Experts like to say stock prices move randomly, which makes it hard to beat the stock market. They base this on sophisticated mathematical tests. They also point to simple statistics like the fact that stocks close higher on about 53% of all trading days. That’s about the same percentage you’d expect to see a coin toss come up heads.

This randomness created the trillion-dollar index fund industry. Index funds proponents argue that you can’t beat the stock market. So, they say, just give up and just accept whatever the market gives you. Many investors do that.

Others look for ways to beat the stock market. And there are proven ways to do just that.

One way is simply to trade based on what happened yesterday.

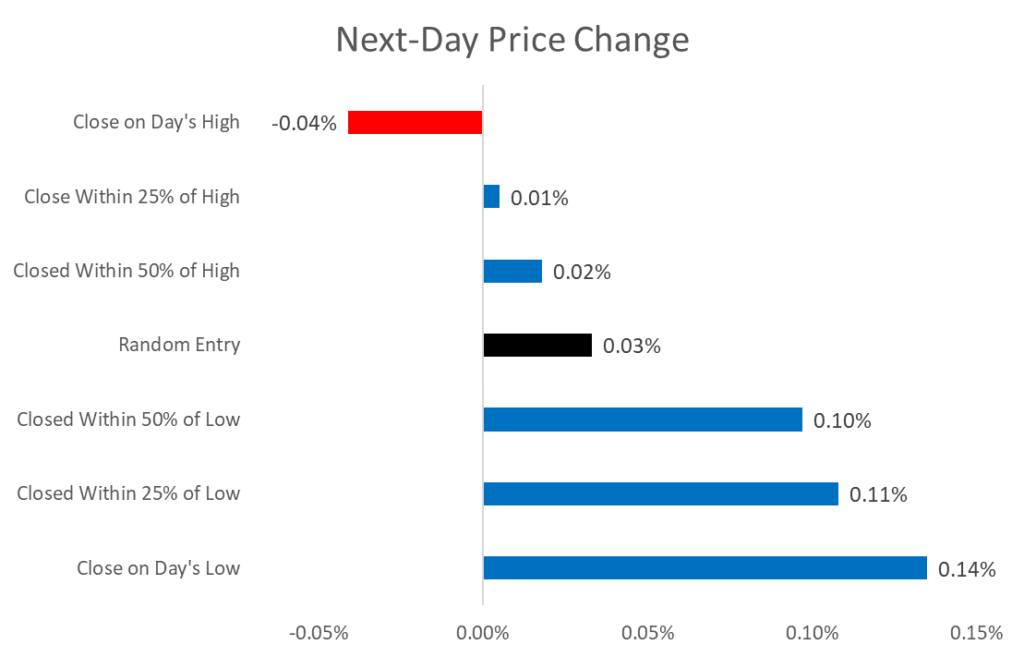

The chart below shows a strong relationship between the close and the daily range. The day’s range is the difference between the high and low for the day. This data is based on changes in the Dow Jones Industrial Average over the past twenty years.

There is a clear trend in the chart. Closes at and near the low are bullish. Closing at the high is the most bearish possible day.

Use Options to Beat the Stock Market

These price changes seem small. But options can magnify small gains.

Call options increase in value when prices rise. You can buy calls on days after the Dow closes at its low. This strategy delivers daily gains, on average, that are five times higher than a typical market day, and are a great way to beat the stock market.

Put options increase in value when prices fall. Buying puts after the Dow closes at its high can deliver significant gains.

The trend in the chart above is easily explained. In the short term, traders drive the market. After a strong day, they expect a sell-off. After a weak day, they look for strength. These behaviors create the pattern shown in the chart.

Mathematically, we say the stock market exhibits mean-reverting tendencies in the short run.

Short-term trading isn’t for everyone. But many investors might find short-term trading helps them avoid large losses and increases profits compared to a buy-and-hold strategy.

A note from Michael Carr: Because of their predictability, I focus on short-term trading. Next week, I’ll be sharing details on a strategy I’ve been trading for a local animal rescue. On average, trades are closed about two days after they’re opened so it does require some effort. But the results indicate the effort can be rewarded. I placed $10,000 in that account on January 1 and we made more than $7,600 in gains by May 31. To learn more, click here.

• Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr also is the former editor of the CMT Association newsletter Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.