I’m surprised, but there were unintended consequences to the Federal Reserve’s massive quantitative easing programs.

One consequence is in the mortgage market. Borrowers are paying a rate that’s about 0.6% higher than it should be.

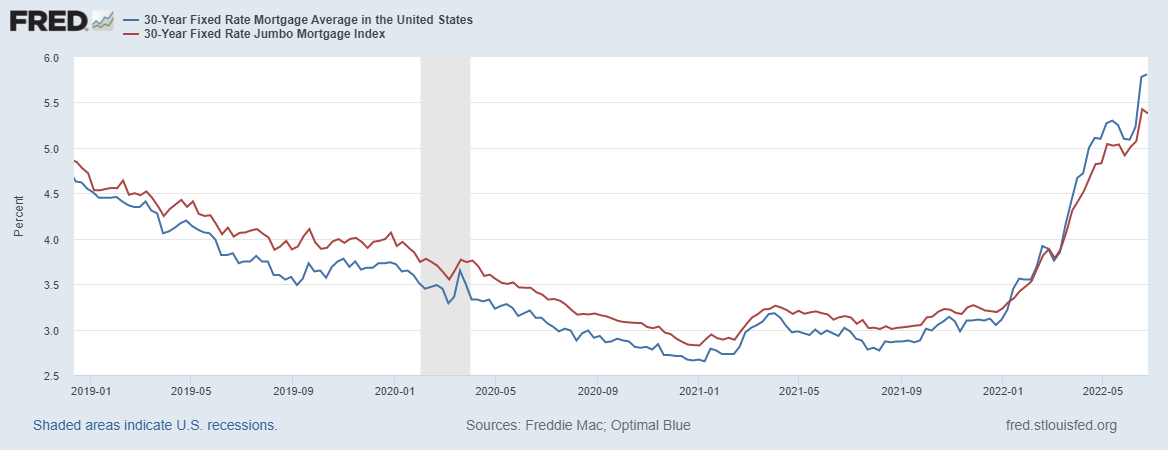

The chart below shows the issue. The red line is the rate for jumbo mortgages. Traditional mortgage rates are shown as the blue line.

Traditional Mortgage Rates Leapfrog Jumbos

Source: Federal Reserve.

Jumbo vs. Traditional Mortgages

Traditional mortgages meet federal guidelines and are less than $647,200 in most cases. A higher limit of $970,800 applies in Hawaii, Alaska and a few designated high-cost mortgage markets.

Jumbo home mortgages are above that limit.

It makes sense that jumbo mortgages should be more expensive. They don’t meet federal guidelines. Mortgage underwriters have more flexibility to approve larger loans. So they can be riskier.

Fed data on jumbo mortgage rates goes back to January 2019. Until early 2022, the rate was consistently 0.2% to 0.3% above traditional mortgages. That reflects risk.

In early 2022, jumbos dipped below traditional mortgages.

This was when the Fed unveiled plans to unwind its balance sheet.

The Fed’s Balance Sheet

The balance sheet consists mostly of Treasurys and mortgage-backed securities (MBSs). The Fed has always had a foot in the Treasury market.

Its dive into the MBS market is more recent, dating to the financial crisis that began in 2008. Since then, the Fed has bought more than $2.7 trillion worth of MBSs.

That’s more than 22% of the total MBS market.

Downside to Unwinding

Unwinding the balance sheet means selling off assets or not replacing them at maturity. That means less demand for MBSs from the single largest owner of those securities in the U.S.

This led to repricing MBSs and higher interest rates on traditional mortgages, which we see in the chart above.

Traditional mortgages should have a lower interest rate than jumbos. Since the Fed doesn’t distort the jumbo market, we can assume that it is a market-based interest rate.

If there were no interferences from the Fed while trading traditional mortgages, the rate would be about 5.1% instead of 5.8%. That’s a difference of $110 a month on a $250,000 loan.

Bottom line: An unintended consequence of the Fed’s policy is that many families now cannot afford the home of their dreams.

As the Fed takes more action over the next year, it’s time to worry about new unintended consequences.

Click here to join True Options Masters.