You can find value in the most unlikely places.

Biotech is one of my go-to sources for winning investments. As I’ve written before, genomics (aka DNA science) will change the world, creating bigger investment opportunities than the internet.

But you may not think the biotech sector is fertile soil for value stocks. It’s more the domain of hyper-growth stocks that are expensive by most traditional value metrics. In a typical biotech investment, expected earnings and revenue are years in the future, and often depend on a successful drug trial or FDA approval.

This is where it pays to take an analytical approach.

Need Biotech Value Stocks? Use Green Zone Ratings

My Green Zone Ratings system rates stocks on six objective, measurable factors to help identify stocks that my research proves will beat the market:

- Momentum.

- Volatility.

- Size.

- Value.

- Quality.

- Growth.

We divide the value factor into subfactors such as the price-to-earnings ratio and price-to-sales ratio.

We break down these subfactors further to cover different timelines and other specific criteria.

All that to say, our value factor rating is robust. It picks apart a stock’s financial statements, then rates the stock relative to stocks in our universe.

And it can help us find value stocks in high-growth sectors like biotech!

2 High-Value Biotech Stocks

I picked through the data to find biotech stocks that meet two criteria:

- An overall “Bullish” or “Strong Bullish” rating. (Bullish stocks beat the overall market by two times, based on historical data. Strong bullish crush the market by three times!)

- Top marks on my value factor.

My research revealed two of the biggest names in biotech!

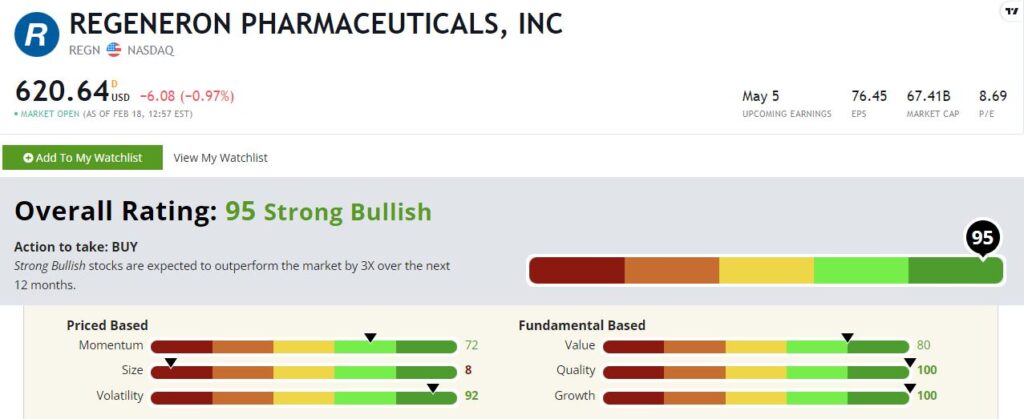

Regeneron Pharmaceuticals Inc. (Nasdaq: REGN)

Regeneron rates a Strong Bullish 95 overall.

As you might expect for a company that has been on the frontlines of the battle against COVID-19 with its antibody therapies, REGN rates a perfect 100 on growth.

Due to its solid profit margins and strong balance sheet, it also rates a perfect 100 on our quality factor.

As icing on the cake, REGN rates a 92 on our volatility score, meaning the company is less volatile than all but 8% of the 8,000 stocks we rate.

It’s rare to find stocks that fit this profile trading at a bargain price. You have to pay up for quality. Yet Regeneron rates a solid 80 on our value factor, putting it in the cheapest quintile of all the stocks in our universe.

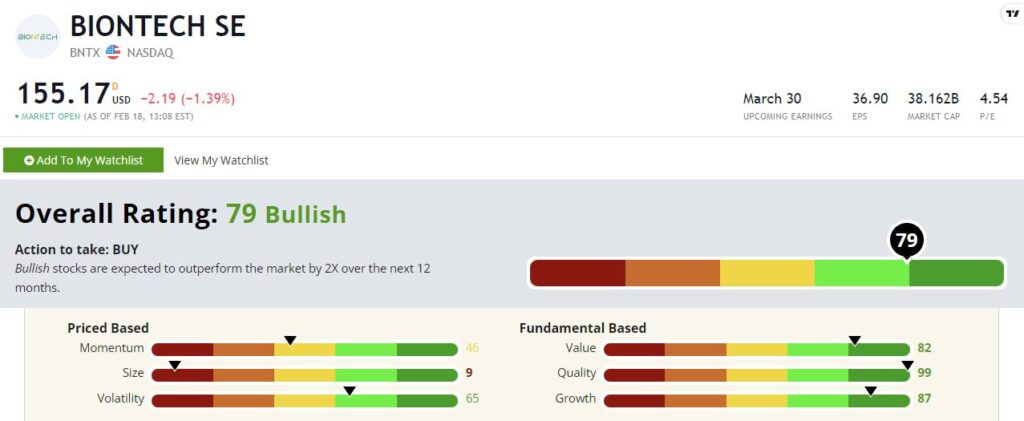

BioNTech SE (Nasdaq: BNTX)

BioNTech SE (Nasdaq: BNTX), Pfizer’s partner that helped develop its COVID-19 vaccine, is another fantastic example of a biotech value stock.

BNTX rates a Bullish 79!

Like Regeneron, BNTX rates well on growth and quality with scores of 87 and 99, respectively. It also sports above-average volatility at 65.

Again, it’s rare to see stocks with that profile trade at bargain prices. Yet BioNTech boasts an 82 on our value factor.

How Value Fits Into Biotech Investing

Given the nature of biotech stocks, I’m willing to be somewhat flexible on the value factor.

When your expected payoff from a blockbuster drug is years in the future, your traditional value metrics based on earnings and sales won’t look perfect in the here and now.

Bottom line: Finding top-rated stocks in this sector that also rate well on value gives us an extra degree of confidence. It tells us that the company is attractive based on its current sales and profits apart from whatever prospects it might have from future blockbusters.

And if you’re interested in taking your biotech and genomics investing to the next level, you need to join my Green Zone Fortunes subscribers.

A technology I call “Imperium” is set to disrupt global industries worth a total of $64 trillion in the coming years, and there’s still time to buy into the company behind this revolutionary development now.

Click here to watch my presentation, and find the details on how to join us in Green Zone Fortunes today. You don’t want to miss this!

To good profits,

Adam O’Dell

Chief Investment Strategist