As the end of the pandemic in the U.S. comes into sight, it’s time to consider what could come next. A year of lockdowns has created pent-up demand among consumers. That could lead to a spike in inflation as consumers rush into the market and increase spending. History, especially the Black Death, allows us to study how economies recover from pandemics.

Economists have access to data spanning hundreds of years. Great plagues occurred in the seventeenth and eighteenth centuries in various European cities. They marked the last major outbreak of the bubonic plague that had ravaged the world for almost 400 years.

The Black Death resulted in the death of 75–200 million people in Europe, Asia and North Africa in the 1300s. Economists recently estimated that’s the equivalent of 2 to 3 billion deaths today.

Large losses of life seem like they should be inflationary.

In England, the Black Death resulted in an estimated 30-45% reduction in the country’s population. From an economic perspective, this tragedy resulted in a doubling of real wages. Landowners saw their rates of return fall as other costs rose.

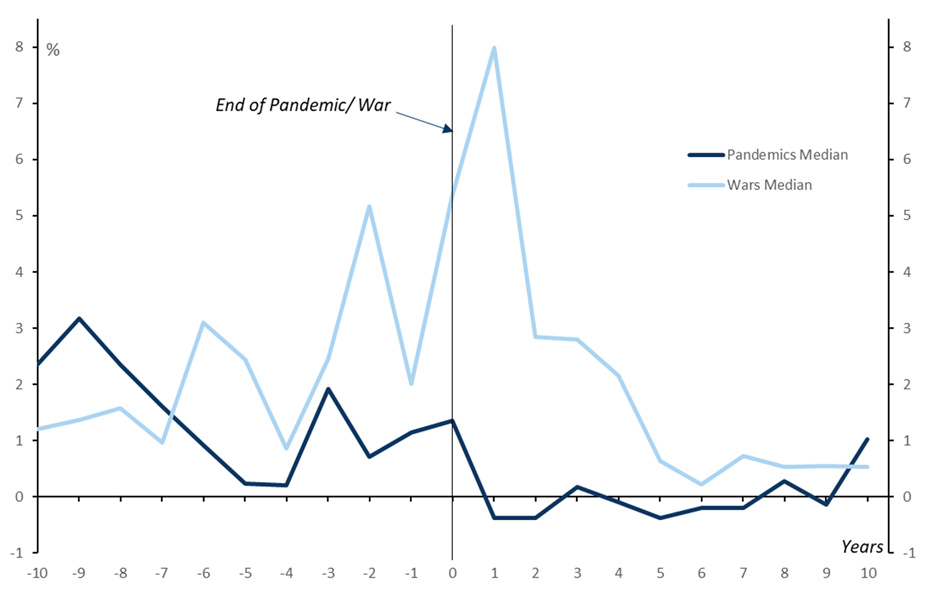

This was an exception to the historical record. Pandemics have not usually pushed prices significantly higher. Wars have been the cause of many historic inflation spikes.

War, not Plague, Is History’s Inflation Driver

Source: VoxEU.org.

Unlike the Black Death, Government Waged War on COVID

Looking ahead, it’s still reasonable to consider whether COVID-19 will have an inflationary impact.

That’s because in the U.S. and Europe, governments have responded to the pandemic as if it was a war.

Wars are often associated with large increases in spending, usually funded by issuing bonds. That spending often requires central banks to raise banks to attract capital. This time, central banks are buying government debt to hold rates down.

In other words, the historical precedents are being ignored. We could well see inflation spike, and those spikes have historically pushed prices higher for years.

Investors can’t ignore the risks of inflation like economists can. We need to prepare for the risks that lie ahead.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.