In the most recent Marijuana Market Update, I:

- Discuss a recent study involving cannabis and COVID-19.

- Answer an email from a viewer on Bioharvest Sciences stock (OTC: CNVCF).

First, COVID…

Some Cannabis Compounds Prevent COVID

Cannabis investors might have gotten a bit too excited earlier this month when major media outlets flashed this headline:

Source: Forbes.

They cited a study that Oregon State University researchers published in the Journal of Natural Products.

For days, a public frenzy surrounded cannabis.

Even late-night talk show host Jimmy Kimmel quipped, “All this time we’ve been listening to the CDC, we should have been eating CBD.”

Despite the headlines, cannabis stocks continued to plunge, as you can see in the chart below.

I looked at the Money & Markets Cannabis Index — an equal-weighted index that looks at the performance of all cannabis stocks with a market cap over $1 million — to see if there was any real change to cannabis stocks.

To little surprise, there wasn’t.

Since November, cannabis stocks have continued to push down and sit 21% lower than a year ago.

We saw a slight uptick in stock prices around the study’s release, but the uptrend didn’t last.

One reason is that the interpretations of the Oregon State studies were incorrect.

The first item that stands out is that the study conducted was “in vitro” (in glass) as opposed to “in vivo” (within the living).

The tests were done in a dish and didn’t use living subjects. Because cannabis remains illegal at the federal level, in vivo research is limited.

Plus, the study used CBGA and CBDA acids against COVID-19. Neither is prevalent in retail cannabis. Smoking cannabis won’t guard you against catching COVID-19.

However, one finding from the study wasn’t widely reported: Acids in cannabis have medicinal benefits.

This is a powerful reminder that we need additional in-depth research on the impacts and effectiveness of medical and adult-use cannabis.

The Cannabis Research Uptick

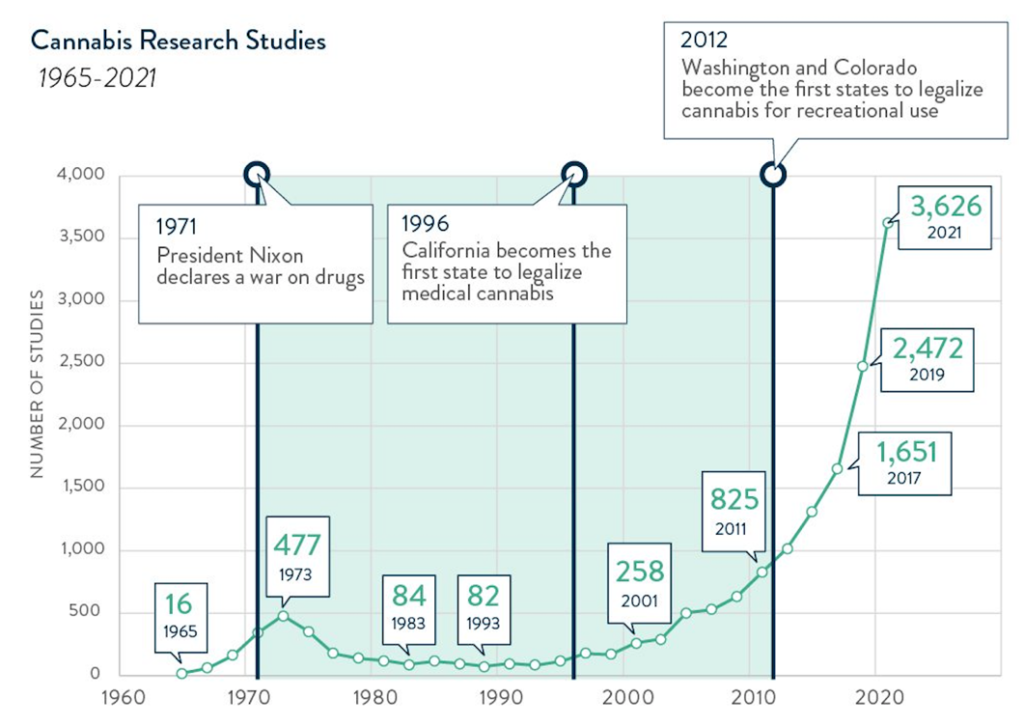

Cannabis data firm New Frontier Data found that from 1960 to 2010, the amount of medical research on cannabis was thin. You can see just how thin in the chart below.

Source: New Frontier Data.

Notice the massive jump in research after Washington and Colorado became the first states to legalize adult-use cannabis in 2012.

In 2021, more than 3,600 different studies of cannabis were conducted.

But it’s still expensive to conduct human research since cannabis remains a Schedule 1 substance with the federal government.

Should that change, expect major findings about the medical benefits of cannabis and its properties.

Now, I’ll answer a reader’s question.

Bioharvest Sciences Stock (OTC: CNVCF) Analysis

Todd emailed me to say:

Hi. I’ve watched several of your YouTube videos and was hoping you could share your thoughts/analysis of Bioharvest Sciences. Seems like it could be a game-changer in the marijuana industry.

Todd, thank you for your question.

Canada-based Bioharvest Sciences (OTC: CNVCF) produces super fruits and cannabis in Israel and other countries.

The cell growth technology it developed produces metabolites without growing the plant.

Its signature product is Vinia — a pill that contains the essential properties of red grapes.

The company targeted 2022 as the year it will develop similar cell growth for cannabis. Last week, Bioharvest announced plans to build a production facility in Ontario to produce its cannabis products.

In its most recent quarterly report, Bioharvest reported 17% quarter-over-quarter growth in sales of Vinia alone and 485% year-over-year growth with total sales of $2.4 million.

Source: Bioharvest.

The company grew its total sales an impressive 71% from the second quarter of 2021 to the fourth quarter.

Its U.S. sales jumped 250% from the second quarter to the third and another 27% from the third quarter to the fourth.

The news, however, did little for the company’s share price.

Bioharvest reached a 52-week high of around $0.55 per share in February 2021. It then trended down until it moved higher in July.

After trading somewhat flat until a jump in January 2022, it dropped about 41% after a board member resigned.

The stock is now 52.7% off the 52-week high from February.

Because of its small market cap, Bioharvest does not rank on my cannabis rating system.

The Takeaway

I like the company’s potential.

To construct the properties of cannabis without growing it could be revolutionary.

However, there’s still a lot that we don’t know.

The bottom line is that it will be hard to realize the true potential of Bioharvest until we see hard numbers related to production costs.

If we find that it’s comparable to or cheaper than growing plants, this could be big.

Dedicating a little capital to Bioharvest might be plausible.

Still, don’t be surprised if the continued uncertainty surrounding the broader market (let alone the cannabis market) causes additional losses before you realize any gains.

Bioharvest has the potential to be a fantastic company that sets the cannabis market on its ear.

I would want to know more before dedicating a lot of capital.

Again, thanks for your email, Todd!

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Make sure you subscribe to our YouTube channel and get notified each and every time we post a new video.

We have a lot of great weekly video features on our channel, including:

- Ask Adam Anything — Where I get to sit down with chief investment strategist Adam O’Dell and ask him any question (from you or me) and get his insights into the stock market.

- Investing With Charles — Green Zone Fortunes co-editor Charles Sizemore and I talk about all things related to stocks and the economy, including comparing stocks to give you the best investment advice.

- The Bull & The Bear — Our weekly podcast where I show you the trends and analysis that moves the market.

All of these series are on our YouTube channel.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.