It’s been all over the news lately.

And U.S. companies are taking note.

The mention of this one little word has rocketed up 800% year-over-year in quarterly earnings calls, according to recent research by Bank of America Securities.

The word? Inflation.

Simply put, inflation is the reduction of a currency’s purchasing power, or how much a dollar will buy, over time.

Last week, Adam O’Dell, Charles Sizemore and I discussed inflation and where it might be headed in our weekend edition of The Bull & The Bear.

Adam even gave you an exchange-traded fund (ETF) that you can use to combat the potential rise in inflation. To listen to that podcast, click here.

That discussion put me on the hunt for another hedge against a coming jump in inflation.

First, let’s break down inflation projections.

Inflation Over Fed’s Target

Richmond Federal Reserve President Thomas Barkin told CNBC on Monday that he expects to see inflation rise this year.

Over the last 12 months, the Fed stated it wants to keep inflation at 2% but could “tolerate a level somewhat higher.”

Inflation to Top 2% This Year

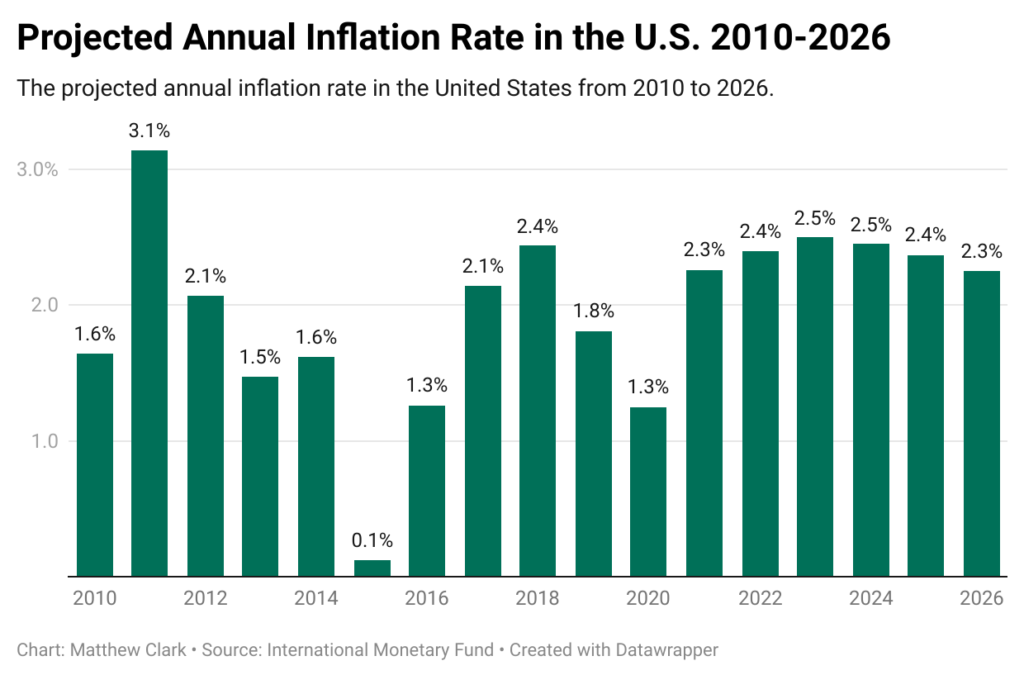

In 2020, inflation was at 1.3% — a low level by comparison to previous years.

However, the International Monetary Fund projects U.S. inflation to reach as high as 2.5% by 2023 — a level we haven’t seen since 2011.

And we’ve already seen evidence of price increases as the economy reopens.

In March, consumer prices jumped 0.6%. It was the largest one-month rise in more than eight years, according to Reuters.

As a smart investor, guarding your portfolio against a rise in inflation is important. The last thing you want is for inflation to outpace your overall gains in any given year.

Adam gave you an ETF last week to do that.

Today, I have another fund for you.

In this episode of The Bull & The Bear, I tell you why this ETF is one for your portfolio.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Facebook

Twitter

LinkedIn

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.