Former Texas Congressman and current 2020 Democratic Primary hopeful Beto O’Rourke announced over the weekend his trade plan proposal that would end President Donald Trump’s tariffs and trade war against China while adding new reforms for U.S. workers.

O’Rourke’s plan would wipe out Trump’s tariffs against China in exchange for Beijing ending tariffs on U.S. imports. And to put an end to China’s unfair trade practices like IP and tech theft, O’Rourke said he’d “modernize the World Trade Organization to address 21st century trade issues.”

Per O’Rourke’s release on Medium:

On day one, Beto will end Trump’s trade wars, which have not only failed to curtail China’s economic aggression, but hurt American workers. And recognizing that trade can unlock opportunity for growth for all communities and enhance small businesses across the country, Beto will aggressively pursue smart trade agreements that defend American values and interests. This will ensure American workers are not only protected, but are the most competitive in the world.

As President, Beto will:

- End Trump’s trade war

- Defend American values and interests against competitors like China

- Pursue trade agreements that support working families

- Work to enhance the competitiveness of U.S. workers and small businesses

There has been a wave of criticism regarding Trump’s trade practices from the packed Democratic field, with Sens. Elizabeth Warren and Bernie Sanders putting their own trade plans out for the public to peruse. Most have also slammed China’s unfair trade practices, but they’ve also attacked the way Trump has gone about seeking change, calling him dangerous and reckless, setting trade policy via tweet.

Warren and Sanders have called for strong workers’ rights and better environmental standards.

O’Rourke’s plan calls for working together with our allies to curtail China’s trade power, which Trump scoffed at in a pair of tweets Tuesday morning (more on what he said later). And if that doesn’t work, O’Rourke says he’d delist Chinese companies from the U.S. stock exchange, limit access to U.S. banking and financial systems, screen and limit Chinese investment and aggressively counter currency manipulation.

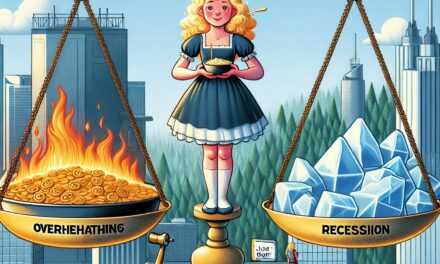

Of course, Trump also has found it hard to get China to change its ways. After initially saying “trade wars are good, and easy to win,” Trump has slapped tariffs on $550 billion worth of Chinese imports, effectively raising prices on goods for American consumers. China has stood firm and signs point to Beijing simply waiting Trump out regarding a new trade deal, hoping he loses the 2020 election.

Trump, who surely sees waiving the tariffs as akin to waving a white flag, tweeted Tuesday morning about the ongoing trade war with China, saying things are going well.

….And then, think what happens to China when I win. Deal would get MUCH TOUGHER! In the meantime, China’s Supply Chain will crumble and businesses, jobs and money will be gone!

— Donald J. Trump (@realDonaldTrump) September 3, 2019

For all of the “geniuses” out there, many who have been in other administrations and “taken to the cleaners” by China, that want me to get together with the EU and others to go after China Trade practices remember, the EU & all treat us VERY unfairly on Trade also. Will change!

— Donald J. Trump (@realDonaldTrump) September 3, 2019

Unlike previous positive tweets from Trump regarding the trade war, Tuesday’s offering didn’t do much to stave off a massive morning sell-off. By 11:20 a.m. EDT, the Dow Jones Industrial average was down 396 points, or 1.5%, the S&P 500 was down 28 points, or 1%, and the Nasdaq was down 86 points, or 1.1%. Markets were down mostly after news of further contraction in the manufacturing sector, a possible recession signal.

August’s contraction was the first since 2016 as companies try to figure out how to work around the trade war.