In addition to powering our cars, we use petroleum to heat our homes and cook our food.

What I found out about the petroleum market led me to today’s Power Stock:

The chart above shows that the value of the global petroleum gas market will almost double from 2021 to 2030.

The increase in value means an increase in demand.

We need to find new sources.

Today’s Power Stock explores, produces and refines petroleum in Norway and the U.S.: Equinor ASA (NYSE: EQNR).

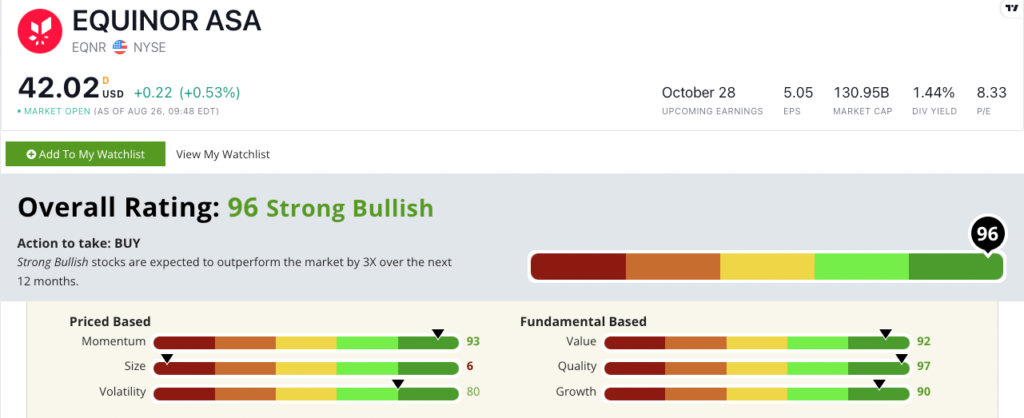

EQNR Stock Power Ratings in September 2022.

Equinor is a $122 billion energy company that finds petroleum in the Norwegian and North seas, as well as off the coast of the U.S.

Nearly 80% of Norway’s crude oil and petroleum exports go to Europe — which now faces an energy crisis due to Russia’s invasion of Ukraine.

Equinor stock scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

EQNR Stock: Strong Fundamentals + Maximum Momentum

EQNR had an outstanding second quarter of 2022 and is lining up for another solid year:

- Quarterly revenue was $36.4 billion — a 109% jump from the same quarter a year ago.

- Revenue for the first half of 2022 was $73 billion — 120% more than the same period last year.

You can see its growth, but Equinor is also a terrific quality stock.

Its return on equity is 41.5%, which hammers the industry average of 23.2%.

The company’s operating margin of 46.2% blows away its oil and gas exploration industry peers’ average of 17.5%.

On value, Equinor’s reasonable price-to-cash flow ratio of 1.9 crushes the industry average, which is more than three times higher.

This tells us EQNR is a bargain compared to its peers.

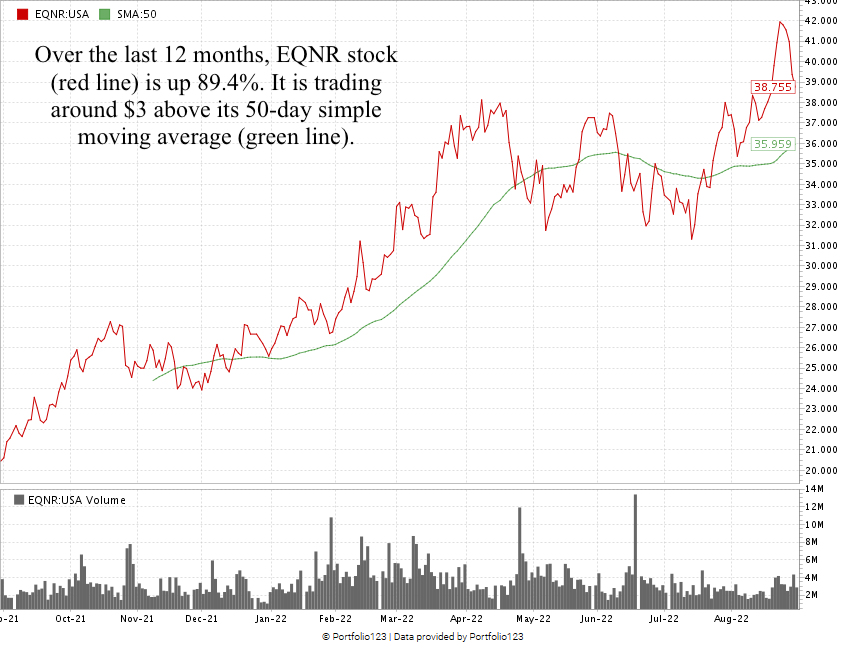

Over the last 12 months, EQNR has climbed 89.4%. Its industry peers are only up 80% over the same time.

It’s showing the “maximum momentum” we love to see in stocks.

The stock is trading more than $3 above its 50-day simple moving average — a bullish indicator.

Equinor stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The global demand for petroleum is growing, but we need to find new sources to meet it.

Equinor’s exploration of the Norwegian and North seas position it to meet that demand.

As you can see, EQNR is a smart addition to your portfolio.

Bonus: The company’s 1.8% dividend yield pays shareholders $0.76 per share, per year to own the stock.

Stay Tuned: Meme Stock to Avoid

I’m switching it up in tomorrow’s Stock Power Daily. Instead of a top-rated company, I’ll analyze a stock to avoid right now.

Stay tuned for the next issue, where I’ll share all the details on a “High-Risk” meme stock to dump.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.