In this episode of The Bull & The Bear podcast, we analyze three blockchain stocks: Square Inc. (NYSE: SQ), Visa Inc. (NYSE: V) and IBM (NYSE: IBM).

I remember going to my grandparent’s house and watching my grandfather use one of those old ledger books to balance their bank account.

Income goes in one column, and expenses go in another. Subtract expenses from income to determine how much money you do (or don’t) have left.

But that’s in the past. Technology has evolved considerably in a short amount of time, and blockchain has replaced the ledger.

In simple terms, blockchain is chunks of transactional data stored in chronological order like links in a chain.

It’s become the new, secure way to balance large transactional accounts.

And the technology (along with company’s using it) are taking the market by storm.

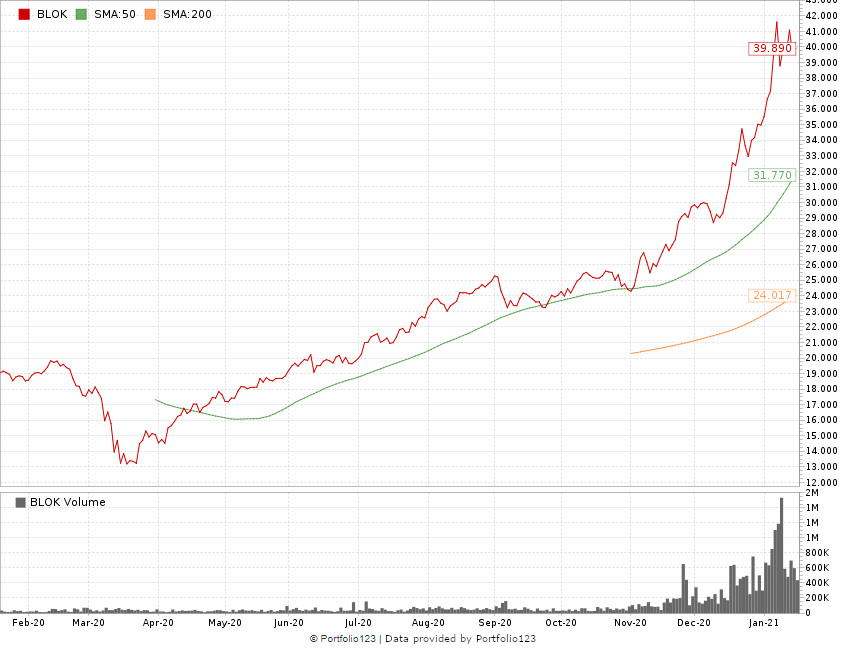

Look at the Amplify Transformational Data Sharing ETF (NYSE: BLOK).

This is an exchange-traded fund that holds some of the biggest names in terms of fintech and blockchain technology.

After hitting a low of around $13 per share in March 2020, the ETF climbed as high as $41 in early January — a 215% jump.

Blockchain ETF Grows 215% Off March Lows

Investors have honed in on blockchain, and ways to profit off the technology, after bitcoin reached $40,000 a week ago

Bitcoin records its cryptocurrency transactions in a permanent blockchain, and those transactions are public information.

For bitcoin, blockchain is decentralized. No one person has control of it — all users share control.

Blockchain Stocks on Our Radar: Square, Visa and IBM

Bitcoin wouldn’t work without blockchain technology.

In this episode of The Bull & The Bear podcast, Chief Investment Strategist Adam O’Dell, editor Charles Sizemore and I take a closer look at three well-known companies held by BLOK that are at the center of blockchain: Square Inc. (NYSE: SQ), Visa Inc. (NYSE: V) and IBM (NYSE: IBM).

We’ll breakdown each company and give you our thoughts on whether these are companies for your portfolio or not.

Remember, that’s why we are here … to give you safe, sound and profitable investment information to bolster your profits.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos like my weekly Marijuana Market Update.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.