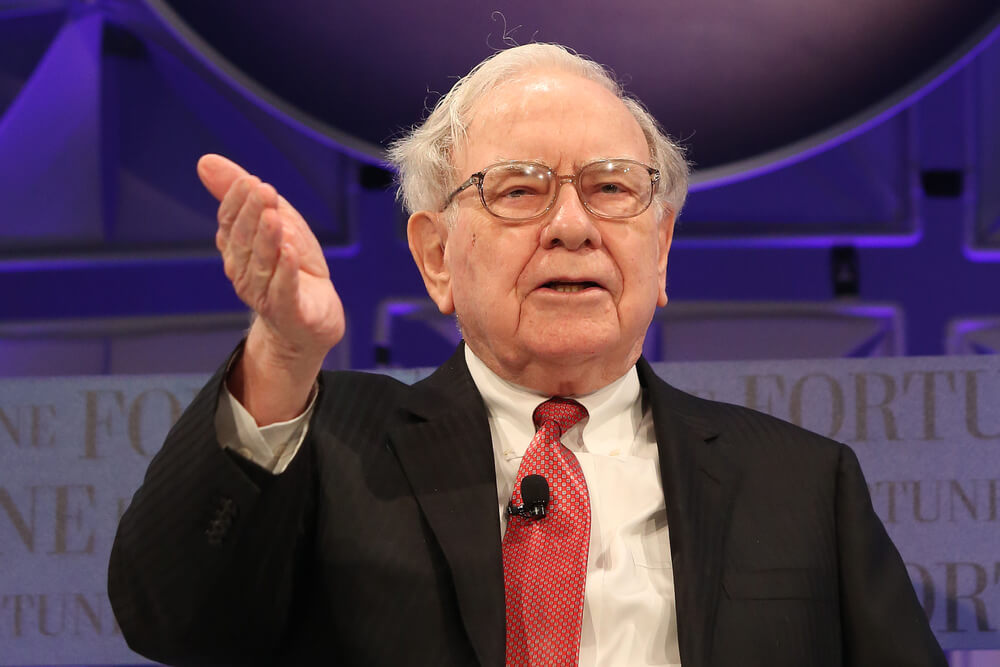

Berkshire Hathaway cut about three million shares of Apple, down to 249.5 million shares in the fourth quarter, but the sell-off order reportedly didn’t come from Warren Buffett himself.

“One of the managers other than Warren had a position in Apple and sold part of it in order to make an unrelated purchase,” Buffett’s assistant Debbie Bosanek told Reuters via email. “None of the shares under Warren’s direction have ever been sold.”

Berkshire also added 10.8 million shares of Suncor, a Canadian energy company based in Calgary, 4.175 million shares of software company Red Hat, 20 million shares of GM, and boosted investments in several banks, including Bank of America, U.S. Bankcorp, PNC, Bank of NY Mellon and 14.45 million shares of JPMorgan Chase, boosting its total holdings to 50.116 million shares of the largest bank in the U.S.

Per CNBC:

Buffett first announced Berkshire was buying Apple in February 2017 despite his usual aversion to tech stocks. And since then, Berkshire’s position in the iPhone-maker has grown significantly. By the end of 2017, Buffett’s conglomerate already owned 165.3 million Apple shares, and it bought another 75 million shares in the first quarter of 2018.

Buffett told CNBC at the time that he clearly likes Apple, and “we buy them to hold.”

“We bought about 5 percent of the company. I’d love to own 100 percent of it. … We like very much the economics of their activities. We like very much the management and the way they think,” Buffett told CNBC’s “Squawk Box.”

New stakes in Suncor, Red Hat

While paring the Apple holdings, Berkshire added more than 10.8 million shares of Suncor, an energy company based in Calgary, Canada, in the fourth quarter, according to a filing Thursday with the Securities and Exchange Commission.Berkshire also revealed a new stake of 4.175 million shares in software company Red Hat, according to the 13-F filing, which documents the company’s holdings as of end of December.

The company added more than 20 million shares of General Motorsin the fourth quarter, raising its total stake to 93.19 million shares. It also boosted its investments in many U.S. banks last quarter including Bank of America, U.S. Bankcorp, PNC, Bank of NY Mellon. The company reported adding 14.45 million shares of J.P. Morgan in the fourth quarter, to total 50.116 million shares.

The filing shows Berkshire dissolved its holding of 41.4 million shares in Oracle.

Berkshire Hathaway’s market moves, per Bloomberg:

Highlights

- Added to its holdings in JPMorgan Chase & Co.

- Decreased its stake in Apple Inc.

- Apple Inc. was the biggest holding, representing 22 percent of disclosed assets

Three new buys

- Red Hat: 4.18 million shares valued at $733.4 million, representing 2.4 percent of shares outstanding

- Suncor Energy Inc.: 10.8 million valued at $300.9 million

- StoneCo Ltd. Class A: 14.2 million valued at $261.2 million, representing 11 percent of shares outstanding

One exited holding

- Oracle: 41.4 million shares valued at $2.13 billion

Seven increased holdings

- JPMorgan: 14.5 million shares, up 41% to 50.1 million valued at $4.89 billion, representing 1.5 percent of shares outstanding

- General Motors Co.: 19.8 million, up 38% to 72.3 million valued at $2.42 billion, representing 5.1 percent of shares outstanding

- Travelers Cos.: 2.41 million, up 68% to 5.96 million valued at $713.5 million, representing 2.3 percent of shares outstanding

- PNC Financial Services Group Inc.: 2.18 million, up 36% to 8.26 million valued at $966 million, representing 1.8 percent of shares outstanding

- Bank of New York Mellon Corp.: 3.09 million, up 4% to 80.9 million valued at $3.81 billion, representing 8.2 percent of shares outstanding

- US Bancorp, Bank of America Corp.

Six decreased holdings

- Apple: 2.89 million shares, down 1.1% to 249.6 million valued at $39.4 billion, representing 5.3 percent of shares outstanding

- Wells Fargo & Co.: 15.6 million, down 3.5% to 426.8 million valued at $19.7 billion, representing 9.1 percent of shares outstanding

- Southwest Airlines Co.: 1.2 million, down 2.1% to 54.8 million valued at $2.55 billion, representing 9.8 percent of shares outstanding

- Phillips 66: 3.54 million, down 23% to 11.9 million valued at $1.02 billion, representing 2.6 percent of shares outstanding

- United Continental Holdings Inc.: 4.05 million, down 16% to 21.9 million valued at $1.84 billion, representing 8.1 percent of shares outstanding

- Charter Communications Inc. Class A

Top holdings

- Apple: down 2.89 million shares, to 249.6 million valued at $39.4 billion, representing 5.3 percent of shares outstanding

- Bank of America Corp.: up 18.9 million, to 896.2 million valued at $22.1 billion, representing 9.1 percent of shares outstanding

- Wells Fargo & Co.: down 15.6 million, to 426.8 million valued at $19.7 billion, representing 9.1 percent of shares outstanding

- Coca-Cola Co.: unchanged at 400 million valued at $18.9 billion

- American Express Co.: unchanged at 151.6 million valued at $14.5 billion