Inflation isn’t a market killer. Certain sectors thrive amid higher prices for goods and services.

And bank stocks are primed for short-term outperformance as prices rise.

Inflation is the highest we’ve seen since the 1980s.

The Consumer Price Index measures the monthly change in the price of goods and services. In January, the index hit 7.5% — its largest change in 40 years!

When prices surge, it pays to find assets that outpace inflation. And regional bank stocks look great to start 2022.

Using Adam’s proprietary six-factor Green Zone Ratings system, I found a regional bank stock that rates “Strong Bullish,” which means it is poised to crush the broader market by at least three times over the next 12 months.

Here’s why you should buy this regional bank stock now.

Regional Bank Stocks Blow Past the S&P 500

The S&P 500 is down about 11% since January 1. It’s now in market correction territory after falling more than 10% from recent highs.

And there’s an even stronger trend developing in regional banks.

The SPDR S&P Regional Banking ETF (NYSE: KRE) holds more than 100 regional banks.

In the last 12 months, KRE has had a total return of 35% compared to the S&P 500’s return of just 15.8%.

Let’s highlight a high-performing regional bank stock that has helped KRE outpace the broader market.

Maximum Momentum: Midland States Bancorp

Midland States Bancorp Inc. (Nasdaq: MSBI) is a financial holding company for Midland States Bank, headquartered in Illinois. It provides a full range of banking services for individuals, businesses and the government.

Midland States operates 52 full-service banking offices across Illinois and Missouri.

But it’s more than just a small, regional bank. It also offers:

- Treasury management — The bank helps businesses with a suite of online banking products.

- Wealth management — Midland’s independent, licensed investment experts help with financial, estate and corporate retirement planning.

- Equipment financing — It helps businesses finance specialty equipment.

MSBI grew its total annual revenue by 41% from 2017 to 2019 but suffered a downturn in 2020 due to the COVID-19 pandemic.

After losing 9.5% of its total revenue in 2020, MSBI is projected to rebound. The bank is expected to increase total annual revenue to more than $300 million by 2023.

MSBI saw a big run of its stock in the first quarter of 2021. However, in its first-quarter report last year, the bank was hit with $4.9 million in loan advance charges. This resulted in a 3.1% decrease in quarterly net income.

But the move paid off. In the third quarter, MSBI received a $6.8 billion benefit from those first-quarter advances. It reported a bump in net interest and net income for the quarter.

Following the favorable report, MSBI stock moved more than 30% higher starting in September 2021. It hit a new 52-week high at the start of this month, showing “maximum momentum” we love to see in stocks.

Midland States Bancorp Stock Rating

Using Adam’s six-factor Green Zone Ratings system, Midland States Bancorp stock scores a 98 overall. That means we’re Strong Bullish on the stock and expect it to beat the broader market by at least three times in the next 12 months.

Midland States’ stock rates in the green in five of our six rating factors:

- Growth — MSBI’s one-year annual earnings-per-share growth rate is a whopping 274%. Its year-over-year quarterly sales growth rate is 7.2%. It scores a strong bullish 94 on growth.

- Value — MSBI is undervalued, especially when compared to other banks. Its price-to-earnings ratio is 8.2 compared to the average of U.S. banks (11). Midland’s price-to-book is 0.99, while the average of its peers is 1.2. It scores a 93 on value.

- Size — With a market capitalization (shares outstanding times current share price) of $649.4 million, MSBI scores a strong bullish 82 on size. All other factors equal, smaller stocks should outperform larger stocks over time.

- Volatility — MSBI faced headwinds through the middle of 2021. But since September, its stock has risen 30%. The company scores an 86 on volatility. It’s less volatile than 86% of the stocks we rate.

- Momentum — As I mentioned, MSBI has jumped 30% since September. This is the definition of maximum momentum. It rates a 83 on momentum.

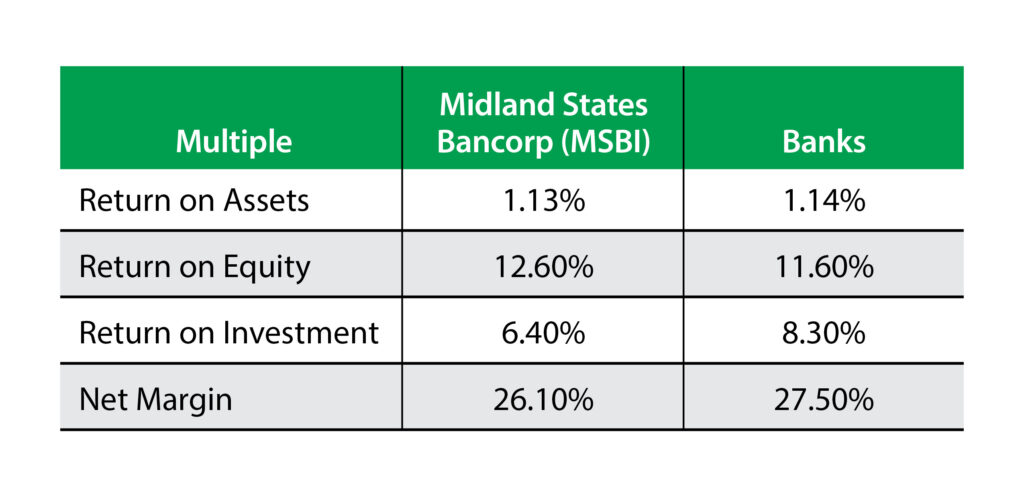

MSBI rates a 49 on quality. But this doesn’t mean the company has weak returns.

As you can see in the table below, its quality multiples are in line or higher than its banking peers:

Another plus for MSBI: its 3.95% forward dividend yield. You’ll earn around $1.16 per share in dividends.

Bottom line: In today’s world of higher inflation, banks are outshining the broader market.

It’s paramount to find a strong bank stock to buy with a lot of upside potential.

With maximum momentum and a solid dividend, Midland States Bancorp fits the bill and should be considered for your portfolio.

Regional bank bonus: In our flagship stock research service, Green Zone Fortunes, we recommended another regional bank before inflation took hold.

It’s just above our recommended buy zone, so you’ll want to wait for a dip before you buy in. But we still expect it to rocket 75% higher over the next two years!

Click here to see how you can join Green Zone Fortunes and gain access to this stock ticker and research, along with a slew of others tracking today’s top mega trends.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.