Black Friday used to be one of the most anticipated days on the calendar.

Unless, of course, you worked in retail. Then, it was the most feared day.

Things are different from the early mornings when lines stretched around a store at 5 a.m.

Deals are everywhere weeks before the unofficial start of the holiday shopping season.

But something else cut into in-store shopping: e-commerce.

Online Sales Growth Thanks to COVID

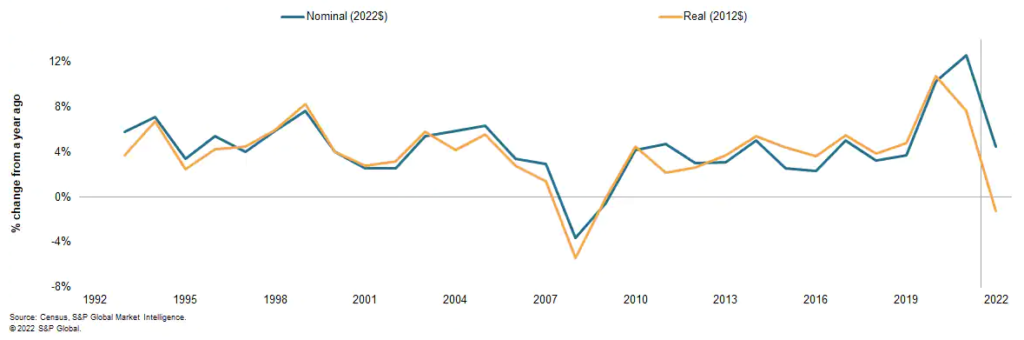

According to S&P Global Market Intelligence, holiday sales growth averaged around 3.9% before the height of the COVID-19 pandemic.

Data shows that 1999 was the best year for growth. Sales jumped 7.6% that year.

Things changed in 2000:

Retail Sales Jumped During COVID Pandemic

The chart above shows retail sales’ nominal growth — changes due to new business and price changes — and real growth from 1992 to 2022.

Amid the COVID-19 pandemic, customers went all-in with online shopping — a dominant factor in holiday sales.

All told, holiday sales jumped 10.3% in 2020 — the highest annual jump since 1992. At the same time, prices were down.

Online Sales Jump After COVID

We had more savings in the year after COVID thanks to stimulus spending.

In 2021, sales hit a fresh record with a 12.6% increase.

Online Sales Flattened After COVID Surge

Demand for pandemic-related goods and services remained high at the start of the year, despite inflation starting to rear its ugly head.

Supply chain issues and the subsequent fear of a drop in merchandise flattened out spending heading into the holidays.

December sales dropped 1.7%, while inflation ticked up 4.5% at the end of the year.

Despite that, holiday sales grew 7.7% last year.

Inflation Will Impact Online Holiday Sales in 2022

S&P Global Market Intelligence forecasts that this year will be the first time in three decades that price increases will be higher than the jump in holiday spending.

Surging COVID cases coupled with Russia’s invasion of Ukraine to start the year sent food and energy prices up.

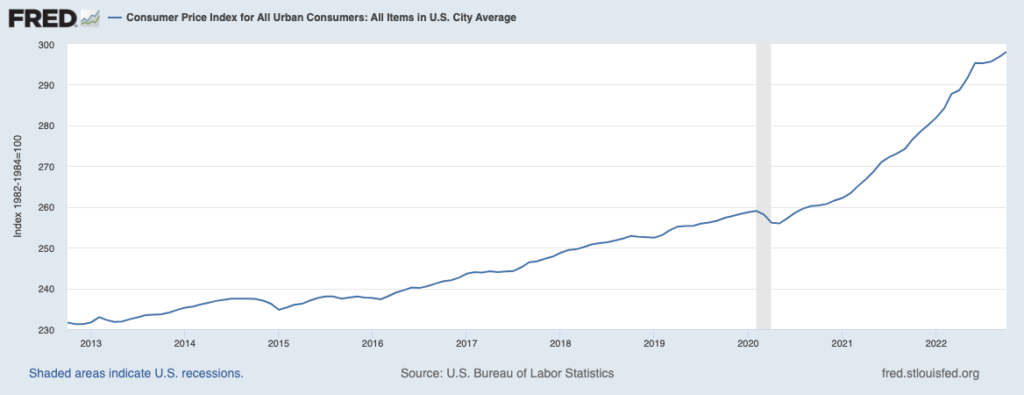

Inflation — the increase in the price of goods and services — is the highest it’s been in a decade:

Inflation at Its Highest in a Decade

This chart shows the Consumer Price Index since November 2012.

Here’s another wrinkle retailers face: Americans’ disposable income is back down to pandemic levels. People don’t have as much money to spend this year.

Real Disposable Income Drops

Retailers need to dive into their deals bucket and give us the deepest discounts possible to entice us to shop.

Since sales dropped over the last few months, retailers have more inventory to try and get out the door.

Here’s what S&P Global Market Intelligence expects for 2022 retail sales:

- Holiday sales up 4.5% — above pre-pandemic levels but below rates we’ve seen in 2020 and 2021.

- Online holiday sales up 7.9% — below the pre-pandemic level of 11.1%.

- Online spending will be 25.1% of total spending.

- Holiday prices will be up 5.8% for the year.

- Real holiday sales will drop 1.2%.

Bottom line: There is some good news in all of these numbers.

Despite consumers having less money amid higher prices, spending is outpacing inflation.

The fact that we are talking about any gains at all in retail sales is good news.

Most of the time, spending is lower when inflation is up and consumer savings are down.

So far, that isn’t the case in 2022.

How long that trend lasts is another story…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Before joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.