First, it was COVID. Now, it’s monkeypox.

Pharmaceutical companies are under enormous pressure to develop vaccines that combat these global outbreaks.

And cutting-edge biopharmaceutical companies are using living cells to pinpoint the source of these diseases. It’s cut down on development time in a huge way.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” biopharmaceutical Power Stock that develops hepatitis B vaccines:

- It reported massive sales growth in the second quarter of 2022.

- Its stock jumped 134.1% over the last three months.

- We expect it to beat the market by 3X over the next 12 months.

Here’s why this biopharmaceutical stock I share with you today will continue its strong performance through this shaky market.

The Biopharma Market Continues to Expand

There’s one big difference to understand about the biopharmaceutical industry versus the more traditional pharmaceutical industry:

- Biopharmaceutical companies use living organisms (think white blood cells or bacteria) to develop therapies and cures for some of the most common diseases.

- Basic pharmaceuticals use chemicals to do the same research.

The biopharma industry is able to zero in on and lock down what causes diseases based on actual cells. Traditional pharmaceutical companies rely on trial and error.

And the biopharma industry is growing by leaps and bounds:

EvaluatePharma expects global annual revenue to grow to $505 billion by 2026. That’s 77% higher than where it sat in 2020!

Bottom line: This is a market that’s just starting to take off. To find maximum gains, now is the time to get in.

Great Growth and Momentum: Dynavax Technologies Corp.

Biopharma companies are developing therapies for numerous diseases and life-threatening illnesses.

Dynavax Technologies Corp. (Nasdaq: DVAX) is a California-based company that develops vaccines for hepatitis B, a disease affecting 350 million people around the world.

Its signature Heplisav-B vaccine prevents infection cases by all types of hepatitis B.

Dynavax has collaboration agreements with companies in Scotland, India and Europe to develop and distribute its therapies.

Now, let’s look at how this biopharma stock has performed.

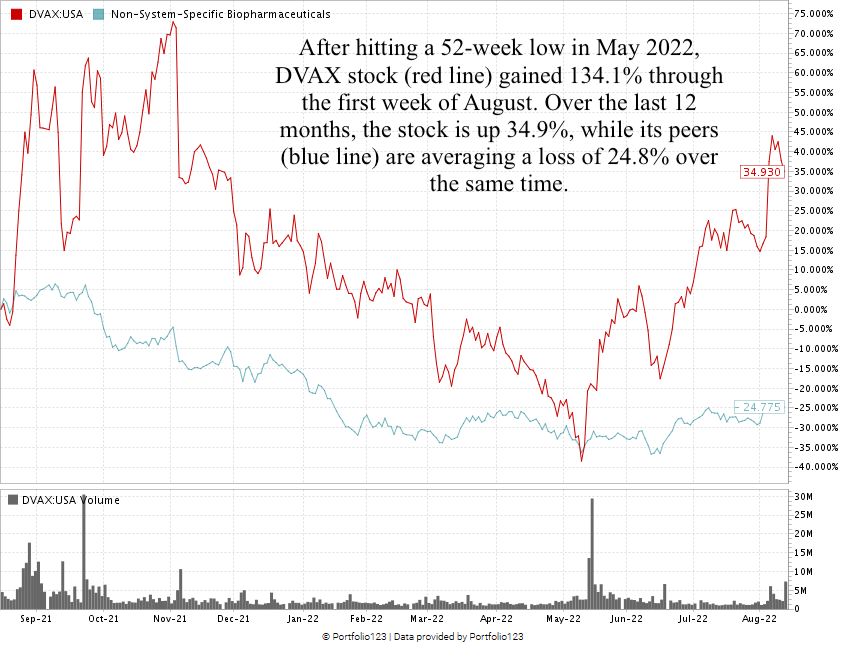

DVAX Bounces Up 134.1% off Its 52-Week Low

DVAX is now trading nearly $3 over its 50-day simple moving average — a bullish indicator for a stock.

And you can see that it’s crushing its industry peers over the last 12 months!

Biopharma Stock to Buy: Dynavax Technologies Corp.

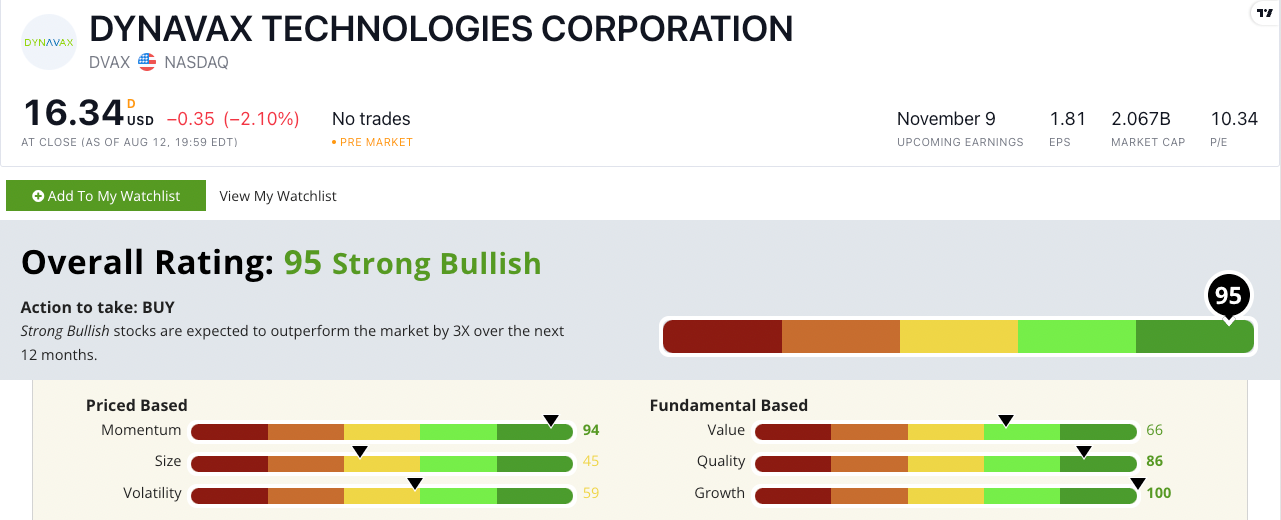

Using Adam’s six-factor Stock Power Ratings system, Dynavax Technologies Corp. stock scores a 95 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times over the next 12 months.

DVAX rates in the green on four of our six factors:

- Growth — DVAX scores a 100 on growth, with a one-year sales growth rate of 838.9% and an earnings-per-share growth rate of 172.6%.

- Momentum — After hitting a 52-week low in May 2022, Dynavax stock jumped 134.1% through the first week of August. DVAX earns a 94 on momentum.

- Quality — Dynavax’s return on equity is 90.2%. Its peers have lost 64.1% of their equity on average. DVAX scores an 86 on quality.

- Value — Dynavax’s price-to-sales ratio is seven times lower than the industry average. Its price-to-earnings ratio is 10.1, while its peers are averaging 15. DVAX earns a 66 on value.

The stock scores a 59 on volatility, but its recent run off the 52-week low met little resistance … all while the rest of the market was in whipsaw.

DVAX earns a 45 on size, but its market cap is $2 billion. It’s still a good-sized biopharma stock for strong gains.

Bottom line: Biopharma companies are on the cutting edge of medicine by using DNA to help create more effective therapies.

Dynavax is an industry leader in developing vaccines for hepatitis B — which 350 million people worldwide suffer from.

This is why DVAX is a strong performer for your portfolio.

Note: If you are looking for more ways to invest in the next wave of health care, you need to check out our premium stock research service, Green Zone Fortunes.

Adam is convinced the genomics (aka DNA science) revolution will be bigger than the interest. If you want to know why, click here to watch his “Imperium” presentation.

You’ll learn how you can start investing in Adam’s No. 1 stock in the genomics mega trend. (It’s up more than 20% in the last month!)

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Stock Power Podcast, as well as the Marijuana Market Update. He’s also a certified Capital Markets and Securities Analyst through the Corporate Finance Institute. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.