My Green Zone Power Ratings system is one of the most powerful tools you can use to guide your investing.

It’s consistently beaten the market 3-to-1 for years while pointing the way to some of the biggest breakout stocks of the decade.

Like in July 2020, when Aviat Networks Inc. (Nasdaq: AVNW) scored a 99 before share prices surged 236% higher. Or when Strattec Security Corp. (Nasdaq: STRT) scored a 96 and promptly doubled over the following year.

Green Zone Power Ratings even gave us the heads-up on Celsius Holdings Inc. (Nasdaq: CELH), which has since soared more than 1,100%!

But I’ll be the first to admit — there’s no such thing as a truly “perfect” system.

I engineered Green Zone Power Ratings to take a more holistic, data-driven approach to evaluating stocks. It’s intended to help shortcut dozens of hours of fundamental and technical research to give you a five-second snapshot of where a stock stands. And it’s perfect for that.

But sometimes it doesn’t tell us the whole story about a particular opportunity…

Bitcoin: 2024’s Biggest Breakout?

Over the last few months, bitcoin has staged a significant rally — setting a new 17-month high and holding strong over $30,000 per coin.

Rumors of an upcoming spot bitcoin exchange-traded fund (ETF) are driving a large part of the interest — something that could drastically change the landscape for crypto adoption and drive demand through the roof.

A new bull market in bitcoin would be phenomenal news for crypto mining stocks, which in the past have soared for as much as 5X the gains of bitcoin during the last bull market.

So if bitcoin miners are going to be a great investment in 2024, we should start seeing that in their Green Zone Power Ratings, right?

Well, not exactly.

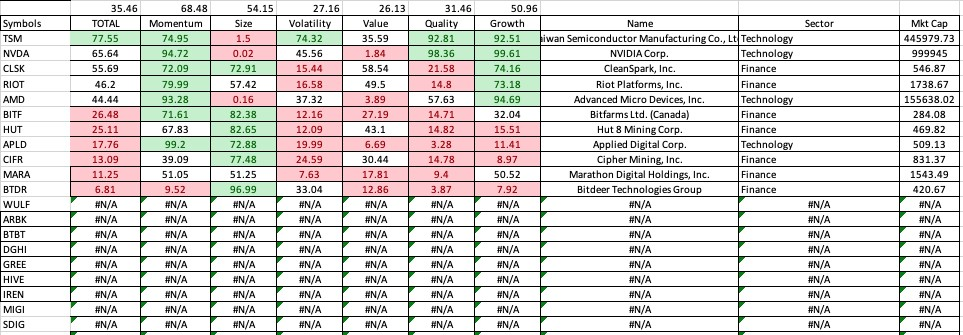

In fact, I had my team run the holdings of the Valkyrie Bitcoin Miners ETF (Nasdaq: WGMI) through my stock rating system.

WGMI rates a lowly 35 out of 100 overall based on the average rating of each holding, and that score would be even lower if it wasn’t buoyed by the bullish ratings of two mega-cap semiconductor stocks, NVDA and TSM, which the Green Zone Power Ratings system has at 66 and 78, respectively, at the moment.

Here’s the breakdown of Green Zone Power Ratings for each stock in the bitcoin mining ETF (note that almost half the stocks in the ETF are too small by market cap to even have a rating, as denoted by the “#N/A” fields):

Crypto Mining ETF: Lackluster Green Zone Scores… But Serious Opportunity?

But in this particular case, a low score doesn’t actually mean these are bad investments. There are two reasons for that…

First, most publicly traded bitcoin miners are still young, so they have far less operating history than a decades-old company such as Microsoft. Since my ratings model considers data as far back as 10 years, newer companies are “penalized” simply for being young.

What’s more, many of the bitcoin miners are aggressively reinvesting revenues and gross profits into additional infrastructure, rapidly increasing production capacity and paving the way for future growth.

That, in turn, is reducing or eliminating their net generally accepted accounting principles profits and cash flows today — particularly since they’ve just had to trudge through another “crypto winter,” whereby bitcoin prices were dramatically depressed.

Don’t Wait for the Robins

I’d like to stress that each of the above ratings is still accurate.

We apply the same standards and scoring metrics to each company, regardless of its size, industry or age.

That’s the real strength of the Green Zone Power Ratings system. It’s completely unbiased, data-based and fine-tuned to assign the best ratings to the best possible investments at any time. If you’re ever looking to filter out the media noise and get the real numbers on an investment, just check the score.

But that strength can also be a limitation.

Because sometimes, when you’re dealing with a breakout innovator in a whole new industry, those numbers just aren’t going to tell you the whole story.

Frankly, if you’re waiting for bitcoin miners to become an obvious and solid investment … you’ll end up joining the herd once most of the biggest gains are already gone.

I suspect that by the time 80% of bitcoin miners rate 80 or higher on my model … upward of 80% of the sector’s profits will have already been doled out to early (and brave) investors. Like Warren Buffett likes to say: “If you wait for the robins, spring will be over.”

It’s a simple fact that if you want to take advantage of some of the market’s biggest opportunities, you may have to go beyond traditional metrics and “beyond the Green Zone.”

I just recommended one bitcoin miner to readers of 10X Stocks, since I believe it has the potential to go “10X” higher over the course of the next bitcoin bull market. For the full details on 10X Stocks and how it differs from Green Zone Fortunes, go HERE.

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets