It was quite late Thursday evening when Canopy Growth Corp. (NYSE: CGC) finally released it’s third-quarter earnings report. The company just made the deadline set out by Canadian securities regulators.

Canopy Growth’s quarterly report is being watched extremely closely due to Canada’s legalization of recreational cannabis. As such, a Canopy spokeswoman told Marketwatch that the late release, which arrived even after extended trading hours had close, was intended to minimize the time between earnings and today’s 8:30 a.m. conference call.

This may seem kind of fishy to your average investor, but Canopy Growth was smart with this move. That’s because cannabis stocks right now are not trading on fundamentals. They’re trading on investor sentiment.

As proof, just take a look at Canopy’s quarterly report. The company saw revenue skyrocket roughly 750 percent from C$9.8 million last year to C$83.1 million in the third quarter. Net earnings soared 514 percent to C$67.6 million from C$11 million in the year prior.

Canopy said it sold 10,102 kilograms of cannabis and equivalents, compared to just 2,250 kilos in the same quarter last year.

CGC stock rose as much as 3.5 percent in after-hours and pre-market trading Thursday into Friday morning.

Those numbers look fantastic. However, there was a mark-to-market adjustment of convertible senior notes that lopped C$185.8 million from Canopy’s bottom line. As a result, diluted earnings came in at loss of 38 cents per share, versus expectations for a loss of 11 cents per share.

This is where Canopy wanted to get out ahead of the major news outlets. Institutional investors will take this news in stride, as they always have. CGC stock’s cult following of investors in the cannabis community, however, may panic sell on this news.

My advice: Don’t panic sell if you already own CGC stock.

Cannabis stocks have whipsawed in the past due to rapid shifts in market sentiment, and they will do so again.

There is one rather glaring reason for CGC stock to rally sharply if the shares come out of today’s investor conference call in rally mode. As of the most recent reporting period, more than 44.6 percent of CGC stock has been sold short.

Read that again: nearly half CGC’s stock is under the control of short sellers.

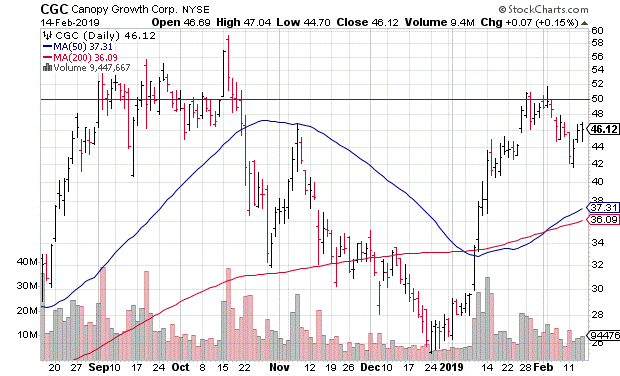

A closer look at these figures shows that the number of CGC stock shares sold short fell by 20 percent in the most recent period. During this time, CGC stock came dangerously close to breaking out above $50 per share on the New York Stock Exchange.

This level, I believe, is a breaking point for CGC shorts. In other words, should Canopy Growth’s stock gain enough buying power from earnings and today’s investor conference call to threaten the $50 level, these shorts will be squeezed into buying back their shares.

All you need to do is look at a chart for confirmation. The last time CGC flirted with $50, the stock spiked erratically to $56 first in September, then to nearly $60 in mid-October.

This is what we call a short-squeeze play. When this happens, CGC stock will surge to the upside. And when it does, it will be time for you to take some profits off the table. But don’t abandon CGC stock completely.

The shares will come back to earth in the natural ebb-and-flow of cannabis stock sentiment. Canopy is a major player in this market, and it could eventually be bigger than investor Constellation Brands.

Full disclosure: As of this writing, Thomas Lancaster held U.S. listed shares in Canopy Growth.