Many experts say the U.S. economy is already in a recession, and as markets continue to tumble it’s helpful to know the best dividend stocks to buy in a market crash to keep at least some income flowing into your account.

It’s one thing for investors to look for companies who may just weather the storm of a bear market.

It’s another to find those companies who can provide shareholders with a steady stream of income, even in a recession economy.

To find those companies, you have to seek ones that have some kind of stability or provide a product people can’t live without, even when economic times are tough. But to get that consistent income, you have to drill down further to find companies that pay a regular dividend.

Put simply, a dividend is a payment made by a company to its shareholders. It is paid by the revenue the company earns. A dividend can go up or down, depending on revenue in any given quarter.

With the current status of the economy, it’s important for investors to know the best dividend stocks to buy in a market crash.

Best Dividend Stocks to Buy in a Market Crash

1. Public Storage

Market Capitalization: $33.7 billion

Annual Sales (2019): $2.8 billion

Annual Dividend Yield: 4.15%

One of the most reliable dividend plays, especially when economic times turn south, is real estate investment trusts, or REITs.

A REIT is a company that owns or finances income-producing real estate in a range of sectors. What makes them even more attractive is they are required, by law, to pay out profits as dividends.

One of the strongest is Public Storage (NYSE: PSA). It operates more than 142 million net rentable square feet of real estate in the U.S. and Europe.

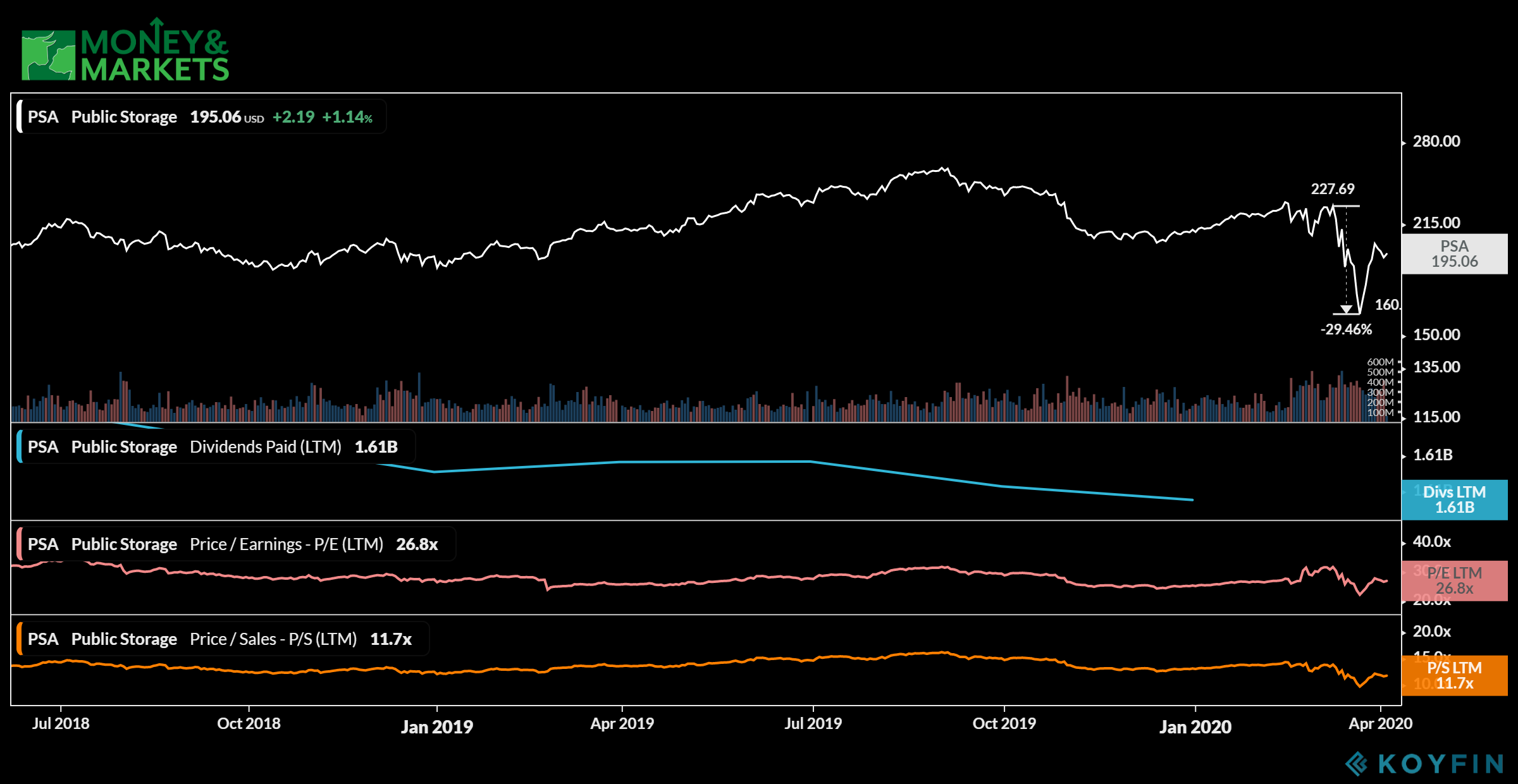

While its share price suffered a 29% drop over 10 days in March, it cut half of those losses in short order.

Because it sells space, not products, companies like Public Storage won’t be negatively impacted by supply chain issues typically suffered during economic downturns.

But, the big selling point for Public Storage is the dividend. Its current annual dividend yield is 4.15%. The company paid out $2 per share in dividends in March — despite the negative market impacts thanks to the coronavirus.

It’s strong dividend and ability to maintain it is why Public Storage is one of the best dividend stocks to buy in a market crash.

2. Eli Lilly and Co.

Market Capitalization: $136 billion

Annual Sales (2019): $22.3 billion

Annual Dividend Yield: 2.08%

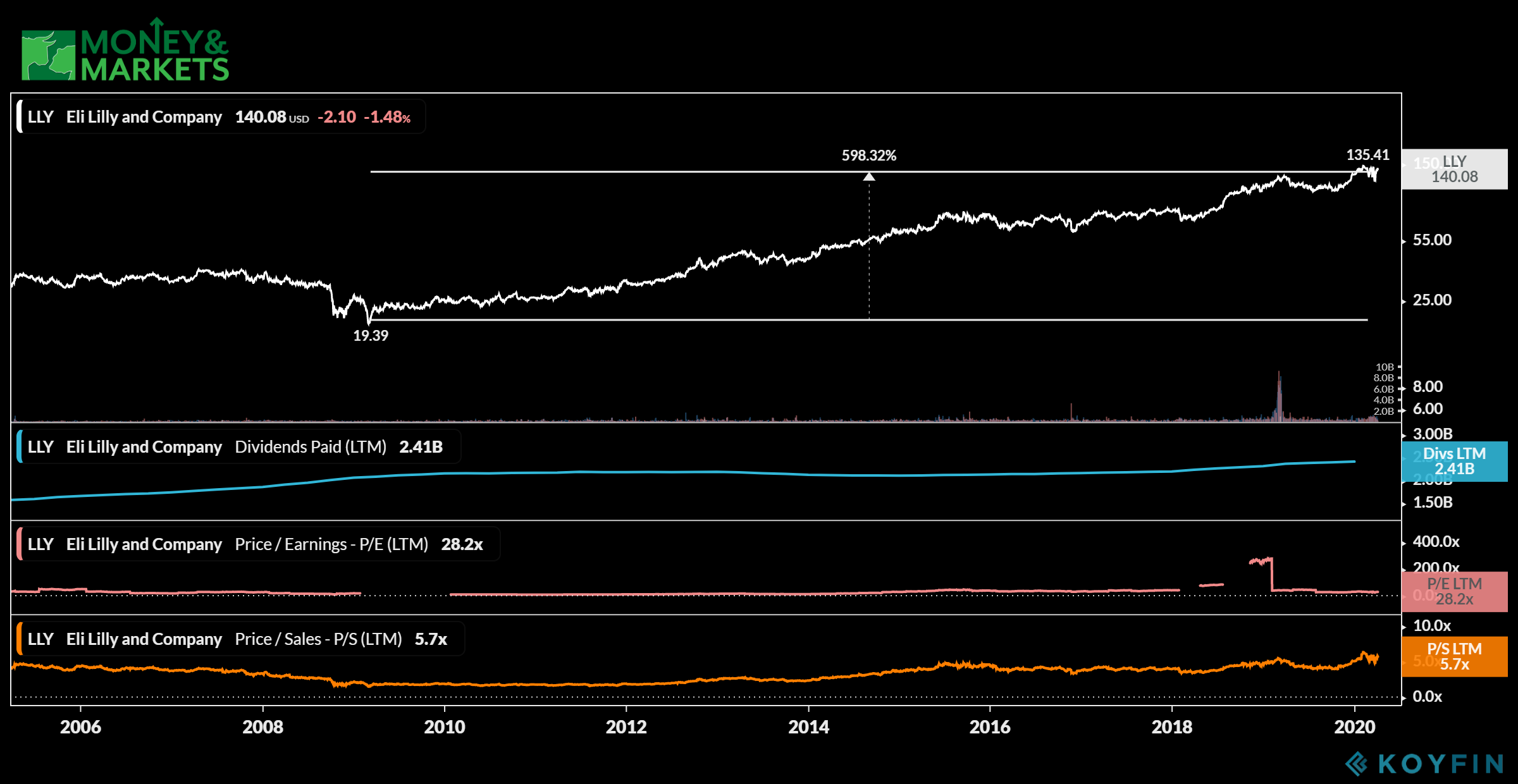

Since March 2009, pharmaceutical giant Eli Lilly and Co. (NYSE: LLY) has been on a tear.

Just out of the last recession, Eli Lilly’s share price has steadily grown by nearly 600% to where it is today.

Eli Lilly recently started collaborating with the Bill & Melinda Gates Foundation and other pharmaceutical companies for product development and testing for COVID-19.

Company CEO David Ricks told CNBC he hopes to start using the company’s treatment for the coronavirus “in the coming months.”

One strength of Eli Lilly is the fact that its pharmaceutical portfolio is very diversified. Their most commonly prescribed medications treat issues ranging from diabetes to cancer.

That insulates the company compared to others who specialize in just one or two drugs.

Another benefit for investors to hold Eli Lilly is the dividend. Its annual dividend yield is 2.08% and its most recent dividend payment was $0.74 per share. That’s an increase from the $0.64 per share it paid in 2019.

Its diversification and increase in dividend payment are what makes Eli Lilly one of the best dividend stocks to buy in a market crash.

3. Digital Realty Trust

Market Capitalization: $35 billion

Annual Sales (2019): $3.2 billion

Annual Dividend Yield: 3.32%

One of the least volatile stocks on our list is Digital Realty Trust (NYSE: DLR).

Like Public Storage, Digital Realty Trust is a REIT, but it focuses on data center real estate in North America, Europe, Asia and Australia.

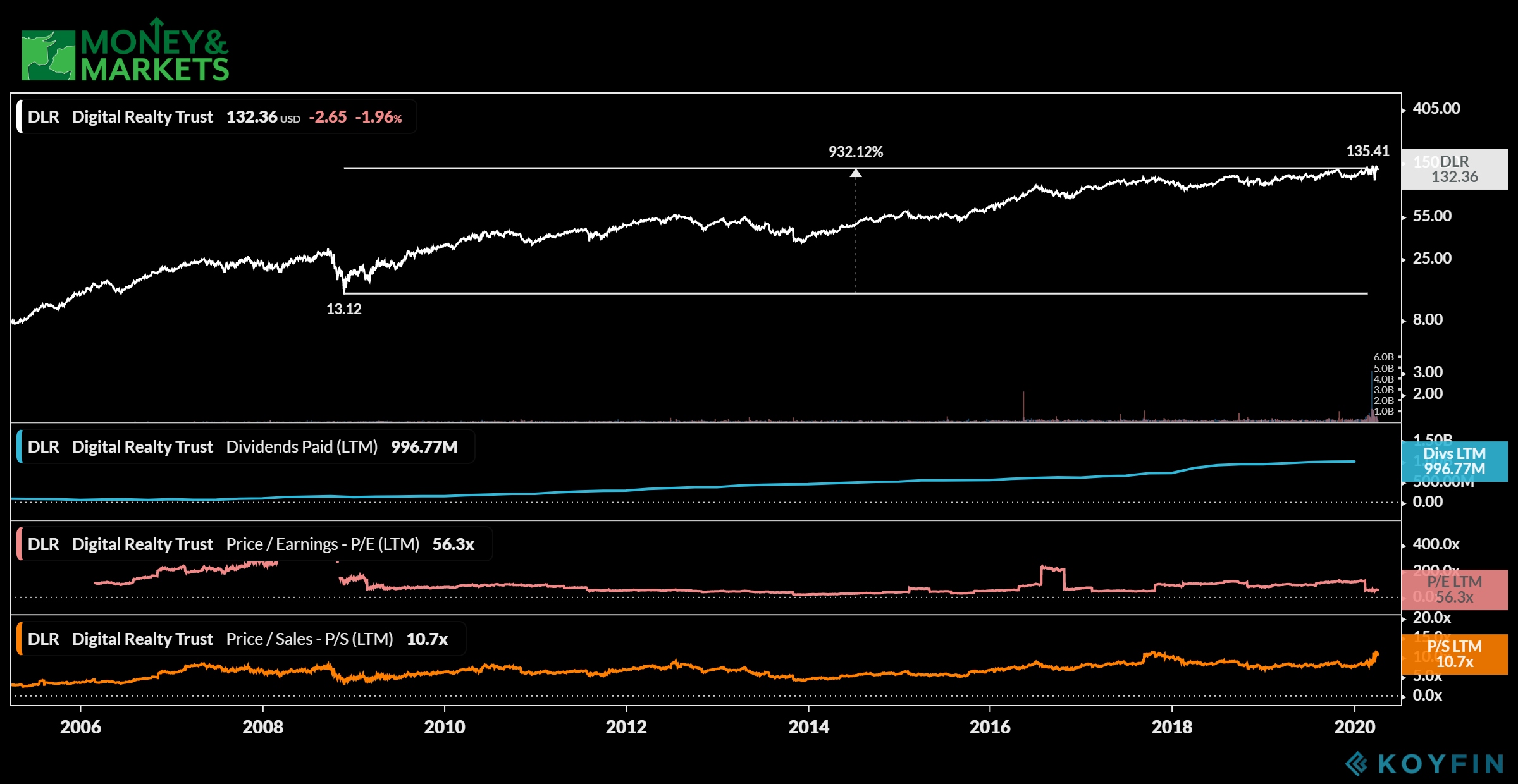

When it comes to volatility, Digital Realty Trust is extremely stable. Its 60-month beta is 0.17. That means its movements are about 17% of the index’s movements.

In other words, when other stocks are fluctuating all over the place, Digital Realty Trust has been extremely stable.

Since the last recession in 2008, DLR shares have jumped more than 900% with a five-year return of around 144%.

It also has an impressive dividend yield. Currently, that annual yield is 3.32%. Its most recent dividend to shareholders was $1.12 per share in March 2020. That equals $4.48 per share annually which is one of the best dividends around.

And that dividend has been going up since 2018.

To put it in perspective, in 2008, DLR paid about $150 million in dividends. Today, that number is up to almost $1 billion.

That’s a big reason why Digital Realty Trust is one of the best dividend stocks to buy in a market crash.

The key for investors to cut potential losses when markets drop is to find those companies that sustain when times are bad and that pay shareholders strong dividends.

Our list includes REITs and a drug company that all have the potential to do both.

That’s why they are on the list of the best dividend stocks to buy in a market crash.