The pandemic has changed consumer behavior. We see that in a variety of data.

Consumers are more cautious about restaurants and movie theaters. That’s understandable.

Now, it’s reasonable to ask if these business changes are permanent. After all, the person coughing in the movie theater was always annoying. Now, many wonder if that person is dangerous.

That might seem like an exaggeration to some. But for many consumers, danger is a new consideration. And that will drive changes in consumer behavior.

Let’s look at one way consumer behavior has shifted.

There’s been a surge in demand for streaming services. Time spent on Netflix and Hulu has doubled since the beginning of the year. By June, consumers spent an average of almost 600 minutes a month on streaming services. That’s up from 300 minutes in June 2019.

This presents an overlooked investment opportunity. Consumers will want to watch those services in comfort.

Retail sales data shows that’s the case.

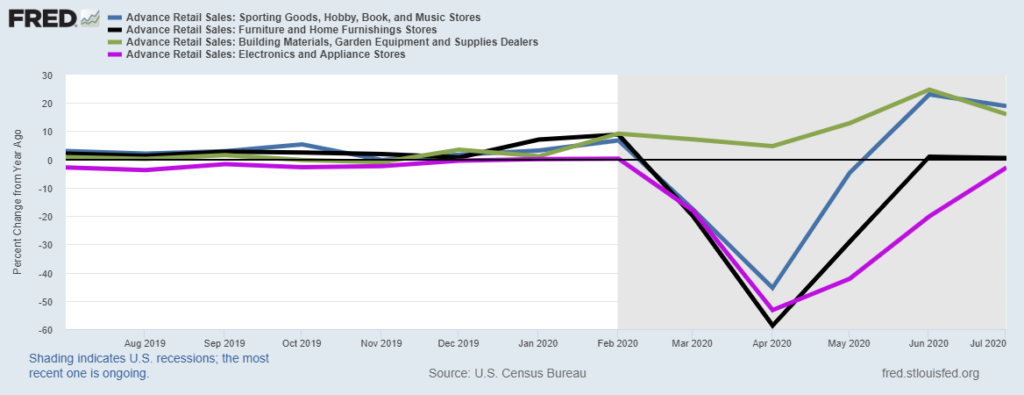

The chart below shows year-over-year changes in sales at home improvement stores (the green line), furniture stores (black), electronics stores (magenta) and sporting goods, hobby, book and music stores (blue).

Consumers Are Improving Their Homes

Source: Federal Reserve

Consumers are investing in furniture and home upgrades to make streaming more comfortable. And it goes beyond Netflix.

Shifting Consumer Behavior Creates Investment Opportunities

The strong rebound in sales for sporting goods, hobby, book and music stores confirms consumers share a focus on homebound activities.

Some family members won’t want to watch Netflix. They might learn to play the piano.

Investors should look beyond Netflix for ideas.

Look at furniture makers such as La-Z-Boy Incorporated (NYSE: LZB), audio equipment maker Dolby Laboratories (NYSE: DLB) and electronic retailers including Conn’s (Nasdaq: CONN).

Companies like these could be leaders of the new stay-at-home economy.

Consumer behavior has changed since the beginning of the year. Some of these changes will stick, and there are potential profits in the companies that help people create comfort at home.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.