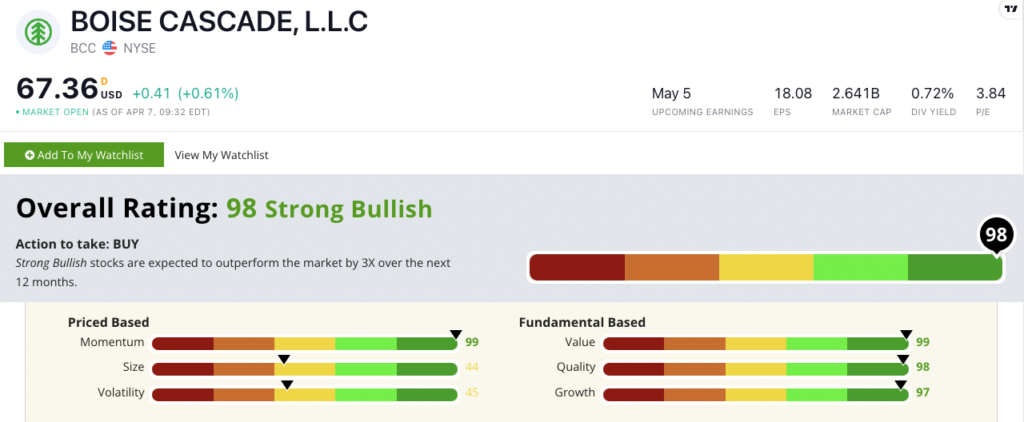

BCC scores a “Strong Bullish” 98 out of 100 on our Stock Power Rating system, and we expect it to beat the broader market by 3X in the next 12 months.

BCC Stock: Strong Fundamentals and Peak Momentum

My research pointed me to BCC for two main reasons:

- In its latest investor report, BCC’s total sales in 2021 were $7.9 million compared to just $5.4 million in 2020 — a 46% jump.

- Boise Cascade’s net income grew 304% from $4.44 per share in 2020 to $17.97 per share in 2021. In plain English, the company made a boatload of money for each share of its stock last year!

BCC stock showed plenty of upward momentum in the past year, climbing almost 53% from the 52-week low it set in July 2021. Check out this chart:

Increasing its total revenue by 18% in 2020, BCC was one of the few industrial companies that grew during the COVID-19 pandemic.

That growth spiked 46% in 2021 as the company responded to increased demand for its building materials. Leadership said it expects that demand to continue through 2022.

And the demand is there: The U.S. Census Bureau said the number of new houses starting construction in February 2022 was 22% higher than the same time a year ago.

Boise Cascade Co. stock scores a 98 overall on our Stock Power Rating system.

That means we are “Strong Bullish” on BCC and expect it to crush the broader market by at least three times in the next 12 months.

The last 12 months show us the “maximum momentum” we like to see in a stock. It earns a 99 on momentum (in the top 1% of all stocks on the metric).

BCC hits it out of the park when it comes to fundamentals: It boasts outstanding trading multiples at least three times lower than the industry average. (BCC scores a 99 on value.)

Its 305% annual earnings-per-share growth rate and 45% annual sales growth rate also make it an outstanding growth play. (It scores a 97 on our growth metric.)

BCC also pays a 0.72% forward dividend yield to the table, meaning you’ll earn $0.48 per share every year — just for holding the stock.

Stay Tuned: Grocery Store Stock to Buy

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a small but promising grocery store stock!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.