In this edition of The Bull & The Bear, we discuss President Biden’s capital gains tax proposal and what it could mean for the stock market.

It’s a common misnomer that when a Democrat is president of the United States, stock market returns are lower than when a Republican is in office.

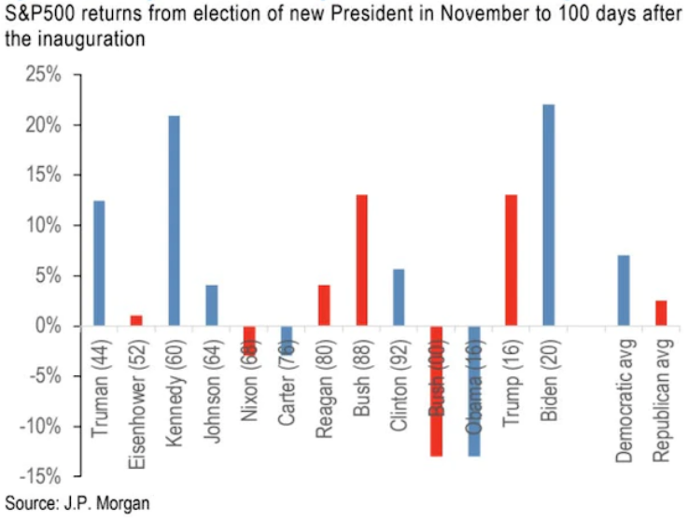

Recent data from JPMorgan illustrates that. It tracked the average returns of the S&P 500 from Election Day through the first 100 days of a president being in office.

The results are pretty interesting.

Market Gains Under Biden Strongest Since World War II

The report found that S&P 500 returns under President Joe Biden are nearly 25%, compared to less than 15% under President Donald Trump.

It’s the highest average return of any president in the last 75 years. It’s also more than double the average return of any Republican president since World War II.

However, something on the horizon may hamper those strong returns.

In this episode of The Bull & The Bear, we examine returns and what could halt those gains in their tracks.

The Capital Gains Quagmire

Capital gains are a tax on the profit of investments when individuals and corporations sell those assets.

If you buy a stock and the stock goes higher, when you go to sell the stock, you pay a tax on the gains. But the tax also applies to homes and businesses.

One of Biden’s proposals includes raising the capital gains tax rate from 23.8% to 43.4% for those earning more than $1 million.

Capital Gains Skyrocketed in 2018

While the top-end tax rate for capital gains has remained fairly flat, the amount of those gains hit a record $943 billion in 2018 while taxes collected were $170 billion.

I bring in two of the best investment minds in the game to talk about capital gains and whether Biden’s plan will change the investing landscape.

Chief investment strategist Adam O’Dell and Green Zone Fortunes co-editor Charles Sizemore join me on this weekend edition of The Bull & The Bear. We break down returns and future returns if a capital gains tax increase is implemented.

At Money & Markets, we aim to provide you safe, smart, sound and simple investment information to grow your portfolio.

Pro tip: Adam has found the next technology that will spark the biggest investment mega trend in history … with one small Silicon Valley company at the center of it all. To learn more about this trend that Tesla CEO Elon Musk called “amazing,” click here.

If you missed last week’s episode of The Bull & The Bear, Adam, Charles and I discussed inflation and what it means for investors. Check it out here.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Facebook

Twitter

LinkedIn

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.