Bitcoin and cryptocurrencies represent a new asset class.

Market data for bitcoin, the oldest crypto, only goes back to 2010 on many data sources. This is about two years after its development and well before widespread knowledge of the asset.

Although the history is brief, it’s been a volatile ride for investors.

Bitcoin investors embrace the volatility and claim to “hold on for dear life.” HODL seems like a source of comfort during steep market declines.

HODL for Bitcoin Recovery

The Dow Jones Industrial Average has declined more than 80% once in its 126-year history. Bitcoin delivered three declines greater than 80% in a little more than a decade!

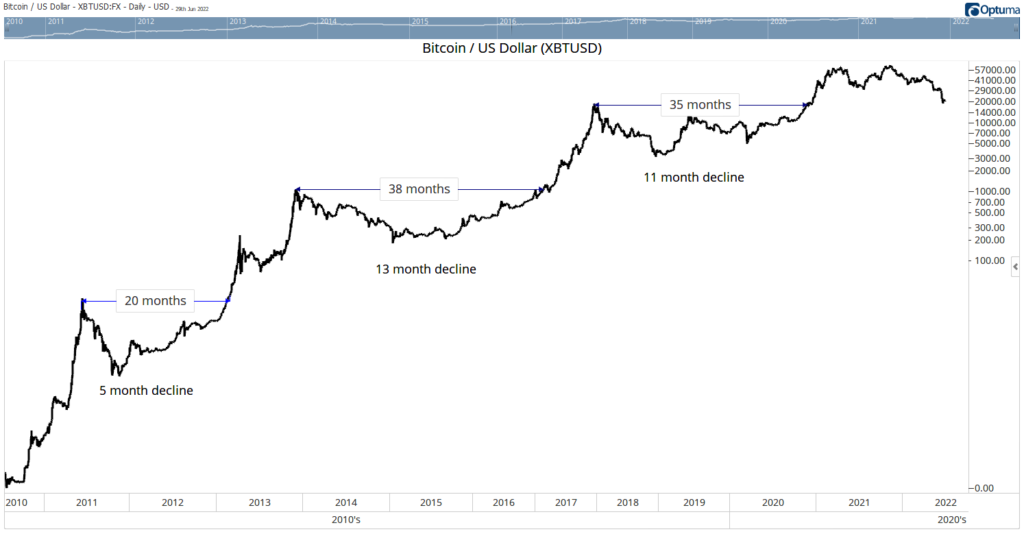

The chart below shows the time it took bitcoin to fall at least 80% and the time it took to recover to its old highs.

Bitcoin’s Steady Recoveries After 80% Tumbles

There’s good news in the chart.

The current decline began in November 2021. It could end this year if the decline is as long as the last two sell-offs.

Not All Good News

There’s also bad news in the chart…

Bitcoin’s last two big recoveries took about three years. The first 80% decline recovered in less than two years.

If history repeats itself, bitcoin could trade at new highs in 2023 or 2024. That means we could see a recovery while President Joe Biden is still in office.

But that’s not likely.

Since public participation in the market has increased, there are more traders with significant losses. They could sell during recoveries to limit losses, offering resistance as the price advances.

Another factor that could delay bitcoin’s recovery is that there no longer seems to be a plausible use for the crypto.

If it has no utility, it probably isn’t worth $60,000. It’s also not worth zero, so some recovery is possible.

Bottom line: I wouldn’t expect bitcoin to reach new highs unless proponents find some way to use their coins.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.