I’m a child of the ‘80s.

I still remember the iconic Miller Lite beer commercials in which rival crowds would insist the beer either “tastes great!” or is “less filling!”

They looked like two armies ready to go to war!

The investing world can feel like that sometimes.

In one corner, you have the “value crowd” that insists there’s a right price for every stock and that growth stocks are fads destined to disappoint.

In the other corner, the “growth crowd” looks for the next big thing while calling value investors a bunch of old fuddy-duddies.

This was always silly to me. Why be ideological about it? Can’t a beer taste great and be less filling?

Why Fight?

Value investing works. The data proves it.

Growth investing works, too. The data proves that as well.

This is why I include both value and growth factors in my proprietary Stock Power Ratings model.

Growth stocks have been in favor since the bottom of the 2008 bear market. But value looks solid these days.

Looking at the broader market, the Vanguard Value Index Fund ETF (NYSE: VTV) is flat over the last 12 months as it has managed to weather the sell-off. The Vanguard Growth Index Fund ETF (NYSE: VUG) is down almost 12% lower after the bear market set in earlier this year.

I’m a trader at heart, and I try to approach each trade with an open mind and no bias. I don’t go in looking for a value trade or a growth trade. I look for a profitable trade, wherever it might be.

Today, value stocks show a lot of momentum compared to growth stocks, so it makes sense to pay special attention to our value factor.

I wrote earlier this year that commodities were ripping higher due to the “inflation trade.”

This also has a value angle. Apart from the commodities themselves, the stocks of companies that produce commodities, including energy, are cheap and have rallied in recent months.

As an example, let’s take a look at one of the most iconic companies in American history: Exxon Mobil Corp. (NYSE: XOM).

Bullish on Value AND Growth: Exxon Mobil

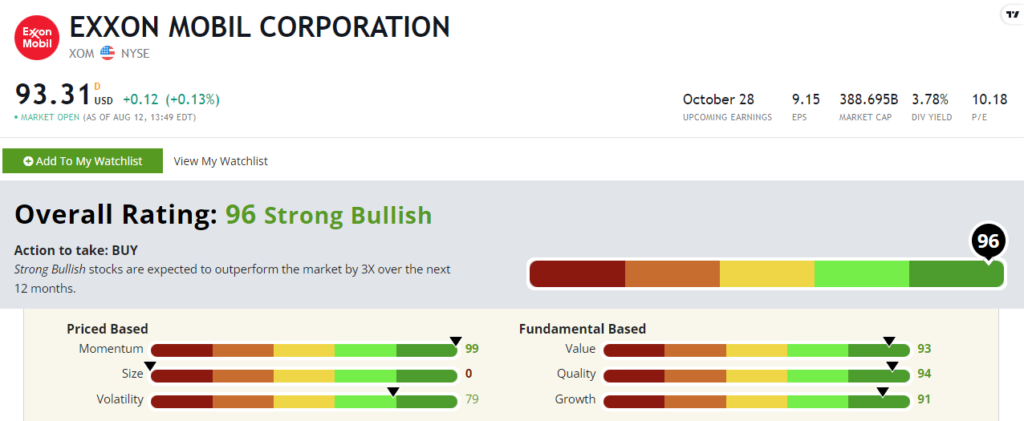

Exxon has pushed higher since late December, and based on its Stock Power Ratings, I expect that to continue. XOM rates a “Strong Bullish” 96 in my proprietary model. And it rates well across all but one of my six factors.

Momentum — Energy is a bright spot in markets right now. Exxon Mobil’s 99 rating on momentum is proof of that. (XOM’s 72 rating when I first talked about it shows how much investors have jumped into this stock in recent months.) XOM has gained around 30% since January!

Value — Exxon Mobil’s value rating is incredible at 93. Energy stocks were left for dead last year, and we’re still benefiting from that pricing today. If value stocks continue to outperform growth, I’d expect XOM to participate in that.

Quality — We measure quality via profitability and balance sheet strength. Exxon Mobil’s quality has also improved to 94. That’s remarkable considering how difficult the past several years have been for the energy industry. The fact that Exxon managed to maintain competitive profit margins during a major, long-term bear market in energy shows what a high-quality business it is.

Volatility — Exxon Mobil rates an 79 on my volatility factor. That’s a little lower than the 88 rating it boasted in January, but it’s still a strong score. In my initial analysis, I mentioned XOM would hold up well if a market correction struck, and that’s been true so far.

Growth — Exxon Mobil is not a growth stock. Energy is a mature business under constant pressure from new alternatives like wind and solar. That said, it has benefitted from higher oil prices and it’s growth factor rating now sits at 91.

Size — Exxon Mobil is massive, with a market capitalization (outstanding shares times current share price) of $388 billion. That’s enough to drag its size factor score down to 0. That’s OK. Every portfolio needs a few established players.

Bottom line: I can’t tell you if value will continue to dominate growth. But, as a trader, it seems that value is the place to be.

And XOM is a solid stock to play this trend now.

To good profits,

Adam O’Dell

Chief Investment Strategist

Story updated on August 15, 2022.