Value investing guru and multibillionaire Warren Buffett will save a good chunk of change if he passes on while living in his current state of Nebraska, which doesn’t have anything like an estate (or death) tax, but he won’t be able to escape the government’s insane federal estate tax.

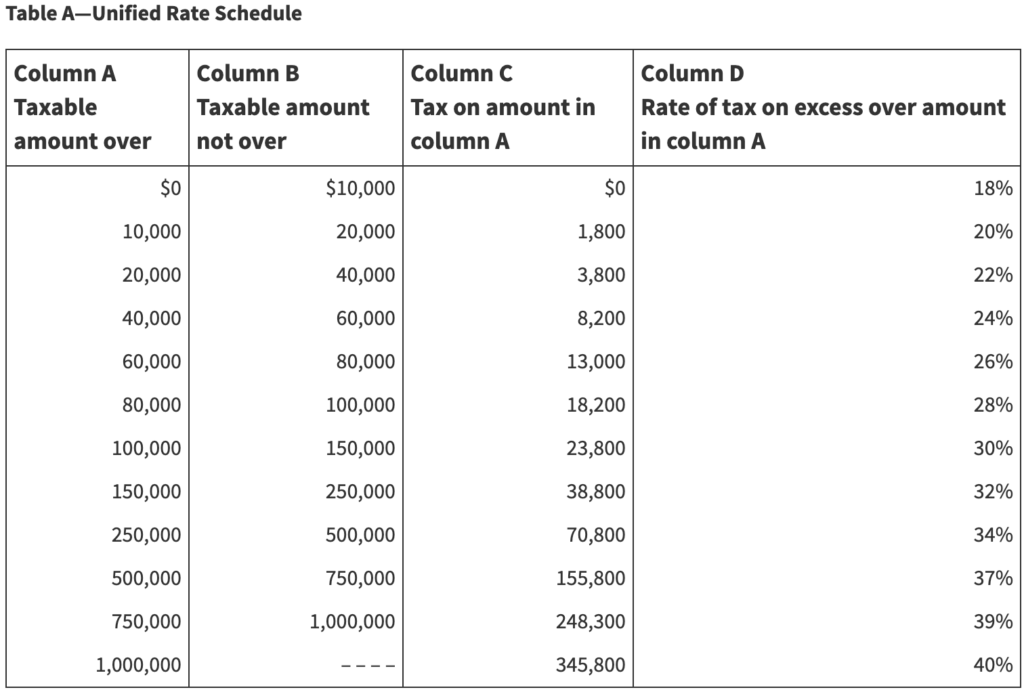

Billionaires (or even multimillionaires, really) stand to lose a good chunk of change when they kick the bucket because the federal levy for an estate worth at least $11.4 million is a whopping 40%. Per CCN:

With Warren Buffett’s net worth hovering around $82.6 billion, he would owe about $33,040,000,000 to the United States if he died today. That’s enough to buy SpaceX, Spotify or Airbnb.

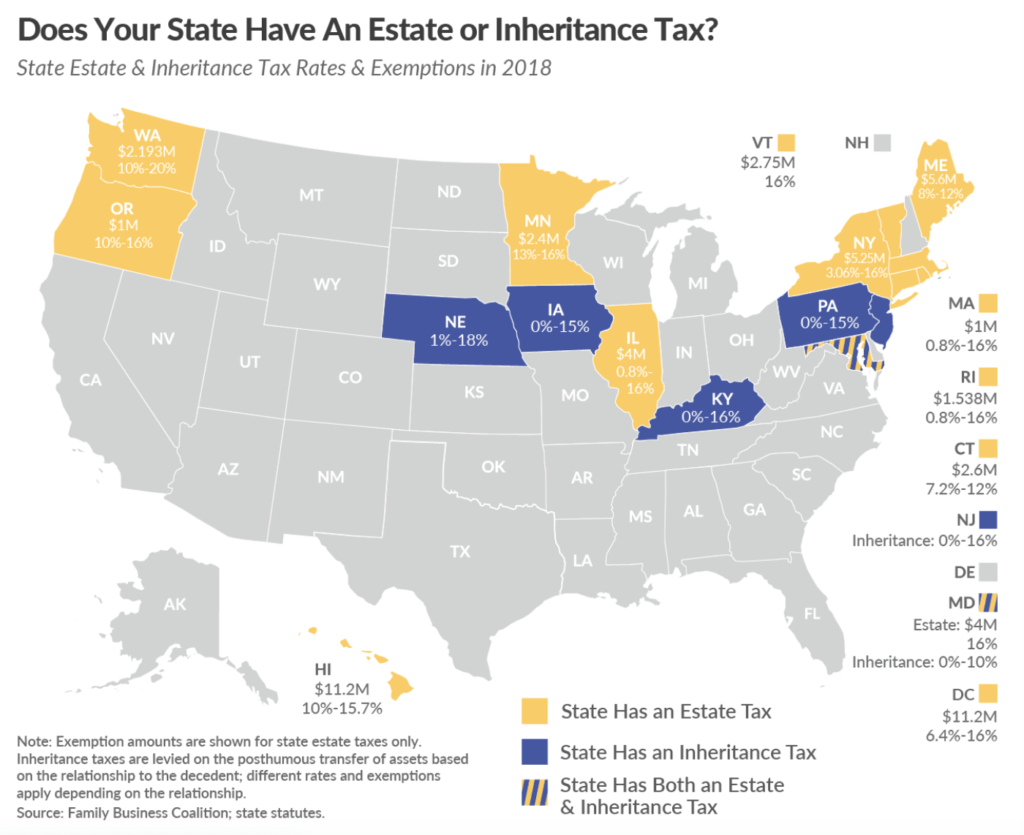

Amazon founder and CEO Jeff Bezos would be writhing in his grave as both the feds ($43.7 billion) and the state of Washington (another $12 billion) sapped his wealth away if he died in his home state.

While Nebraska’s lack of an estate tax would be a boon for Buffett’s family, it does have an inheritance tax that would apply a 1% duty to anything received by immediate family members (not spouses), while anyone else getting a cut of the Buffett pie would have a massive 18% tax applied to their inheritance.

Only 17 states in the union have an estate or inheritance tax, though, and a recent study by UC Berkeley and the Federal Reserve Bank of San Francisco found that many billionaires are already packing up and relocating to at least escape the state levies.

“Billionaires tend to leave states with an estate tax, especially as they get old,” the study said. “By year 2010 — namely 9 years after the reform — 21.4% of individuals who originally were in an estate tax state have moved to a non-estate tax state; while only 1.2% of individuals who originally were in a non-estate tax state have moved to an estate tax state.”

So, what state hosts the most brutal tax laws when it comes to death? Maryland — by a mile. It is the only state in the U.S. that boasts both estate and inheritance taxes, and the one-two punch would hit a billionaire (or really anyone that has an estate worth more than $11.4 million) with a 66% levy.

Ted Lerner, owner of the MLB’s Washington Nationals, is Maryland’s richest resident in 2019, according to the Forbes 400. His $4.9 billion estate would get rocked for $3.2 billion in duties if it had to pay the full 66%.

So even after life, taxes are still inevitable.