Remember the hype last year with GameStop Corp. (NYSE: GME)?

The stock skyrocketed from $8 a share to $81 in a matter of weeks because of social media users.

Now it’s back down to $27 and has lost 23% in 2022.

Stocks that are popular among retail investors based on social media hype are “meme stocks.”

Here at Stock Power Daily, we don’t buy based on hype.

Our proprietary Stock Power Ratings system helps you cut through the noise to find the smartest, highest-potential investments.

The latest meme stock that’s popular with retail investors isn’t one of these…

Shares of retailer Bed Bath & Beyond Inc. (Nasdaq: BBBY) surged 120% over seven days in the middle of August.

But despite its cult following, this is a stock to stay far away from.

Here’s why.

Bed Bath & Beyond: Meme Stock Mania

The root of most meme stocks is the social media message board Reddit.

In early August, Reddit started to push up BBBY — one of the most shorted stocks on the market (meaning many institutional investors are betting against it).

Retail investors poured cash into BBBY, pushing the price up.

The price soared, forcing short sellers to repurchase shares. That pushed the price up even higher.

Our Stock Power Ratings system tells you investing in this company is risky.

Bed Bath & Beyond sells home furnishings, such as bedsheets, bath towels and coffee makers.

From its 52-week high in September 2021 to the first week of July 2022, the stock was in free fall, dropping 84.5%.

So short sellers piled in.

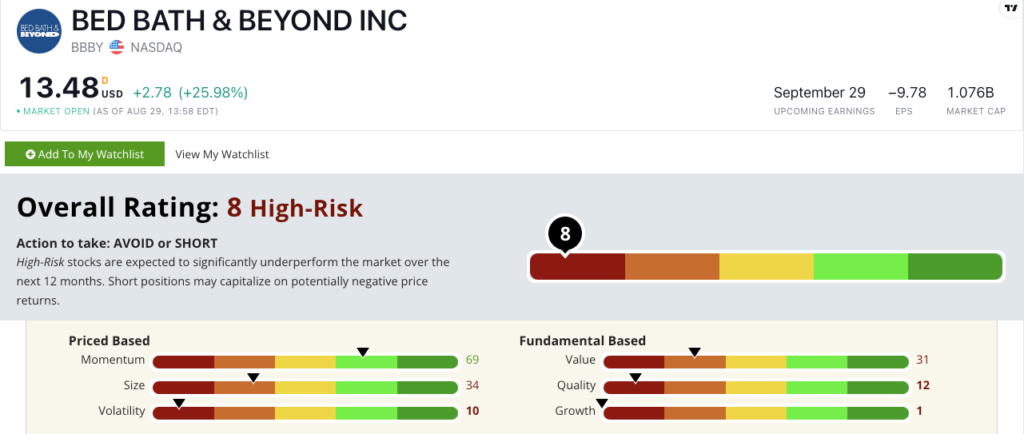

BBBY Stock Power Ratings in September 2022.

Bed Bath & Beyond stock scores a “High-Risk” 8 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

BBBY Stock: Lowest Growth + Poor Quality

I like to share exciting findings about our Power Stocks.

But that’s not the case with BBBY:

- In its last fiscal year, the company reported sales of $7.8 billion — a 15% year-over-year drop!

- The company has reported lower sales in each of the last four years.

That shows you why BBBY earns the lowest growth score possible: a 1.

It also scores in the red on our other fundamental metrics, quality and value.

BBBY’s return on equity is awful, at negative 195.5%. Its industry peers, on the other hand, average a positive 31%.

The company’s net margin is negative 11.7%. The home improvement retail industry average is 6%, so BBBY earns a 12 on our quality metric.

Its price-to-earnings, price-to-cash flow and price-to-book values are all in the red, earning it a 31 on value.

These numbers tell us BBBY stock is overvalued while its financials are underperforming.

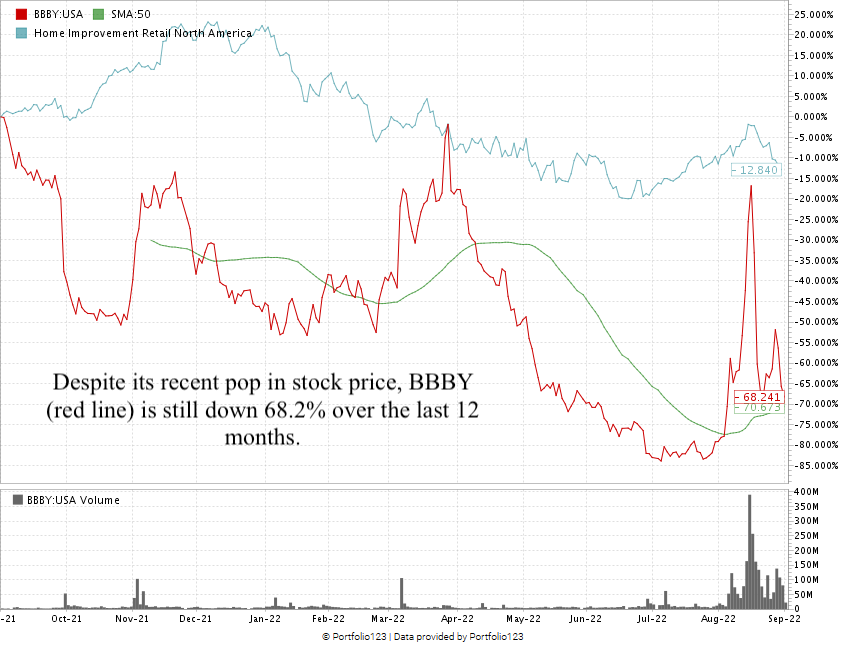

You can see BBBY’s (red line) frequent ups and downs in the stock chart above.

From its high in September 2021 to its low in July 2022, the stock lost 84.5%.

Despite its Reddit push, it’s still down 68.2% for the year.

Bed Bath & Beyond stock scores an 8 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Sales are in decline, and the company isn’t making any money.

A quick glance at our Stock Power Ratings system shows that meme stock BBBY is one to avoid.

Stay Tuned: Indiana Steel Producer

On Monday, we’re returning to our original Stock Power Daily format.

Stay tuned — I’ll share all the details on the third-largest producer of carbon steel products in the nation.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing high-risk stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?