In the futures market, the largest traders are positioned to win big when stocks rally.

Futures markets offer data not available for individual stocks. But the data is available for broad stock market indexes.

Right now, it tells an important story.

Every week, the Commodity Futures Trading Commission (CTFC) releases the Commitment of Traders report. It tells us who buys and sells different commodities and futures contracts like the S&P 500.

Who Is Buying in the Futures Market

The report assigns all positions in the market to one of three groups: commercial, large and small speculators.

Commercial speculators are traders who hedge their positions in the market. This is easy to understand in gold markets.

Gold miners would be commercial traders in that market. They know how many ounces they expect to mine and have insights into demand. Rather than accept the risk of a sharp rise in prices, they can use futures to hedge their exposure and lock in prices they are comfortable with.

In the S&P 500, commercials could be financial firms that need to maintain exposure to the stock market, but that want to reduce risk as much as possible. This could include investment banks or insurance companies.

Other groups in the CFTC data include:

- Large speculators like hedge funds using futures as an asset class to generate returns for their investors.

- Small speculators like individual traders who buy or sell a few contracts at a time.

Commercials: Positioned For a Win

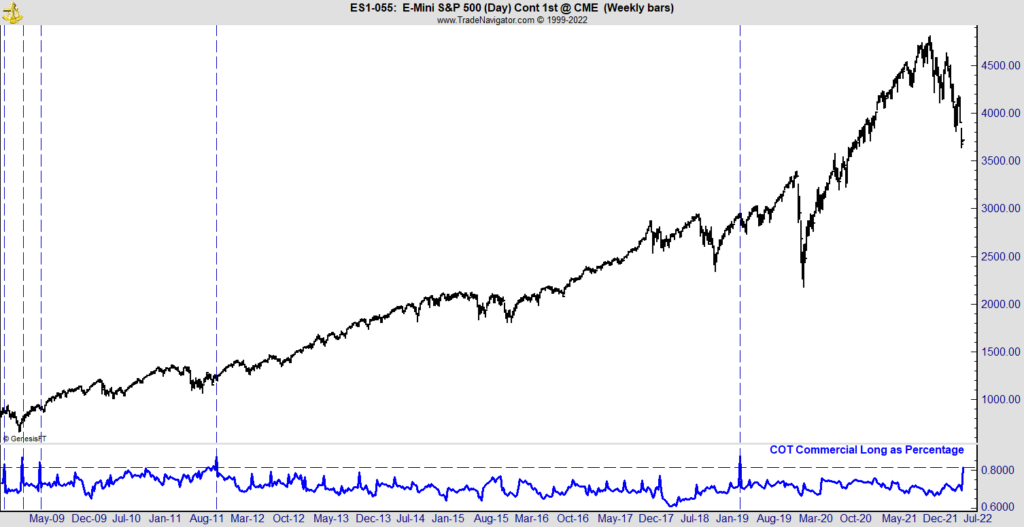

Both large and small speculators are almost out of the market right now. The chart below shows S&P 500 futures.

The indicator at the bottom is the percent of contracts held by commercials. It’s unusually high, at 81.4%.

S&P 500 Futures Market

The horizontal dashed line is drawn at 80%, and the vertical dashed lines show previous readings at this level. Four of the five were timely buy signals. The fifth was three months early and 27% above the low.

Bottom line: This isn’t a tradable signal because there is such a limited history. But it’s a promising sign that the stock market’s decline is near an end.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.