In the latest Marijuana Market Update, I cover a pair of options to take advantage of the burgeoning, multibillion-dollar drug testing market. I then compare them directly.

THC Law Opens Up Drug Testing Market

More and more states are eyeing cannabis legalization measures, and that brings about an unresolved issue … law enforcement. The struggle is that lawmakers and scientists are at odds over driving under the influence of cannabis and how it should be regulated.

We now have 38 states that have legalized cannabis in some form — whether that be medical, adult-use or both.

According to New Frontier Data — a cannabis data firm — 44.6 million Americans consume cannabis.

The drug testing market had a value of $8.1 billion last year. That figure is only going to get higher as more states legalize and recreational marketplaces open up — remember, New York will soon open up for recreational cannabis use.

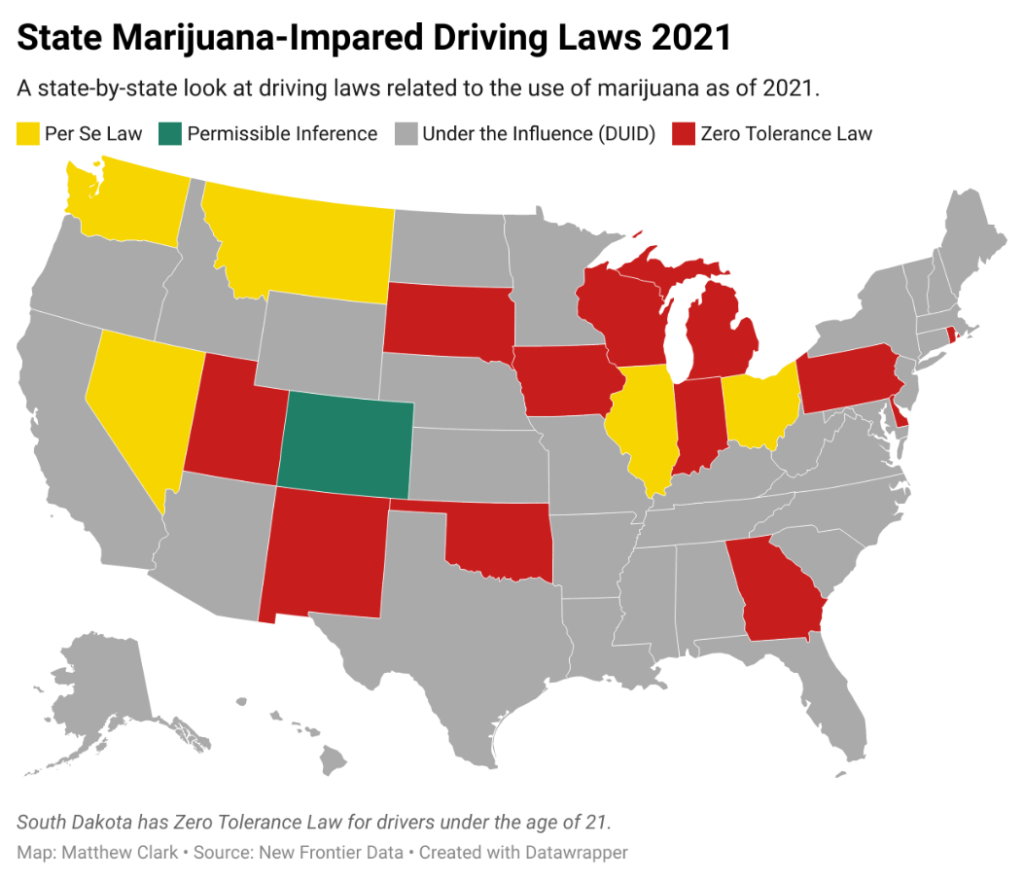

States are currently all over the place in terms of the types of laws related to driving under the influence of cannabis:

- Zero Tolerance (shown in red) — prohibition of driving with any levels of THC present.

- Per Se Law (shown in yellow) — prohibits driving with a THC level over a set limit.

- Under the Influence, or DUID (shown in gray) — driver tests as affected by/under the influence of THC.

- Permissible Inference (shown in green) — driver with a THC level of 5 nanograms per milliliter or higher is presupposed as under the influence.

As you can see, most states have an under the influence law on the books while others have zero tolerance.

The biggest issue is finding a way to test for levels of THC in a driver’s system since the parameters between testing for a driver under the influence of alcohol and one under the influence of THC are wildly different.

Comparing THC Drug Testing Competitors (BLOZF & LCTC)

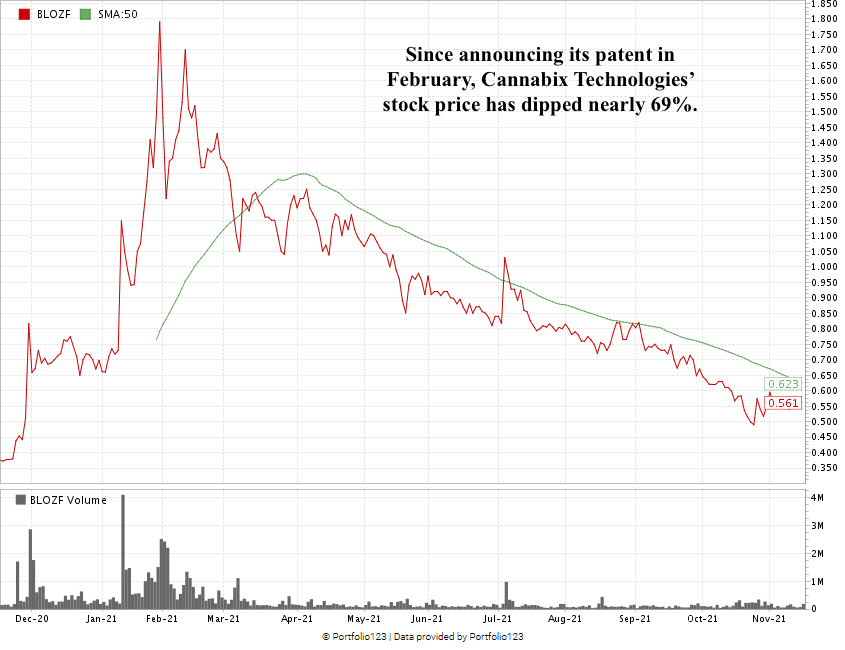

In February, I told you about Cannabix Technologies Inc. (OTC: BLOZF). This Canadian company received a patent on its cannabis drug detection device earlier this year — one it has been working on since 2014.

California-based Hound Labs is a private company that is also producing a cannabis testing device. It recently raised $20 million to scale its operation for a 2022 launch of its cannabis breathalyzer.

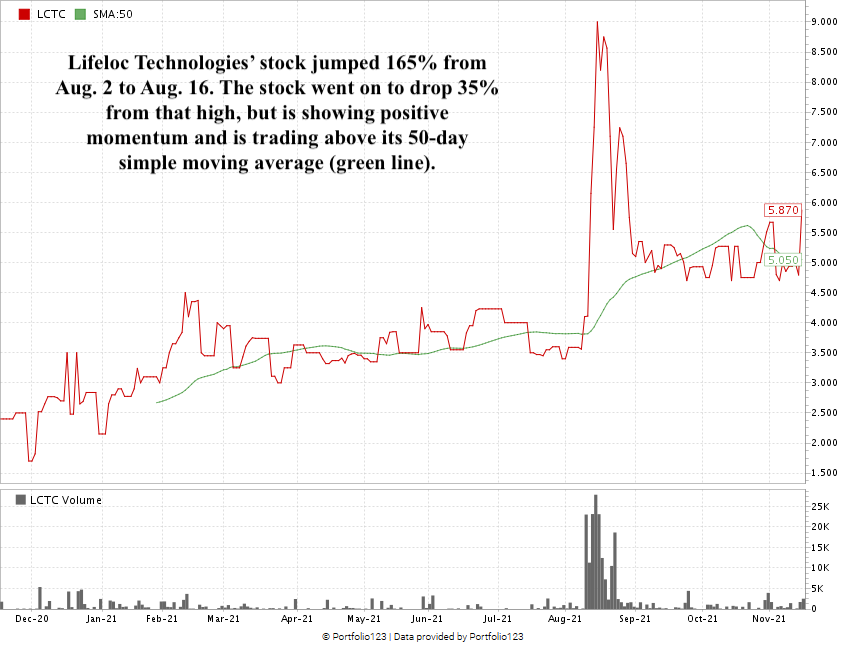

Then, there is Lifeloc Technologies Inc. (OTC: LCTC) which is based in Colorado and has success in the field of alcohol breathalyzers and is throwing its hat in the ring for cannabis testing using its SpinDX technology platform.

First, let’s look at Cannabix Technologies:

Cannabix’s Stock Freefall

After announcing its patent in February, Cannabix’s stock has been in freefall … dropping 69% off its 52-week high.

It’s especially tough to dive into this company as financials are very hard to come by. But, essentially, the company has yet to produce any top-line revenue as its money is going to fund research and development of its cannabis breathalyzer.

In February, I said Cannabix was a “buyer beware” situation and that proved to be correct as the stock continues to fall.

Now, let’s look at Lifeloc:

Lifeloc Bounces

After its August quarterly report that showed less-than-expected losses, Lifeloc’s stock bounced up 165% in a matter of 14 days.

However, almost as fast as it went up, the stock moved 35% down off that 52-week high of $9. It’s currently showing some positive momentum.

Lifeloc went from top-line revenue of $7.9 million in 2017 to $8.7 million in 2019. That total annual revenue dropped to $6.3 million in 2020 — a 20% drop from 2017.

Its third-quarter report came out in October, and the company reported a net income of $523,000 compared to a loss of $213,000 in the same quarter a year ago. Year-over-year revenue increased 21%.

For the last 12 months ending Sept. 30, 2021, Lifeloc has nearly $6.9 million in total revenue, indicating its 2021 figures could be slightly higher than 2020, but not by much.

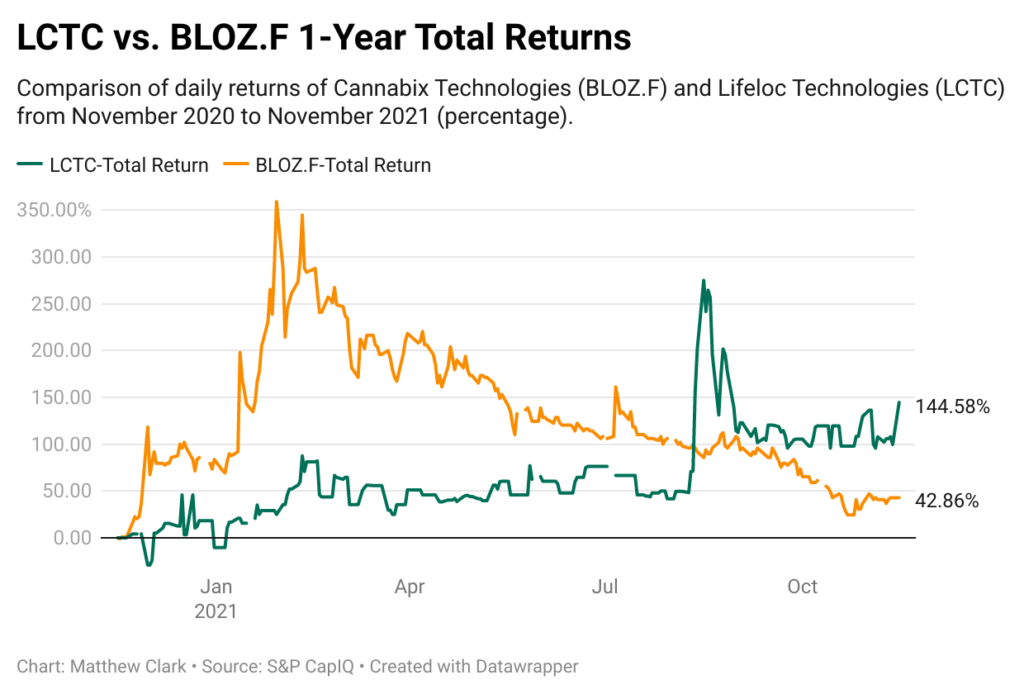

If we compare the two based on total returns, we see that Lifeloc is up 144.5% in 12 months while Cannabix is up 42.8%.

You can also see the trend line that indicates upward movement for Lifeloc and a slight flattening of returns for Cannabix.

There’s also Hound Labs — the private company that received private equity to expand its breathalyzer launch in the early part of next year.

This isn’t necessarily a situation where the first to market will be the big winner because there are still a lot of questions left unanswered when it comes to testing impairment related to THC.

The legal blood alcohol limit of .08 is based on more than 30 years of scientific evidence, whereas THC impairment testing is not nearly as vast or concrete.

There is no doubt the potential for big profits in this corner of the cannabis market.

The Takeaway on THC Drug Testing

For now, if you are looking to invest in the early stages, Lifeloc Technologies would be the best bet but remember, I think we are still a long time from having anything definitive in terms of a field test for cannabis.

Additionally, lawmakers and scientists, the court system is going to have its say.

And all three of these companies are in different stages of development, with only Hound Labs expecting a breathalyzer release sometime in early 2022.

If you do have a question about a cannabis stock or the market, just email me at Feedback@MoneyAndMarkets.com or comment below here on YouTube. Send us a question or a video of your question or testimonial … we use it … and you can get free Money & Markets apparel.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

And check out our Ask Adam Anything video series, where we ask any question to chief investment strategist Adam O’Dell, as well as our Investing With Charles series, in which our expert Charles Sizemore and I discuss the trends you write in to ask about.

Also, you can follow me on Twitter (@InvestWithMattC), where I’ll give you even more insights, not just in the cannabis market.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.